Decoding Optimism's Treasury Management Move

Ethereum layer-2 scaling solution, Optimism, has revealed its plan to sell 116 million OP tokens to seven private buyers as part of its treasury management strategy. The sale, valued at $159 million, is aimed at optimizing the token's value and ensuring its long-term stability.

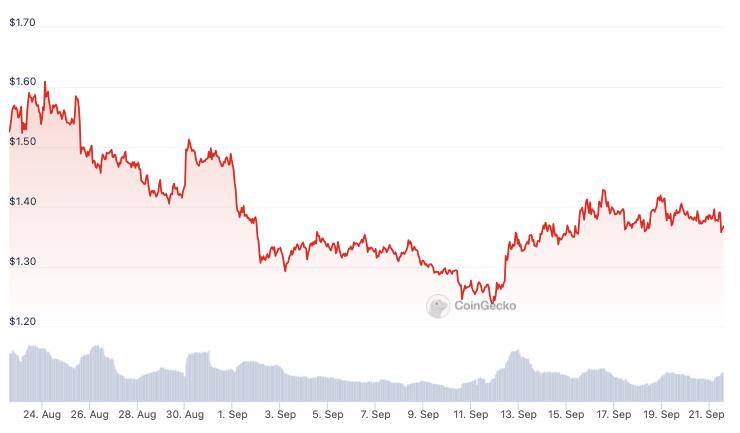

No Cause for Price Concern

While some industry experts expressed concerns that the sale could lead to a drop in OP token prices due to "dumping," it is highly unlikely that the market will be affected. This is because the sale is exclusive to private buyers and does not involve the circulating supply of OP tokens.

Locked Up and Delegated

The tokens sold are sourced from the unallocated portion of the OP token treasury. These tokens are subject to a two-year lock-up period, preventing buyers from selling them on secondary markets. However, they are allowed to delegate the tokens to unaffiliated third parties for governance purposes.

Part of the Original Plan

Optimism assures its community that this sale was always part of its original working budget. The company had allocated 30% of its initial token supply for this purpose. Therefore, the sale is a strategic move rather than a reactive measure.

Recent Airdrop and Network Activities

In a separate announcement, Optimism also revealed its third airdrop, distributing 19.4 million OP tokens to over 31,000 addresses involved in delegation activities related to its decentralized autonomous organization (DAO), Optimism Collective.

Industry Leading Layer-2 Scaling Solutions

Optimism, alongside Polygon and Arbitrum, holds a prominent position in the industry as the most widely used layer-2 scaling solutions. While Arbitrum leads in terms of total value locked (TVL), Optimism outperformed in total transactions in August. This was largely driven by increased activity from Coinbase's sandbox and the identity verification project, Worldcoin.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/british-politicians-advocate-for-uk-blockchain-and-web3-industries-in-virtual-gathering