Introduction

The relationship between Bitcoin's price and U.S. Treasury yields has long been considered a strong indicator due to historical data and the underlying rationale.

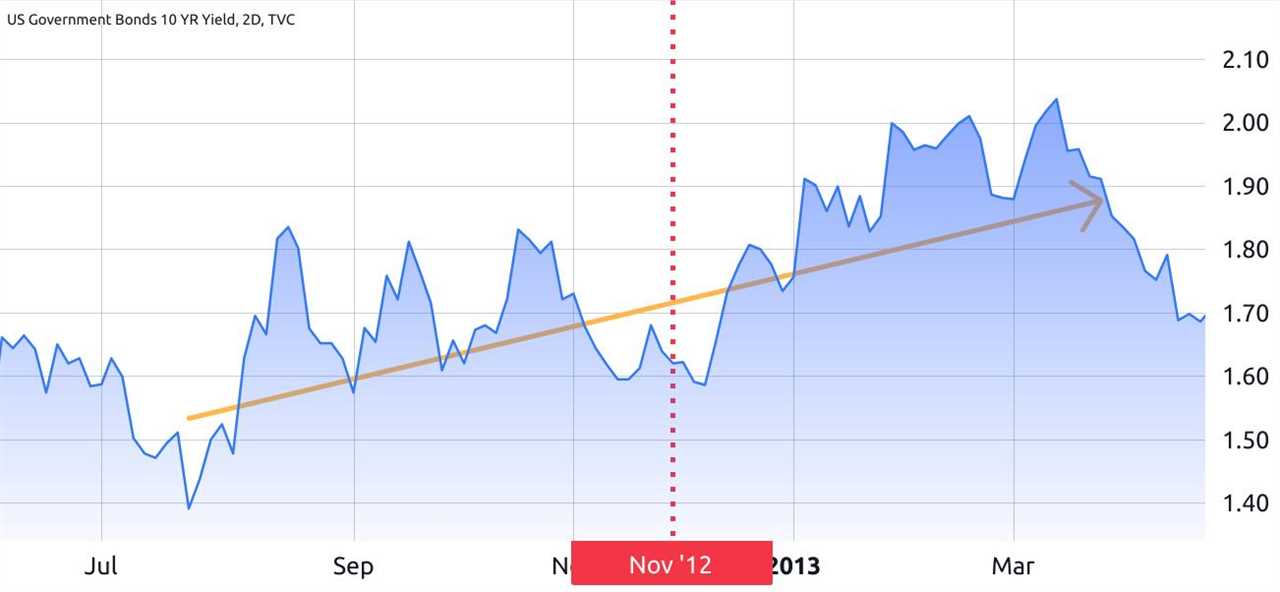

Bitcoin Halvings vs. 10-year Treasury Yields

When investors turn to government-issued bonds for safety, assets like Bitcoin, which are considered risk-on, tend to perform poorly. A notable chart shared by TXMC on X (formerly known as Twitter) argues that Bitcoin halvings have coincided with "relative local lows" in the 10-year Treasury yield. Let's examine the macroeconomic trends surrounding past halvings.

The Correlation and Causal Link

The author asserts that the correlation should not be taken as a "direct causal link between yields and BTC price." TMXC argues that over 92% of Bitcoin's supply has already been issued, suggesting that daily issuance is unlikely to be the factor "propping up the asset's price."

Analyzing the 10-year Yield Chart

Human perception is naturally inclined to spot correlations and trends, whether real or imaginary. It's essential to recognize that Bitcoin's first halving coincided with a period of steadily rising 10-year yields. The same cannot be said for the third halving in May 2020, where yields remained at a low level despite a modest gain in Bitcoin's price.

Statistical Merit and Bitcoin's Price

Attempting to attribute Bitcoin's bull run to a specific event with an undefined end date lacks statistical merit. Even if one concedes the idea of "relative" local lows on the 10-year yield chart, there's no compelling evidence that Bitcoin's halving date directly impacted its price in the subsequent four months.

No Bitcoin Rally is the Same

Bitcoin's rally after the halving is influenced by various macroeconomic factors. For instance, between October 2020 and January 2021, Bitcoin saw a remarkable increase in value, coinciding with a significant outperformance of small-cap companies compared to the S&P 500. This suggests that investors were seeking higher-risk profiles, rather than being driven by Treasury yields.

A Nuanced Understanding of the Cryptocurrency Market

Charts can be misleading when analyzing extended time periods. Linking Bitcoin's rally to a solitary event lacks statistical rigor. This underscores the need for a more nuanced understanding of the cryptocurrency market, one that acknowledges the multifaceted factors influencing Bitcoin's price dynamics rather than relying solely on simplistic correlations or isolated data points.

Note: This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author's alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/bahrains-bank-abc-partners-with-jpmorgans-onyx-blockchain-for-crossborder-payments