Coinbase Stock Jumps 15% on News of Favorable Ruling

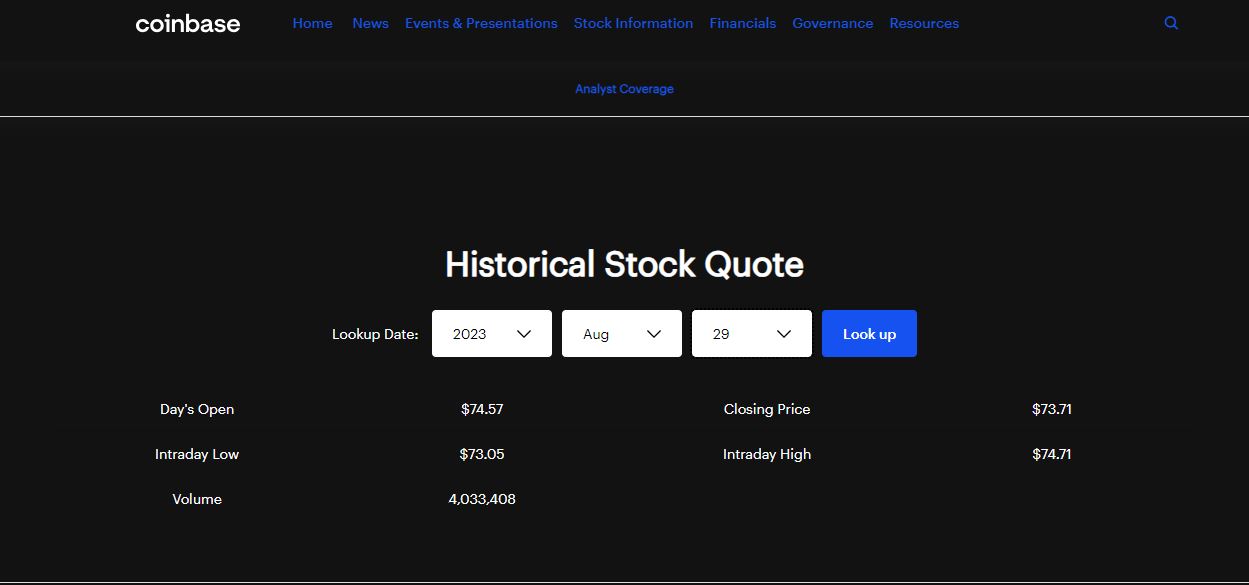

Coinbase, the leading cryptocurrency exchange in the United States, experienced a significant surge in its stock price on August 29th following reports of a federal judge ruling in favor of Grayscale in their legal dispute with the U.S Securities and Exchange Commission (SEC). In the final moments of the trading session that day, the value of Coinbase's stock (COIN) reached $85.13 per share, representing an increase of over 15% compared to the previous day's closing price.

Victory for Cryptocurrency Sector Fuels Hopes of a Bitcoin ETF

The federal court ruling on August 29th determined that the SEC failed to provide sufficient justification for rejecting Grayscale's request to convert its Bitcoin Trust into a traditional Bitcoin exchange-traded fund (ETF). Investors perceived this verdict as a win for the cryptocurrency sector, igniting optimism for the potential introduction of a Bitcoin ETF in the financial market. Coinbase is among the candidates vying to launch a Bitcoin ETF and has been selected as a potential custodian and partner for sharing surveillance data.

Data Sharing to Mitigate Risks and Ensure Secure Storage

In order to mitigate market manipulation risks and ensure the secure storage of the Bitcoin supporting the fund's shares, Coinbase will collaborate with Grayscale by sharing data related to trading, clearing operations, and customer identification. This partnership seeks to foster transparency and strengthen the safety measures surrounding the cryptocurrency market.

Demand for Direct Bitcoin Exposure Drives Interest in ETFs

Although the U.S. SEC has been hesitant to approve a Bitcoin spot ETF, investors are eagerly seeking investment instruments that provide direct exposure to Bitcoin. In June, BlackRock, the world's largest asset manager, joined other prominent applicants in applying for SEC approval to launch a Bitcoin ETF. Many investors have expressed a strong demand for cryptocurrency exposure, indicating the increasing mainstream acceptance of digital assets as an investment option.

Bitcoin Price Rises 7% in 24 Hours but Remains Lower Than Peak

As of the time of writing, the price of Bitcoin stands at $27,982 per coin, representing a more than 7% increase in the past 24 hours, according to Coinmarketcap data. However, Bitcoin's market capitalization remains significantly lower, nearly 60%, compared to its peak in November 2021 when it reached $69,044. Despite this, the positive developments in the cryptocurrency industry, including the potential arrival of a Bitcoin ETF, continue to drive interest and participation in the market.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/naturebased-carbon-projects-need-more-accurate-measurement-and-verification-and-dmrv-could-be-the-solution