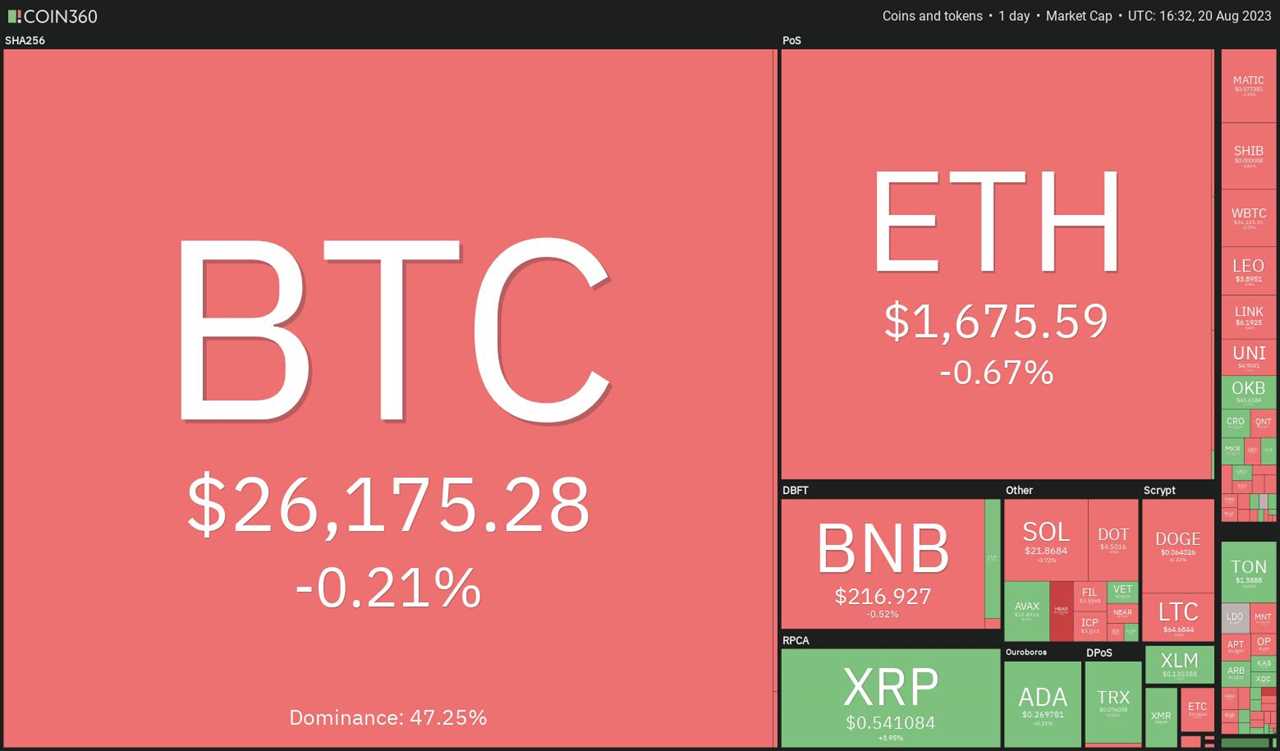

Trader sentiment turns bearish as Bitcoin suffers an 11% slump this week, leaving analysts predicting a potential drop to the crucial $20,000 level. This decline in the cryptocurrency market is also mirrored in the United States equities markets, with the S&P 500 Index falling 2.1% and the Nasdaq Composite dropping 2.6%. However, amidst the sell-off, there are a few altcoins that are showing signs of resilience and upward momentum.

Bitcoin price analysis

Bitcoin has been trading within a range of $24,800 and $31,000 recently. After failing to sustain above the resistance, the price has fallen to near the lower end of the range. The Relative Strength Index (RSI) indicates it may be oversold, suggesting a potential recovery may be on the horizon. If the price bounces back from this level, it could reach the 20-day exponential moving average ($28,309). However, the bears are likely to sell at this level. If the price drops below the crucial support at $24,800, it could potentially descend to $20,000.

On the upside, a break and close above the 20-day EMA would indicate that the pair may continue to trade within the range for a little longer. However, for a new upward trend to start, the bulls will need to push the price and sustain it above $31,000, which seems unlikely at the moment.

Looking at the 4-hour chart, both moving averages are sloping down and the RSI is in the oversold territory. This suggests that bears are still in control. If the price turns down from the 20-day EMA, it may retest the support zone between $25,166 and $24,800. However, a break above the 20-EMA could indicate that the bears are losing their grip.

Overall, while Bitcoin and the cryptocurrency market as a whole are experiencing a bearish sentiment, there are a few altcoins that are showing signs of strength and potential bullish signals. HBAR, OP, INJ, and RUNE are among these altcoins to watch for potential positive movements in the coming days.