Welcome to Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights, a newsletter crafted to bring you some of the major developments over the last week.

This past week, the DeFi ecosystem got recognition from the United Kingdom government, as they sought public feedback on taxation of the DeFi ecosystem, especially staking and lending.

MakerDAO is looking to collaborate with the traditional banks, which would take place after the proposal gets community approval. Aave (AAVE) is planning to launch an overcollateralized stablecoin called GHO, subject to the community decentralized autonomous organization’s (DAO’s) approval. The hacker who exploited Solana-based liquidity protocol Crema Finance on July 2 returned most of the funds but was allowed to keep $1.6 million as a white hat bounty.

After nearly two weeks of bearish dominance, the top 100 DeFi tokens finally started to trade in the green. The majority of the DeFi tokens registered double-digit weekly gains.

UK government seeks public input on DeFi taxation

The government of the United Kingdom is asking the public for input on the taxation of crypto-asset loans and staking in the context of DeFi.

In particular, the government is interested in gathering information on the taxation of crypto-asset loans and staking. Her Majesty’s Revenue and Customs (HMRC) call for evidence paper, published on Tuesday, described its intention to study whether administrative hassles and costs may be reduced for taxpayers who participate in the emerging industry, as well as whether the tax treatment might be more aligned with the transactions’ fundamental economics.

Continue reading

Aave to launch overcollateralized stablecoin called GHO

DeFi giant Aave has unveiled plans to launch an overcollateralized stablecoin called GHO, subject to the community DAO’s approval. The announcement was made by Aave Companies, the centralized entity supporting the Aave protocol, on its Twitter page on Thursday.

According to the governance proposal shared on Thursday, GHO would be an Ethereum-based and decentralized stablecoin pegged to the United States dollar that could be collateralized with multiple assets of the user’s choice.

Continue reading

MakerDAO voting on collaborating with a traditional bank

MakerDAO is voting on a proposal that will bring a traditional bank into its ecosystem for the first time, allowing the bank to borrow against its assets using DeFi.

At the end of voting on Thursday, 87.1 % of voters were in favor of the proposal. The proposal involves creating a vault with 100 million Dai (DAI) for Huntingdon Valley Bank (HVB) as part of a new collateral type in the Maker Protocol.

Continue reading

Crema hacker returns $8M, keeps $1.6M in deal with protocol

The hacker who exploited Solana-based liquidity protocol Crema Finance on July 2 returned most of the funds but was allowed to keep $1.6 million as a white hat bounty.

The bounty, 45,455 Solana (SOL), is worth a generous 16.7% of the $9.6 million Crema lost initially, which forced the protocol to suspend services. Crema’s team began an investigation to identify the hacker by tracking their Discord handle and tracing the original gas source for the hacker’s address. Just as it seemed the team may have been onto the secret identity, it announced that it had been negotiating with the hacker. On Wednesday, the hacker returned 6,064 Ether (ETH) and 23,967 SOL worth roughly $8 million.

Continue reading

DeFi market overview

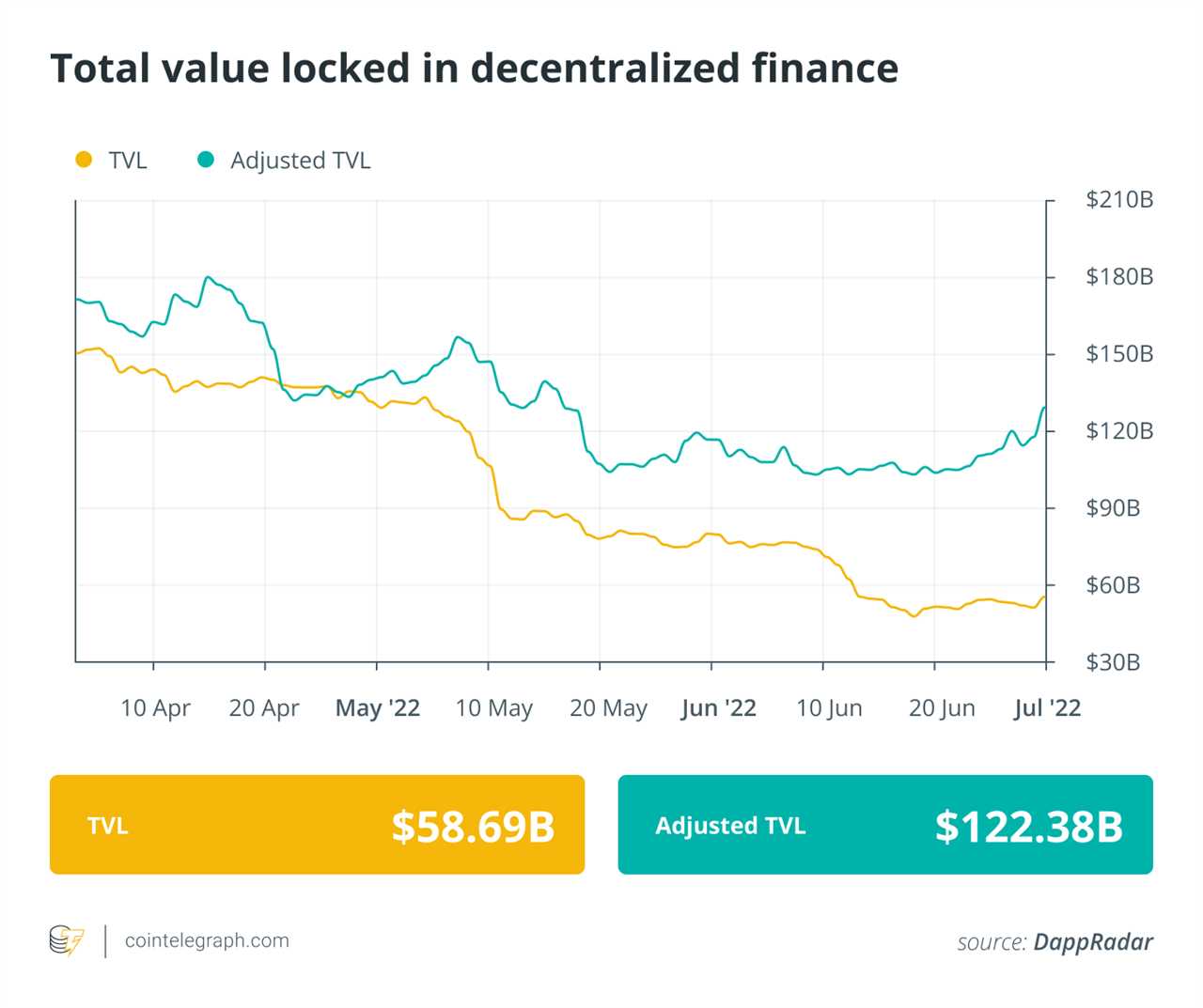

Analytical data reveals that DeFi’s total value locked registered a minor rise from the past week, rising to a value of $58.69 billion. Data from Cointelegraph Markets Pro and TradingView shows that DeFi’s top-100 tokens by market capitalization showed great signs of recovery with the majority of the tokens trading in green with double-digit gains.

Curve (CRV) was the biggest gainer in the top-100 DeFi token list with a weekly surge of 50.18%, followed by Convex Finance (CVX) with 43.15% weekly gains. ThorChain (RUIN) registered a 28% gain over the past seven days, while Aave gained 26% during the same time period.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education in this dynamically advancing space.

Title: Finance Redefined: UK government explores DeFi with a focus on staking and lending

Sourced From: cointelegraph.com/news/finance-redefined-uk-government-explores-defi-with-a-focus-on-staking-and-lending

Published Date: Fri, 08 Jul 2022 21:15:00 +0100