The sudden market crash in the crypto space liquidated many traders — and according to data shown on the blockchain, the attackers responsible for the infamous BNB Chain exploit which led to the theft of almost $600 million worth of BNB (BNB) tokens.

The exploit and theft

On Oct. 6, the cross-chain bridge by blockchain network BNB Chain was suspended because of an exploit that allowed the hackers to make off with 2 million BNB tokens, which were worth around $568 million at the time of the theft.

Hacker's liquidation

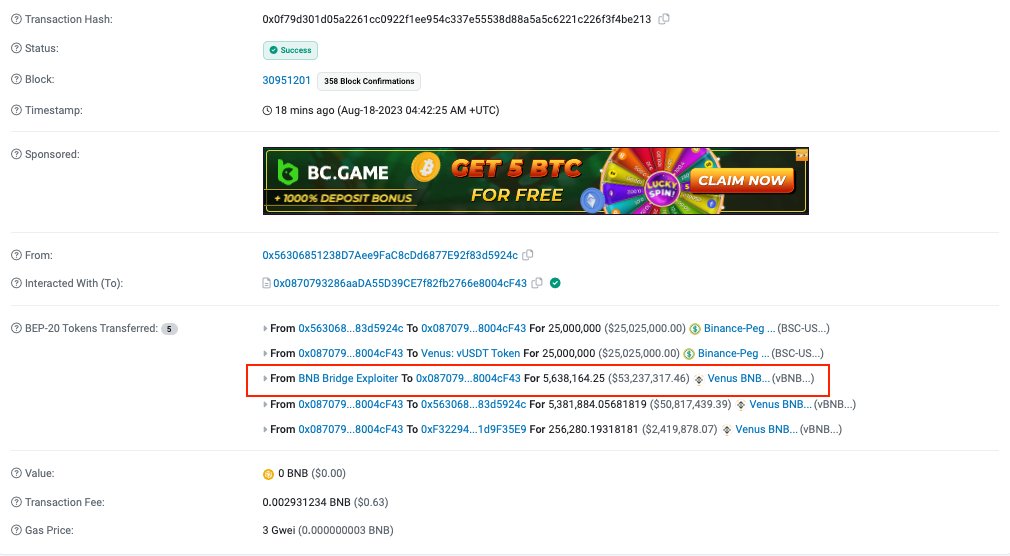

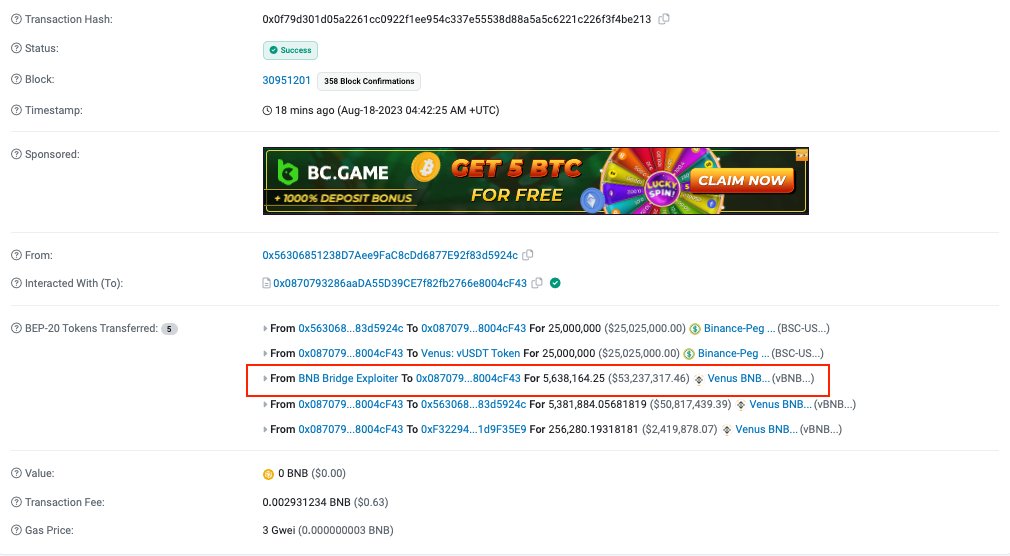

On Aug. 18, a crypto wallet linked to the exploit had its collateral, worth more than $53 million, liquidated on the crypto lending platform Venus Protocol, according to blockchain security firm PeckShield. The hacker apparently used the tokens as collateral for a $30 million Tether (USDT) loan on the protocol.

The market crash

On Aug. 18, the entire crypto market suffered a 6% drop, sending the overall market capitalization to $1.1 trillion, according to coin information sites. The event wiped out over $1 billion in crypto positions in the last 24 hours according to market data tracker Coinglass.

Impact on BNB chain hackers

The BNB chain hackers were also affected as the price of BNB dropped below $220. According to blockchain data, three positions linked to the wallet were automatically liquidated after the price fell. At the moment, BNB trades at $218 per token.

Minimizing losses and potential gains

While many suffered losses as a result of the massive drop in the market, some were able to minimize the damage. Days before the crash, a crypto whale sold 22,341 Ether (ETH), worth around $41 million, and avoided a potential loss of over $5 million in value. Despite this, the crypto trader still lost around $1.7 million in the trade.