2020 was the most important year for the crypto derivatives market so far. Both Bitcoin (BTC) and Ether (ETH) derivatives steadily grew throughout the year, with their futures and options products available across exchanges such as the Chicago Mercantile Exchange, OKEx, Deribit and Binance.

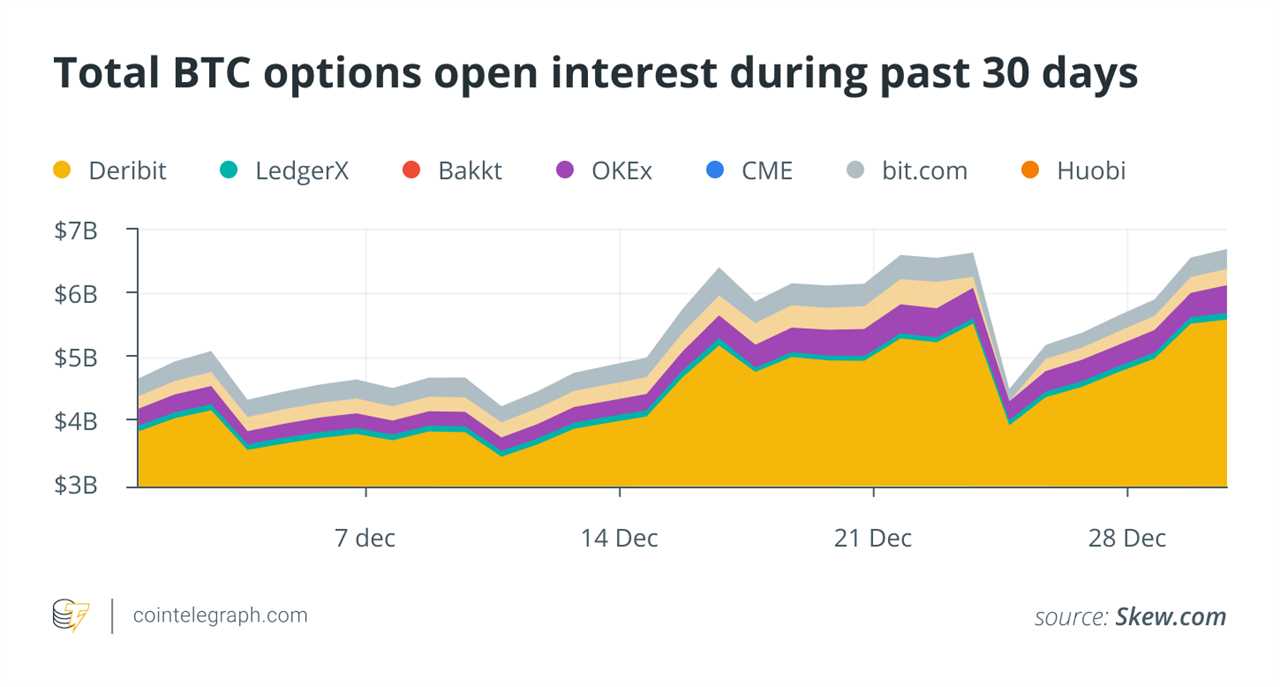

On Dec. 31, Bitcoin options open interest reached an all-time high of $6.8 billion, which is three times the OI seen 100 days before that, signifying the speed at which the crypto derivatives market is growing amid this bull run.

The bull run has led to a lot of new investors entering the market amid the uncertainty that plagues traditional financial markets due to the ongoing COVID-19 pandemic. These investors are looking to hedge their bets against the market through derivatives of underlying assets like Bitcoin and Ether.

Institutional investors are bringing the key change

While there are multiple factors driving the growth of crypto derivatives, it’s safe to say that it has primarily been driven by interest from institutional investors, considering that derivatives are complex products that are difficult for the average retail investor to understand.

In 2020, a variety of corporate entities such as MassMutual and MicroStrategy showed considerable interest by purchasing Bitcoin either for their reserves or as treasury investments. Luuk Strijers, chief commercial officer of crypto derivatives exchange Deribit, told Cointelegraph:

“As Blackrock’s Fink put it ‘cryptocurrency is here to stay’ and bitcoin ‘is a durable mechanism that could replace gold.’ Statements like these have been the driver for the recent performance, however as a platform we have seen new participants joining the entire year.”

Strijers confirmed that as a platform, Deribit sees institutional investors entering the crypto space using trade instruments they are familiar with, like spot and options, which led to the tremendous growth in open interest throughout 2020.

The Chicago Mercantile Exchange is also a prominent marketplace for trading options and futures, especially for institutional investors, as the CME is the world’s largest derivatives trading exchange across asset classes, making it a familiar marketplace for institutions. It recently even overtook OKEx as the largest Bitcoin futures market. A CME spokesperson told Cointelegraph: “November was the best month of Bitcoin futures average daily volume (ADV) in 2020, and the second-best month since launch.”

Another indicator of institutional investment is the growth in the number of large open interest holders, or LOIHs, of CME’s Bitcoin futures contracts. A LOIH is an investor that is holding at least 25 Bitcoin futures contracts, with each contract consisting of 5 BTC, making the LOIH threshold equivalent to 125 BTC — over $3.5 million. The CME spokesperson further elaborated:

“We averaged 103 large holders of open interest during the month of November, which is a 130% increase year over year, and reached a record 110 large open interest holders in December. The growth of large open interest holders can be viewed as indicative of institutional growth and participation.”

The fact that the crypto derivatives market is now in demand is a sign of maturity for assets like Bitcoin and Ether. Similar to their role in the traditional financial markets, derivatives offer investors a highly liquid, efficient way of hedging their positions and mitigating the risks associated with the volatility of crypto assets.

Other macroeconomic factors are also pushing demand

There are several macroeconomic factors that are also causing the boost in demand for the crypto derivatives market. As a result of the COVID-19 pandemic, several large economies including the United States, the United Kingdom and India have been stressed due to limited working conditions and growing unemployment.

This has caused several governments to roll out stimulus packages and engage in quantitative easing to reduce the impact on the base economy. Jay Hao, CEO of OKEx — a crypto and derivatives exchange — told Cointelegraph:

“With the pandemic this year and many governments’ responses to it with massive stimulus packages and QE, many more traditional investors are moving into Bitcoin as a potential inflation hedge. Cryptocurrency is finally becoming a legitimized asset class and this will only mean a greater rise in demand.”

There is a growing interest from the mining community and other companies generating income in Bitcoin looking to hedge their future earnings so as to be able to pay their operating expenses in fiat currencies.

Besides institutional demand, there is a significant increase seen in retail activity as well, Strijers confirmed: “The unique accounts active on a monthly basis in our options segment keep rising. Reasons are overall (social) media attention to the potential of options.” The CME spokesperson also stated:

“In terms of new account growth, in Q4 2020 to date, a total of 848 accounts have been added, the most we’ve seen in any quarter. In November alone, 458 accounts were added. In 2020-to-date, 8,560 CME Bitcoin futures contracts (equivalent to about 42,800 bitcoin) have traded on average each day.”

Ether derivatives grow due to DeFi and Eth2

Apart from Bitcoin futures and options, Ether derivatives have also grown tremendously in 2020. In fact, the CME even announced that it will be launching Ether futures in February 2021, which in itself is a sign of the maturity that Ether has reached in its life cycle.

Previously, the crypto derivatives market was monopolized by products using Bitcoin as the underlying asset, but in 2020, Ether derivatives grew to take a significant share of the pie. Strijers further elaborated:

“When looking at USD value of turnover we see that on Deribit the BTC derivatives contributed the majority of volume, however the percentage has decreased from ~91% in January to ~87% in November. During the peaks of the DeFi summer, the BTC percentage dropped to mid seventies due to the increased ETH activity and momentum.”

The reason that Bitcoin derivatives make up a larger portion of the crypto derivatives market is that BTC is now well understood by the market and has received validation by large institutions, governing bodies and several prominent traditional investors. However, in 2020, there were several factors that influenced the demand for Ether derivatives as well. Hao believes that “The huge growth in DeFi in 2020 and the launch of ETH 2.0’s Beacon chain has definitely spurned more interest in Ether and, therefore, Ether derivatives.”

However, even though Ether is continuing its bull run alongside Bitcoin and will likely see a further increase in demand for derivatives, it’s highly unlikely that BTC will be overtaken any time soon. Hao further elaborated: “We will see rising demand for both of these products, however, BTC as the number-one cryptocurrency will likely see the steepest growth as more institutional dollars flood the space.”

2021 set to be a crucial year

Starting with the launch of CME’s Ether futures product in February, this year is set to be an even bigger year for crypto derivatives if the bull run continues. The market also recently witnessed the biggest options expiry yet, with nearly $2.3 billion worth of BTC derivatives expiring on Christmas.

With traditional markets, the derivatives market is several times larger than the spot market, but it’s still the opposite with crypto markets. So, it seems the crypto derivatives market is still in its nascent stage and is set to grow exponentially as the industry expands in size. As volumes increase, markets tend to become more efficient and offer better price discovery for the underlying asset, as Strijers added:

“Due to the overall increase in market interest, [...] we see more market makers quoting our instruments, increasing our ability to launch more series and expiries, tightening spreads which acts as a fulcrum for further interest as execution becomes cheaper and more efficient.”

Apart from Bitcoin and Ether derivatives, there are altcoin derivatives products that are offered on various exchanges, most popularly perpetual swaps but also even options and futures. Hao elaborated further on these products and their demand prospects:

“Many other altcoins are already on offer to trade derivatives particularly in perpetual swap but also futures. [...] The demand for this is largely driven by retail traders as some of these assets haven’t won over the confidence of institutional traders yet.”

Even though institutional investors are not flocking to the derivatives products of these altcoins just yet, that is set to change with the further growth of decentralized finance markets and the use cases that they can offer. Ultimately, this can translate into a rise in demand for more crypto derivatives in the near future.

Title: Crypto derivatives gained steam in 2020, but 2021 may see true growth

Sourced From: cointelegraph.com/news/crypto-derivatives-gained-steam-in-2020-but-2021-may-see-true-growth

Published Date: Fri, 01 Jan 2021 19:26:33 +0000