Uncertainty surrounding US debt limit pushes Bitcoin to $28,000

Bitcoin's recent price surge towards $28,000 was partly driven by the uncertainty surrounding the United States debt limit. However, President Joe Biden signed a spending bill just before the September 30 deadline, avoiding a government shutdown. This has left investors wondering whether the momentum for cryptocurrencies will continue now that the worst-case scenario is off the table. It's worth noting that the bill only provides extra funding for the next 45 days, giving lawmakers more time to work on their funding plans for 2022.

Futures contracts carry risks for Bitcoin investors

While it may be tempting for investors to use futures contracts to go long on Bitcoin, there is a significant risk of being liquidated if the price suddenly drops. Furthermore, it is impossible to predict whether a successful budget discussion in the future will benefit cryptocurrencies. Therefore, investors need to proceed with caution.

Lawmakers have until November 17 to find a solution

With the current extension in place, lawmakers now have until November 17 to find a solution. According to Margaret Spellings, the President and CEO of the Bipartisan Policy Center, continued postponements of the fiscal health and negotiations on the brink of government shutdowns and debt defaults cannot continue.

Risks of economic recession remain despite avoiding crisis

Although narrowly avoiding a crisis, the overall risk of an economic recession remains. The US Federal Reserve is dealing with persistent inflation and rising energy prices, which have negatively impacted the S&P 500 and pushed the 10-year Treasury yield to levels not seen in over a decade. Additionally, soaring oil prices are further constraining economic activity due to upward pressure on inflation.

Bitcoin's reaction does not guarantee a bullish momentum

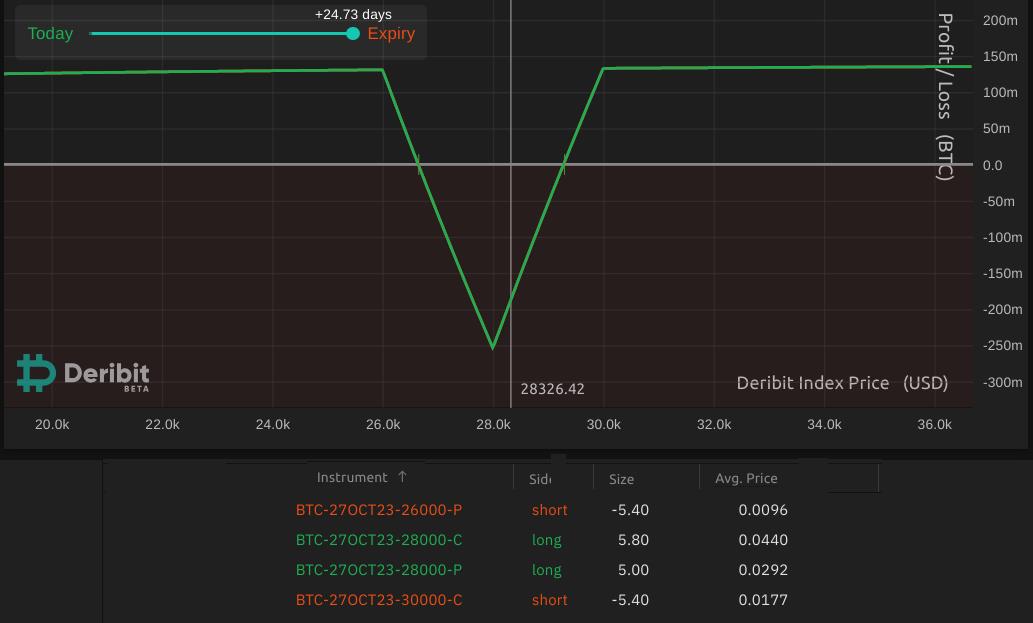

Amidst this turmoil, Bitcoin has continued to increase in value, breaking through the $28,000 resistance. Investors are now anticipating heightened volatility for the cryptocurrency as the debt ceiling decision approaches. Professional traders are opting for a limited-risk, limited-profit trading strategy known as the reverse iron butterfly to avoid directional risk.

Neutral-market strategy to navigate uncertain outcomes

A recommended strategy for neutral markets involves selling put and call options at certain strike prices. This allows investors to profit if Bitcoin's price remains within a specific range. However, it's important to note that options have an expiry date, meaning the price increase or decrease must occur during the defined period.

Understanding the potential risks and rewards

To fully shield against market fluctuations, investors must deposit a certain amount of BTC as collateral to cover potential losses. The potential profit zone is substantial, but losses are higher than potential gains if Bitcoin remains stagnant. It's crucial for investors to have conviction in the volatility of Bitcoin in order to maximize their chances of profit.

Flexibility in reversing the operation

Investors have the option to reverse the operation before the options expire, particularly after a significant Bitcoin price movement. By repurchasing the initially sold options and selling the initially bought options, investors can adjust their positions based on market conditions.

Please note that the information provided in this article is for general information purposes only and should not be considered legal or investment advice. The views, thoughts, and opinions expressed are solely those of the author and do not necessarily reflect the views and opinions of the publication.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/cryptocurrency-assets-experience-inflows-after-sixweek-drought