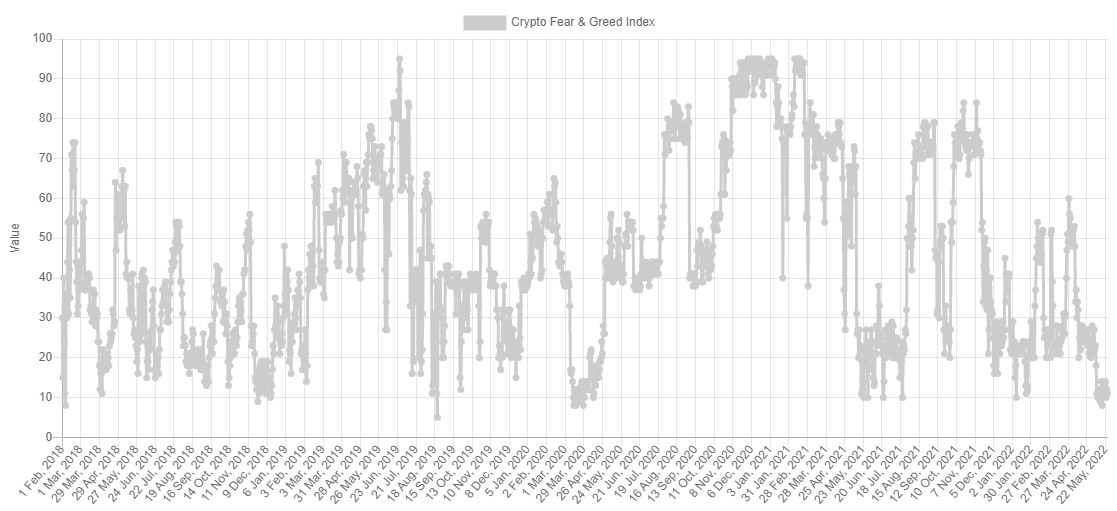

The cryptocurrency market settled into a holding pattern on May 25 after traders opted to sit on the sidelines ahead of the midday Federal Open Market Committee (FOMC) meeting where the Federal Reserve signaled that it intends to continue on its path of raising interest rates. According to data from Alternative.me, the Fear and Greed Index seeing its longest run of extreme fear since the market crash in Mach 2020.

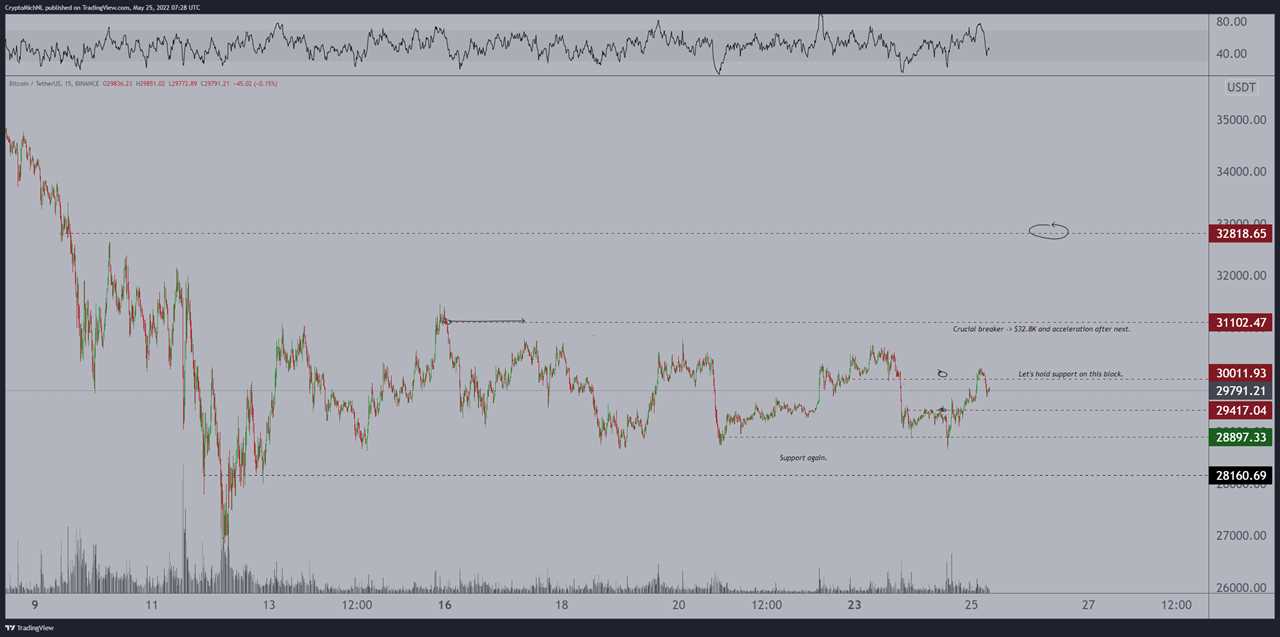

Data from Cointelegraph Markets Pro and TradingView shows that the price action for Bitcoin (BTC) has continued to compress into an increasingly narrow trading range, but technical analysis indicators are not providing much insight on what direction a possible breakout could take.

Here’s a look at what analysts think could come next for Bitcoin price.

Whales accumulate as Bitcoin battles to reclaim $30,000

According to market analyst Michaël van de Poppe, "#Bitcoin broke through $29.4K and ran towards the next resistance zone. If we hold $29.4K, we'll be good towards $32.8K. Finally.”

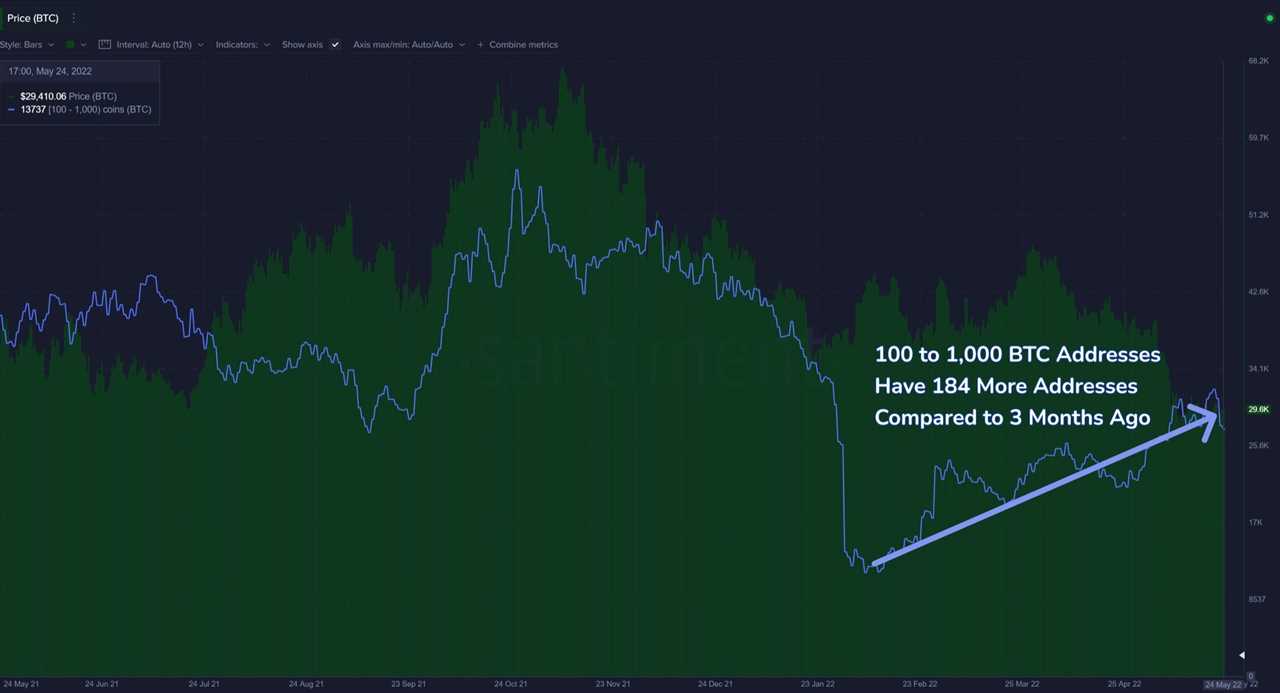

One interesting thing to note at these price levels is that while the predominant sentiment is that of extreme fear, on-chain intelligence firm Santiment pointed out that whale wallets have taken this as an opportunity to accumulate some well-priced BTC.

Santiment said,

“As #Bitcoin continues treading water at $29.6K, the amount of key whale addresses (holding 100 to 1k $BTC) continues rising after the massive dumping from late January. We've historically seen a correlation between price & this tier's address quantity.”

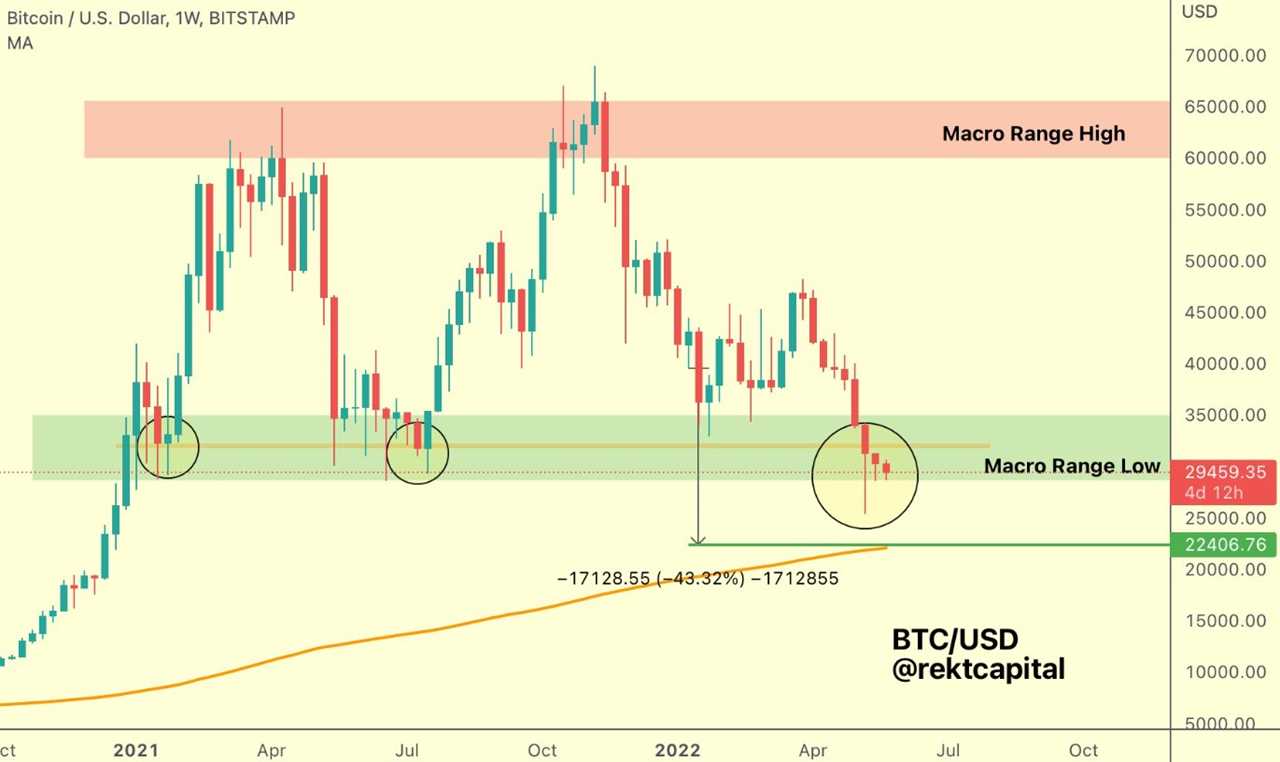

Price could still pull back to $22,500

A macro perspective on how Bitcoin performs following the appearance of a death cross was offered by pseudonymous Twitter user Rekt Capital, who posted the following chart outlining what to expect if the “historical price tendencies relating to the #BTC Death Cross repeat [...]”

Rekt Capital said,

“$BTC will breakdown from the Macro Range Low support & continue its drop to complete -43% downside. The -43% mark is confluent with the 200-Week MA at ~$22500.”

Related: Scott Minerd says Bitcoin price will drop to $8K, but technical analysis says otherwise

“A pivotal retest”

The importance of the current price level for Bitcoin was touched upon by economist Caleb Franzen, who posted the following chart looking at the long-term performance of BTC versus its weekly anchored volume-weighted average price (AVWAP) noting that “This is a pivotal retest, similar to the dynamics in March 2022.”

Franzen said,

“A rebound on the weekly AVWAP from the COVID low could increase bullish probabilities. A breakdown below it would drastically increase bearish probabilities, foreshadowing a retest of the grey range, $13.8k-19.8k.”

The overall cryptocurrency market cap now stands at $1.265 trillion and Bitcoin’s dominance rate is 44.8%.

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: ‘Extreme fear’ grips Bitcoin price, but analysts point to signs of a potential reversal

Sourced From: cointelegraph.com/news/extreme-fear-grips-bitcoin-price-but-analysts-point-to-signs-of-a-potential-reversal

Published Date: Wed, 25 May 2022 23:00:00 +0100

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/injective-partners-with-wormhole-to-bring-10-new-blockchains-to-the-platform