Recent data from the Crypto Fear & Greed Index indicates that the cryptocurrency market is experiencing a period of investor fear with a 3-month low score of 27 out of 100.

By utilizing leading cryptocurrency asset Bitcoin (BTC) as the markets representative, the seasoned technical analysis tool informs cryptocurrency traders worldwide on the current emotional sentiment and bias of the market.

This data can be then used — in accordance with other analytical strategies — to determine the potential of a future surge or correction, and ultimately, whether price levels represent an opportunity to buy or sell the market.

A lower number out of 100 indicates a shift towards extreme market fear and that BTC may be undervalued, whilst a higher number represents extreme market greed and that prices could be inflated above true value, foreshadowing a future decline.

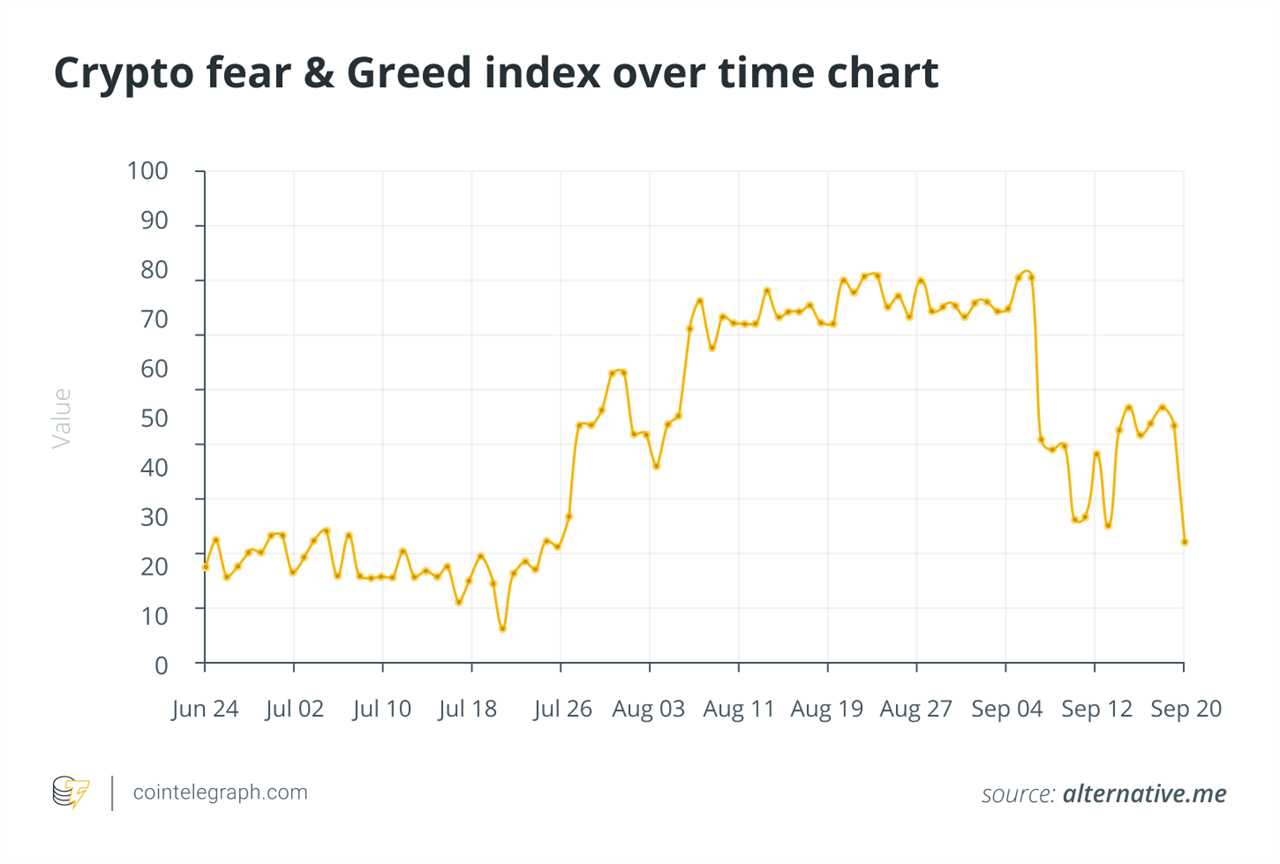

Following Bitcoin’s 10.4% decline to $43,313 this week, the index revealed a score of 27. The last time it printed a figure at or below this level was almost 3 months ago today on the 26th July.

The index recorded 1-year lows on the 21st July with a score of 10, followed by a parabolic rally to 5-month highs of 79 across late August and early September. This volatility has been paralleled across the entire cryptocurrency market, with prices frequently printing double-digits.

Related: Bitcoin bounces to $43K ahead of fresh crypto comments from SEC Chair Gensler

Reddit user u/_DEDSEC_ adapted the common trading mantra ‘buy the rumour, sell the news’ and commented that traders should "buy the fear, sell the greed."

Title: Fear & Greed Index suggests Bitcoin's price is undervalued

Sourced From: cointelegraph.com/news/fear-greed-index-suggests-bitcoin-s-price-is-undervalued

Published Date: Tue, 21 Sep 2021 17:30:00 +0100