Investors Betting on Bitcoin's Potential

The demand for Bitcoin (BTC) among institutional investors is on the rise, as evidenced by the Chicago Mercantile Exchange (CME) Bitcoin futures flipping Binance's BTC futures markets in terms of size. According to BTC derivatives metrics, investors are showing strong confidence in Bitcoin's potential to break above the $40,000 mark in the short term.

CME's Growth and the Spot Bitcoin ETF Speculation

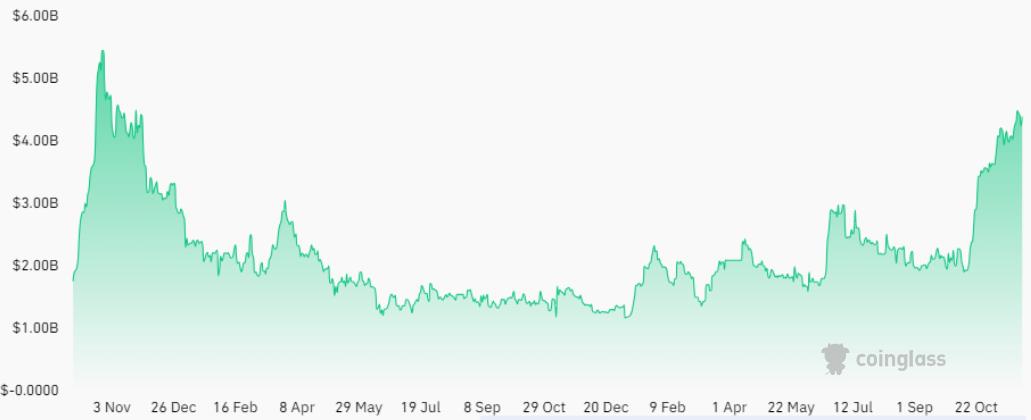

CME's Bitcoin futures open interest has surged by an impressive 125% in recent weeks, reaching $4.35 billion, the highest since November 2021. This growth is believed to be tied to the anticipation of the approval of a spot Bitcoin ETF. While there's no direct correlation between this movement and the actions of market makers or issuers, it indicates the increasing interest of institutional investors in the cryptocurrency market.

Extreme Optimism in CME's Bitcoin Futures

The most noteworthy development in CME's Bitcoin futures activity is the spike in the contracts' annualized premium. On November 28, the premium surged from 15% to 34%, indicating substantial optimism among buyers. However, the premium has since stabilized at 14%. It's important to note that the surge in Bitcoin's price during that period cannot be solely attributed to futures contracts, as arbitrage between the spot market and futures contracts occurs in milliseconds.

Bullish Sentiment Among Institutional Investors

Despite the speculation about whales accumulating assets ahead of a potential spot ETF approval, derivatives metrics do not indicate excessive short-term optimism. The 30-day BTC options 25% delta skew has consistently remained below the -7% threshold, supporting the bullish sentiment among institutional investors using CME Bitcoin futures. As long as the hope for a spot ETF approval remains, bulls are likely to continue challenging resistance levels.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.