The cryptocurrency market is "dramatically underestimating" the bullishness of spot Bitcoin exchange-traded fund (ETF) approvals, according to analysts from crypto research firm K33, formerly known as Arcane Research.

Increase in Chances for Approval

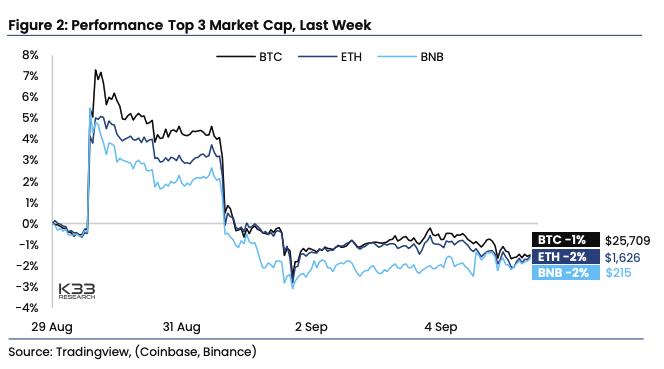

In a recent market report, K33 analysts Vetle Lunde and Anders Helseth stated that the chances of a spot Bitcoin ETF approval have significantly improved in the past three months. Despite this, the sentiment is not being reflected in the price of Bitcoin or other major crypto assets.

The analysts explained that even though Bitcoin had lost its gains following Grayscale's legal victory over the US Securities and Exchange Commission (SEC), an approval for a spot ETF would attract significant investment and greatly increase the buying pressure for Bitcoin.

If a spot ETF is rejected, the downside would be minimal, and Bitcoin prices would continue as usual, according to Lunde and Helseth.

Fundamental Misunderstanding

The analysts also highlighted the fundamental misjudgment of the market's outlook on ETFs. They mentioned that several Bloomberg analysts are now predicting a 75% chance of ETF approval within the year.

Lunde and Helseth firmly disagreed with the market's sentiment, stating that it is a buyer's market, and it is crucial to accumulate Bitcoin aggressively at its current levels.

To reinforce their bullish prediction, the analysts pointed to the recent 2% gain in the tech-heavy Nasdaq-100 index, which often indicates the broader market's risk appetite.

Ether Expected to Outperform Bitcoin

The analysts also shared their positive outlook on the price of Ether (ETH), stating that it is likely to outperform Bitcoin in the next two months. They explained that ETH will benefit from strong momentum ahead of a futures-based ETF listing.

According to Lunde and Helseth, Ether may follow a similar path to Bitcoin, which experienced a 60% increase in price in the weeks leading up to the launch of the first Bitcoin futures-based ETF on October 19, 2021.

A verdict on a futures-based Ether ETF is expected to be announced in mid-October and is reportedly set to receive approval from the SEC.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/coinbases-ethereum-layer2-network-base-experiences-first-major-outage-since-launch