Shapeshift CEO Erik Voorhees has drawn a metaphorical line in the financial sand, stating that every asset manager should understand Bitcoin now based on its astonishing rate of return.

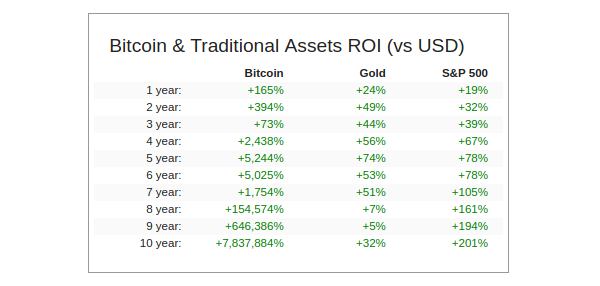

Voorhees made the comments while retweeting data shared by analytics platform Messari co-founder Dan McArdle that shows Bitcoin has dramatically outperformed everything over the last decade. While gold has returned a 32% profit and the S&P 500 has tripled investors’ money, Bitcoin has posted an incredible 7,837,884% gain in ten years.

Looking across its 10-year life, Voorhees believes Bitcoin is “vastly superior to any other investment.” He said that:

“One could be forgiven for not understanding it eight years ago... but any asset manager today who remains ignorant of this phenomenon needs to seriously check their premises.”

Voorhees is not the only one discussing the recent embrace of Bitcoin by traditional finance that is believed to underpin the latest rally. This week alone half a dozen figures with expertise in the traditional finance world made similarly bullish observations. On Dec 2. Crypto trading firm Genesis CEO Michael Moro predicted that 250 publicly traded companies will invest in Bitcoin by the end of 2021.

On Dec. 4, former JP Morgan commodity trader Danny Masters told CNBC that soon it will be a “career-risk for not having Bitcoin in your portfolio.”

Also this week, BlackRock chief investment officer Larry Fink warned that Bitcoin’s success could have a real impact on the U.S. dollar, and will even “take the place of gold to a large extent.” This fits with Gold Bullion International co-founder Dan Tapiero’s recent assertion that it’s only a matter of time before Bitcoin’s price surges into the six-figure threshold.

Of course, no matter how many pundits back Bitcoin, or how much money institutions put into it, gold bug Peter Schiff, will remain unmoved:

Some have postulated that investors are selling #gold and buying #Bitcoin. Since they have nothing in common, I doubt that's happening. But some speculators may be selling gold stocks and buying GBTC, with gold stocks falling as gold rises, and GBTC trading up to a 25% premium.

— Peter Schiff (@PeterSchiff) December 3, 2020

Title: Every asset manager must understand Bitcoin — Erik Voorhees

Sourced From: cointelegraph.com/news/every-asset-manager-must-understand-bitcoin-erik-voorhees

Published Date: Fri, 04 Dec 2020 05:41:55 +0000

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/polkadot-launches-defi-alliance-with-chainlink-and-will-let-1000-nodes-bloom