Record-breaking Inflows

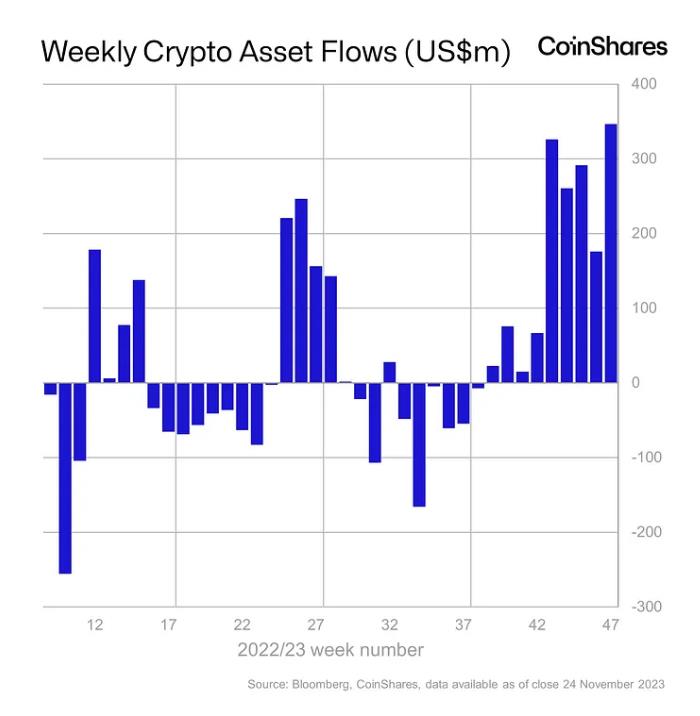

Bitcoin exchange-traded products (ETPs) have seen a surge in inflows, reaching $312 million for the week of November 24, according to CoinShares. This brings the year-to-date inflows to approximately $1.5 billion. Inflows for all cryptocurrencies totaled $346 million, marking a nine-week trend of positive net flows.

Bullish Indicator

Inflows into crypto ETPs are seen as a bullish indicator for the overall crypto market, reflecting optimism among investors. Conversely, outflows are viewed as bearish.

Reversal of Trend

Prior to September 25, crypto ETPs experienced several weeks of outflows. However, since the week of September 25-29, the sector has been experiencing sustained weekly inflows. The amount of inflows has also been increasing over time, with the week ending on November 24 recording the largest inflows during the nine-week period.

Canadian and German ETPs Lead the Way

According to CoinShares, Canadian and German ETPs accounted for the majority of inflows, making up 87% for the week. In contrast, inflows from the United States were relatively subdued at $30 million.

Optimism for a US Bitcoin ETF

CoinShares speculates that the recent inflows may be driven by growing optimism surrounding the potential approval of a U.S. spot Bitcoin ETF. BlackRock and Grayscale have both met with the U.S. Securities and Exchange Commission in an effort to make progress towards this goal.

Record Assets Under Management

The total assets under management for crypto funds now stand at $45.4 billion, the highest in 18 months.