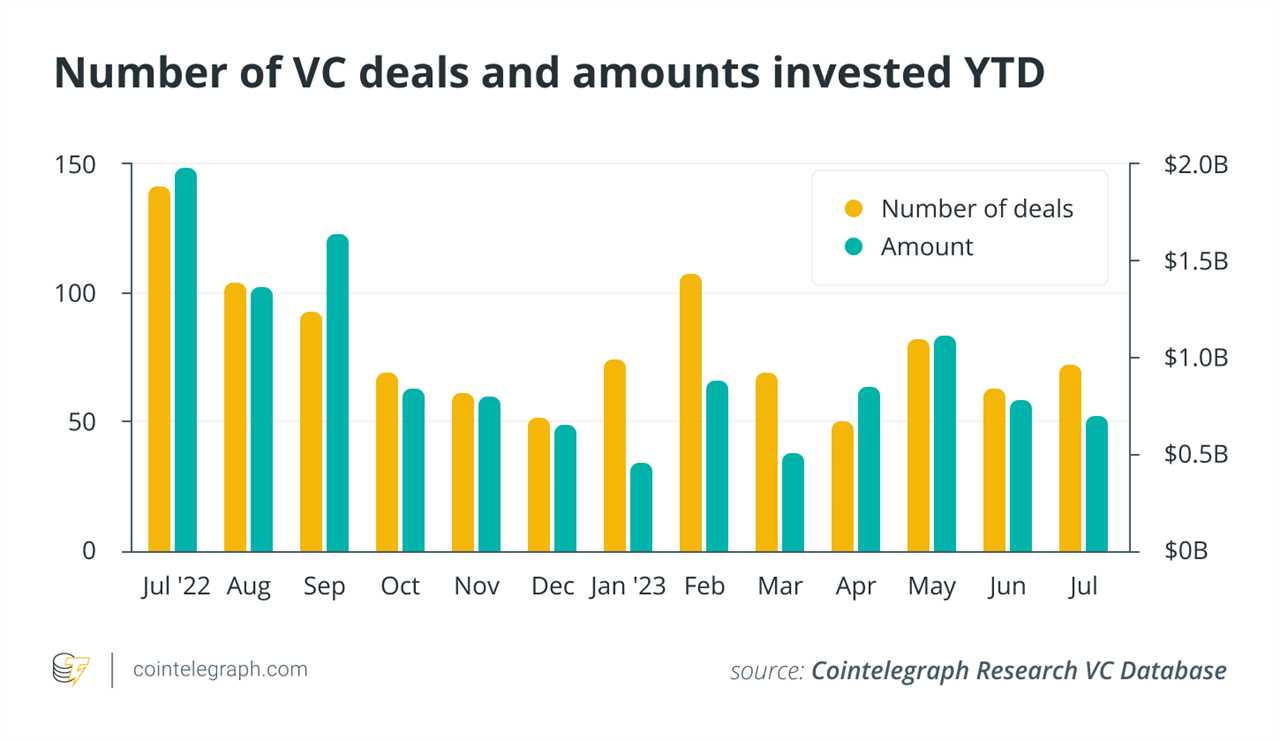

Capital inflows from venture capitalists down by 10.26% in July

Inflows from venture capitalists (VCs) in the cryptocurrency sector dropped by 10.26% in July, resulting in a total of $700 million raised, according to data from Cointelegraph Research VC Database. This decline continues the downward trend of the past two months, as macroeconomic conditions, including US Federal Reserve rate hikes and geopolitical events, continue to influence VCs' decision-making process.

VCs staying risk-off, opting for value investments

Amidst the uncertain climate, many VC firms are adopting a risk-off approach, holding onto most of their reserves. Some are choosing to deploy their capital to value investments, carefully examining each new project for potential opportunities. Rather than taking speculative bets, VCs are opting to follow "smart money" in the industry.

Notable outliers in the crypto VC sector

While the overall trend is discouraging, there have been some notable outliers in the crypto VC sector. Polychain Capital launched an Investment Fund IV with a value of $200 million in July, and CoinFund launched a Seed Fund IV worth $152 million. In June, only three crypto funds emerged, raising less than $100 million in total, making these recent launches stand out.

Potential approval of Bitcoin ETFs could revitalize the industry

There is growing hype surrounding the potential approval of spot Bitcoin exchange-traded funds (ETFs) in the US. If approved by the Securities and Exchange Commission (SEC), this development could breathe new life into the industry and trigger the next crypto bull run. The approval would signal confidence in crypto investments and attract more attention and capital.

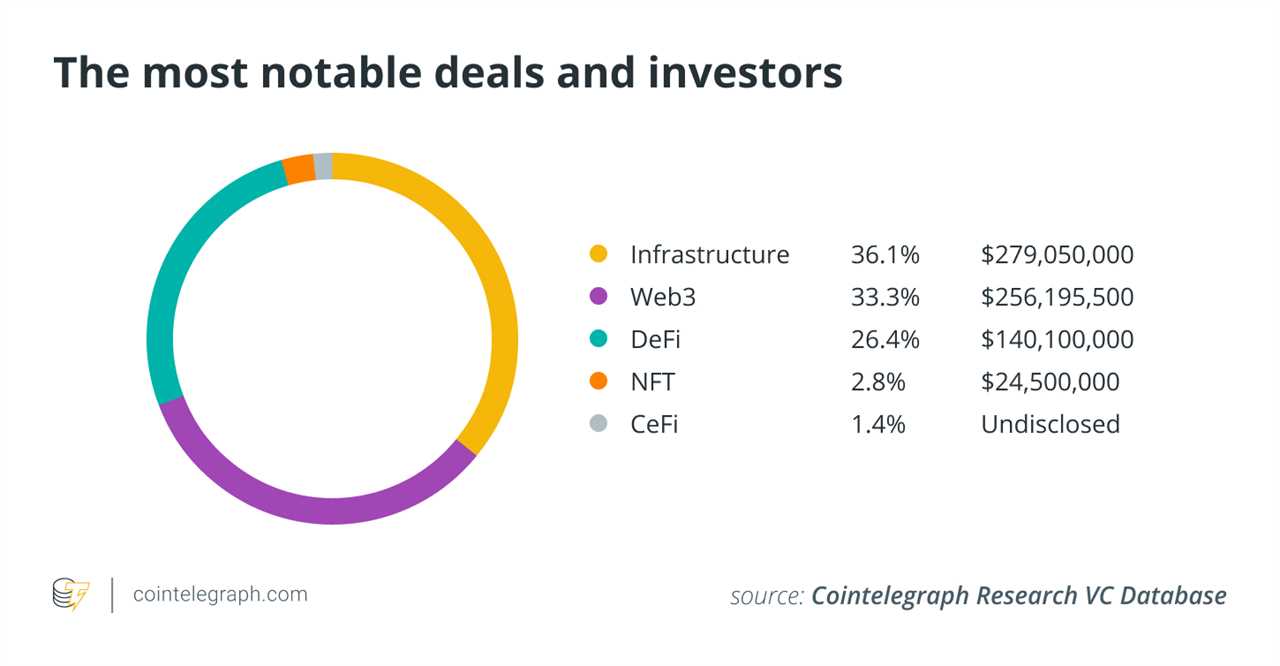

Infrastructure and Web3 sectors maintain momentum

The Web3 sector has been particularly active, with 26 individual deals raising $256.2 million in July. Infrastructure projects have also been successful in attracting capital, with $279 million raised over 24 deals during the same period. Decentralized finance and nonfungible tokens (NFTs) have also seen significant investments.

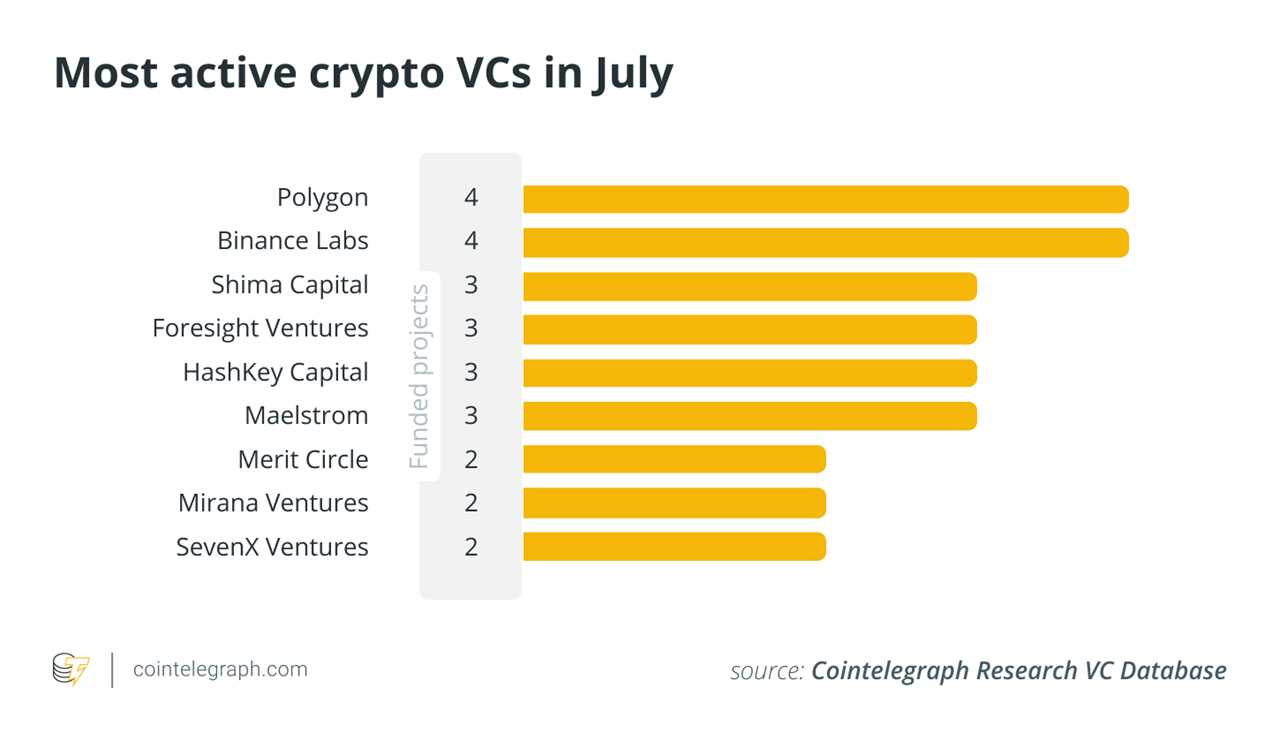

Notable projects and investments in July

Polygon and Binance Labs participated in multiple funding rounds in July. Several investment companies, including Polygon, Binance Labs, and HashKey Capital, invested in projects such as 0xBoost Finance, Aethir, Dappos, and Delabs Games. However, the top raisers in July were Web3 startup Zyber 365, which secured $100 million in a Series A round, and infrastructure solution provider Flashbots, which closed a Series B round of $60 million.

Unlikely to see a quick return to the upward trend

Despite the positive sentiment surrounding the potential approval of Bitcoin and Ether ETFs in Europe and the US, it is unlikely that the blockchain industry will quickly return to a steady upward trend. Investor activity remains subdued, and the impact of macro factors continues to weigh on the sector.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/balancer-warns-28m-still-in-danger-after-vulnerability-discovery