An Energy-Efficient Network with Technical Challenges Ahead

It has been a year since Ethereum made its historic transition to proof of stake (PoS), and the results are in. The shift from the energy-intensive proof-of-work (PoW) consensus mechanism to PoS has led to a massive reduction in energy use and improved access to the network. However, the road ahead is not without its challenges.

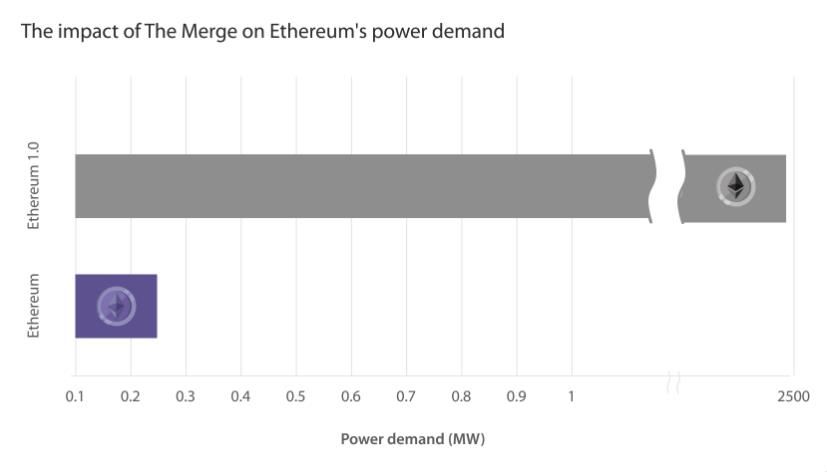

A Drastic Reduction in Energy Consumption

One of the most significant improvements brought about by the transition to PoS is the drastic reduction in energy consumption. The Ethereum network has seen its energy use drop by more than 99.9% since implementing PoS, according to data from The Cambridge Centre for Alternative Finance. This shift has helped Ethereum become more sustainable and environmentally friendly.

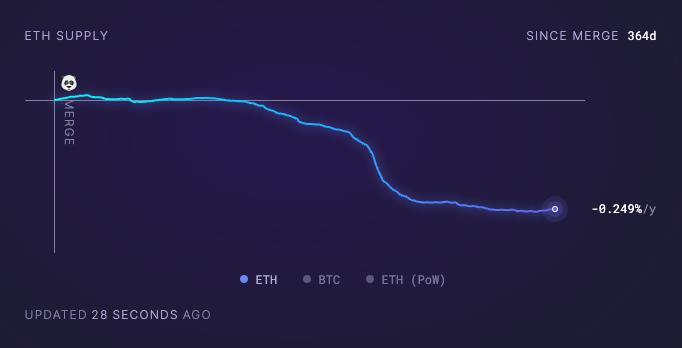

Ethereum Turns Deflationary

In addition to reducing energy consumption, the transition to PoS has also made Ethereum economically deflationary. This means that more Ether (ETH) is being removed from supply forever than the amount of new ETH issued to secure the network. Since the transition, over 300,000 ETH (worth $488 million) has been burned, leading to a reduction in the total supply of ETH at a rate of 0.25% per year.

The Impact on Price and Market Trends

While many expected the transition to PoS to drive up the price of Ethereum, macroeconomic factors such as the banking crisis and inflation have hindered the desired price surge. In contrast, Bitcoin has experienced significant growth in the first quarter of this year, benefiting from the traditional financial instability caused by the banking crisis. The price action of Ethereum may not have met expectations, but it is clear that the transition to PoS has long-term benefits for the network.

The Rise of Liquid Staking Providers

The introduction of stakers to secure the Ethereum network has led to the rise of liquid staking providers such as Lido and Rocket Pool. These providers now dominate the Ethereum landscape, with over $19.5 billion worth of ETH currently staked through liquid staking protocols, according to DeFiLlama data. Lido is the largest staking provider, accounting for 72% of all staked ETH.

Concerns over Centralization

While the shift to liquid staking has removed the barriers of expensive mining hardware, it has also raised concerns about the level of control granted to staking providers, particularly Lido Finance. Some Ethereum liquid staking providers are working towards imposing a 22% limit to ensure network decentralization, but Lido voted against it. This has sparked concerns about the potential centralization of validation on Ethereum.

The Future Challenges for Ethereum

In addition to the technical challenges posed by the rise of liquid staking, Ethereum faces regulatory pressure, particularly in the United States. The regulatory bodies in the US are looking to eliminate the blockchain industry, posing a threat to Ethereum's future. Another central concern is the need for client diversity and reducing reliance on centralized web providers. Vitalik Buterin suggests that statelessness could be the solution, but solving these issues may take another 10 to 20 years.

In conclusion, Ethereum's transition to proof of stake has brought about significant improvements, including reduced energy consumption and economic deflation. However, challenges such as the dominance of liquid staking providers and regulatory pressures lie ahead. The Ethereum community must address these issues to ensure a decentralized and sustainable future for the network.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/bitcoins-price-could-suffer-due-to-global-monetary-policy-changes-says-crypto-market-analyst