Bitcoin (BTC) made the most of weekend volatility on June 26 as a squeeze saw BTC/USD reach its highest in over a week.

"Unusual whale activity" flagged

Data from Cointelegraph Markets Pro and TradingView followed the largest cryptocurrency as it hit $21,868 on Bitstamp.

Just hours from the weekly close, a reversal then set in under $21,500, Bitcoin still in line to seal its first "green" weekly candle since May.

The event followed warnings that volatile conditions both up and down could return during low-liquidity weekend trading. On-chain data nonetheless fixed what appeared to be buying by Bitcoin's largest-volume investor cohort prior to the uptick.

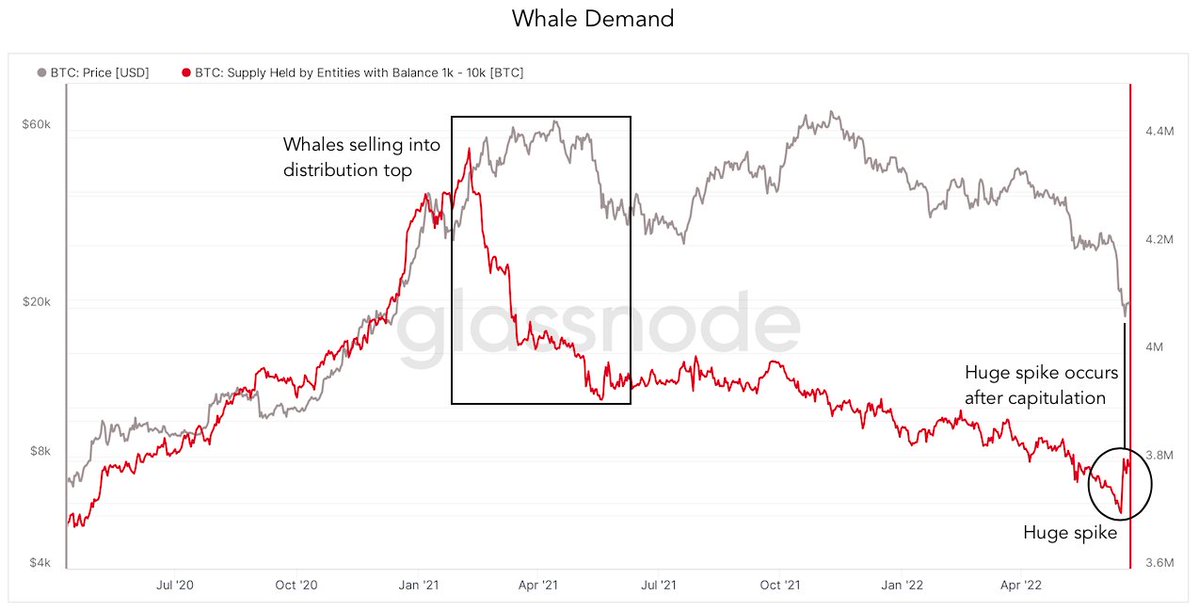

"Unusual whale activity detected in Bitcoin," popular analytics resource Game of Trades observed.

"The supply held by entities with balance 1k-10k BTC just saw a huge spike in demand. Let’s watch if the trend confirms."

An accompanying chart from on-chain analytics firm Glassnode showed shifting up markedly from around the time BTC/USD hit lows of $17,600 this month.

As Cointelegraph reported, whales had eagerly purchased BTC below $20,000, forming new support clusters in the process.

CME futures gap looms large

For others, however, conservative views on price action remained the norm.

Related: Bitcoin gives ‘encouraging signs’ — Watch these BTC price levels next

Cointelegraph contributor Michaël van de Poppe eyed the need to crack $21,600 definitively in order to secure the chances of further upside. Additionally, last week's closing price of $21,100 on CME Group's Bitcoin futures could provide a short-term target.

"Standard weekend fake-outs happening and probably ending at CME close at $21.1K for Bitcoin," he forecast on the day.

"No clear breakout above $21.6K at this point, yet."

The monthly close was still on course to cement Bitcoin's worst June on record with monthly losses of almost 33%.

Along with May 2021, this would also be the worst-performing month since before the 2018 bear market bottom, data from on-chain monitoring resource Coinglass confirms.

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: BTC price tops 10-day highs as Bitcoin whale demand sees 'huge spike'

Sourced From: cointelegraph.com/news/btc-price-tops-10-day-highs-as-bitcoin-whale-demand-sees-huge-spike

Published Date: Sun, 26 Jun 2022 16:26:02 +0100