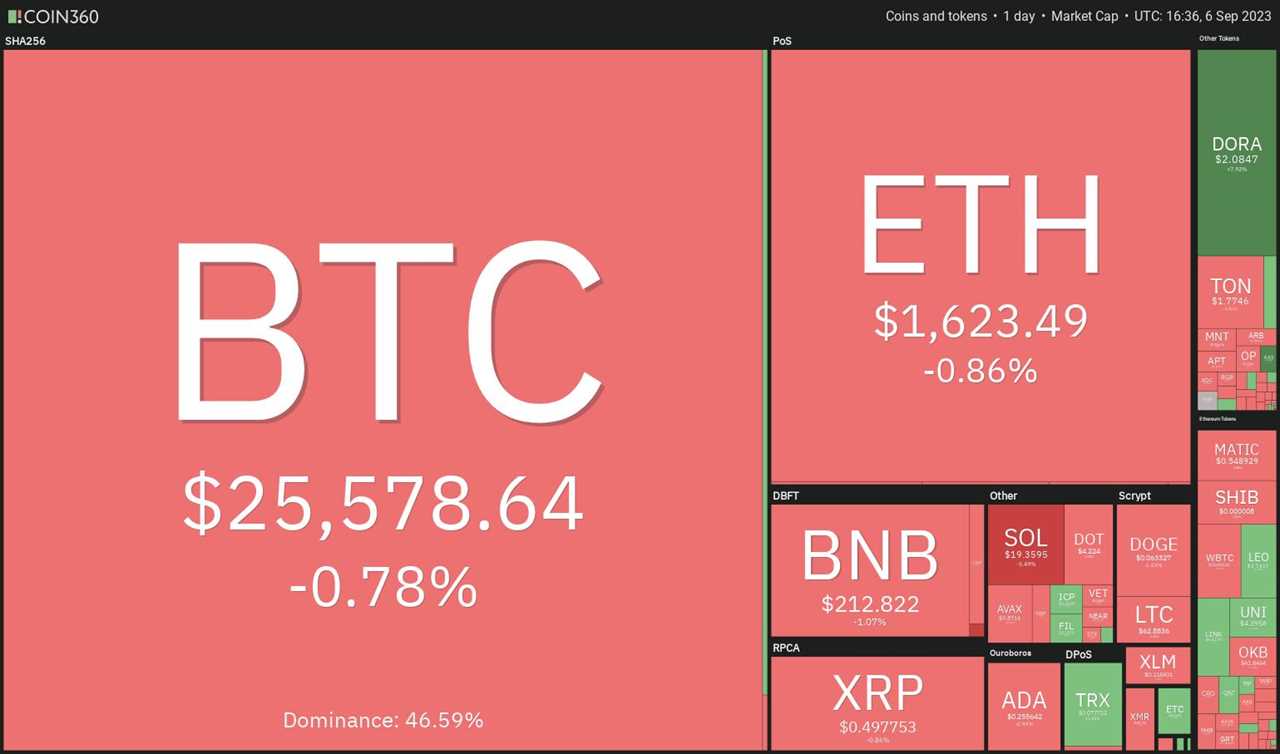

Bitcoin (BTC) has been experiencing a period of low volatility, trading in a tight range between $25,333 and $26,156 since September 1. However, experts are unsure about the direction of the inevitable volatility breakout.

Bitcoin's September Slump

Historical data from CoinGlass reveals that Bitcoin has historically fallen in September for six consecutive years, casting doubt over the short-term prospects for the cryptocurrency. The recent sharp rise in the United States dollar index (DXY), which has an inverse correlation with Bitcoin, further suggests that the digital currency could face pressure in the near-term.

Opportunity for Bullish Buyers

Despite the potential challenges, analysts believe that lower price levels will attract buyers looking to invest in Bitcoin. The market is optimistic about the possibility of one or more Bitcoin spot exchange-traded fund (ETF) applications receiving regulatory approval, which could limit further downside. If positive news regarding the approval of these ETFs appears, it could drive Bitcoin prices higher.

Looking Ahead

While there may be short-term weakness in the Bitcoin market, analysts are cautiously optimistic about the long-term prospects for the cryptocurrency. The future direction of Bitcoin's volatility breakout remains uncertain, and investors and traders will be closely monitoring trends and news developments to make informed decisions.