Yield farming has grown in popularity over the past year alongside the rise of decentralized finance, but recently the ability to earn a good return has been limited by the high transaction costs on the Ethereum (ETH) network.

As a result, yield farmers have begun exploring options outside the Ethereum network for more accessible opportunities in a low fee environment.

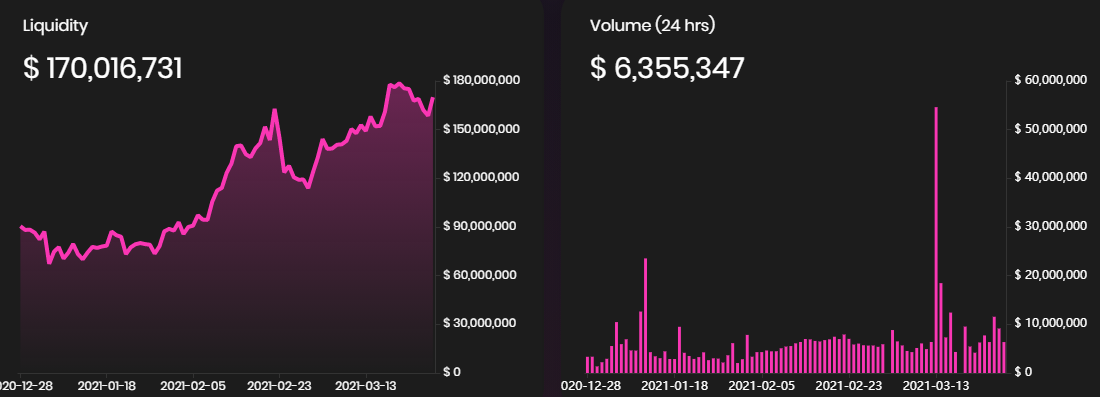

One option that has shown steady growth in liquidity since launching is Flamingo Finance (FLM), a DeFi platform based on the Neo (NEO) blockchain and the Poly Network interoperability protocol.

Flamingo aims to become a full-service DeFi platform and the protocol currently has a cross-blockchain asset gateway (wrapper), an on-blockchain liquidity pool (swap), a blockchain asset vault, a perpetual contract trading platform (perp) and a decentralized governance organization (DAO).

The cross-blockchain asset gateway is currently capable of wrapping ERC-20 tokens including Wrapped Ether (WETH) and Wrapped Bitcoin (WBTC), as well as Ontology-based (ONT) tokens.

Interaction with the protocol is done using the NeoLine or O3 wallet browser extensions for Neo tokens, the Cyano wallet browser extension for Ontology-based assets, and the MetaMask browser extension for transactions requiring the Ethereum network.

While the platform is not really a contender with Etheruem, the low fees have been attracting users, as shown by the rising TVL. Once all collateral has been wrapped and deposited on the Neo blockchain, all transactions on the Flamingo protocol have a fixed cost of 0.011 GAS and there is a option to choose a feeless transaction if the user is willing to wait a little longer for the transaction to process.

Competitive yields boost liquidity

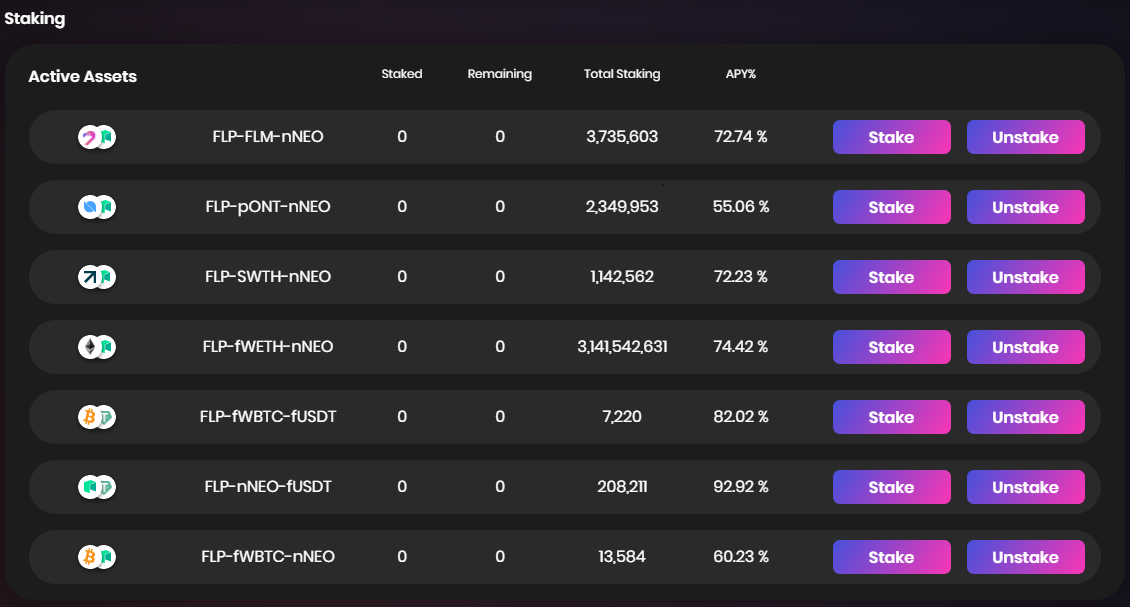

When Flamingo originally launched, it offered simple staking and high yields to attract the initial pool of liquidity that helped get the ecosystem established. It has since shifted into offering yield opportunities for liquidity pool providers, especially on pools where there is a greater need for liquidity.

As seen in the graphic above, all of the pools are paired with Neo and rewards are paid out in FLM token.

According to Flamingo’s Twitter feed, the protocol is now gearing up for the release of Neo 3.0, which began its Testnet launch on March 25. Once fully implemented, Neo 3.0 could see increased activity on the network and spark a rise in value for FLM as it's the base pair for all of the liquidity pools.

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: Flamingo (FLM) TVL rises as Ethereum gas solutions remain elusive

Sourced From: cointelegraph.com/news/flamingo-flm-tvl-rises-as-ethereum-gas-solutions-remain-elusive

Published Date: Mon, 29 Mar 2021 22:18:38 +0100