The crypto market has been surging recently and there’s one cryptocurrency — Bitcoin (BTC) — leading the way. After having suffered through volatility for the better part of the last 60-some days, the flagship crypto has showcased a high level of recovery, even breaking past its 200-day moving average earlier this month, suggesting that a move to the $50,000 psychological barrier may be in the cards soon.

To really put things into perspective, over the last month alone, BTC has registered gains of more than 55%, helping to take the total market capitalization of this relatively nascent space back beyond the $2 trillion threshold. These startling figures can, in large part, be attributed to increased institutional adoption that has been witnessed in relation to this industry in the recent past.

In this regard, some of Bitcoin’s most significant institutional backers include Michael Saylor-led Microstrategy, EV manufacturer Tesla and crypto-focused investment firms Galaxy Digital Holdings and Voyager Digital. Additionally, even a number of traditional banking institutions have entered the crypto fray recently. Wells Fargo, one of the oldest banks in the United States, is the newest member of a list of growing financial institutions to offer its wealthy clients indirect exposure to Bitcoin.

Other prominent financial institutions that also offer a range of crypto-focused financial offerings include JPMorgan, BNY Mellon, Morgan Stanley, Bank of America and Goldman Sachs, among many others.

Lastly, according to recent filings made with the United States Securities and Exchange Commission (SEC), a growing list of wealth management companies — such as Illinois-based Clear Perspective Advisors and Ohio-situated Ancora Advisors — have been acquiring sizable sums of Grayscale's Bitcoin Investment Trust (GBTC) shares, signaling a growing demand for the asset among institutional players.

What to expect?

Providing his take on when he sees Bitcoin scaling up to the $50,000 mark, Iqbal Gandham, VP of Transactions for security and infrastructure solutions provider Ledger, told Cointelegraph that when crossing significant price milestones, there is always a pause — much like the one we are witnessing now — so that the market can stabilize:

“The longer we hold it here the more support it will gather. As for factors that will drive this run, I really feel it's more psychological rather than news-driven. People are just waiting for a trend, so any slightly positive news could cause the price to move dramatically. It's not a matter of if anymore, just a when.”

Daniele Bernardi, CEO of fintech management company Diaman Group, told Cointelegraph that his company’s proprietary indicators are all extremely positive regarding BTC’s near-term growth. In his personal view, however, the next wave of bullish market growth will not purely be driven by Bitcoin, but rather by alt-assets such as Ether (ETH), Cordano (ADA) and Binance Coin (BNB).

“My point of view is that it is actually more important to focus on altcoins for a while. We can expect a reduction of Bitcoin dominance for some months,” he said.

Lastly, according to Talal Tabbaa, chairman and co-founder of CoinMENA — an FTX-backed Middle East-based cryptocurrency exchange — even though Bitcoin could be trading at $50,000 in the coming few days, such short-term price action is quite irrelevant when looking at the grand scheme of things:

“Technical analysis has limitations and shouldn’t be solely used for decision making. I actually think it crazy that some people think they can draw lines on a chart and predict the future. Macro events like China banning mining or the US hopefully approving ETFs will have much bigger impacts on Bitcoin’s short term movements than any technical analysis.”

Bitcoin “gold cross” spotted suggesting solid near-term price action

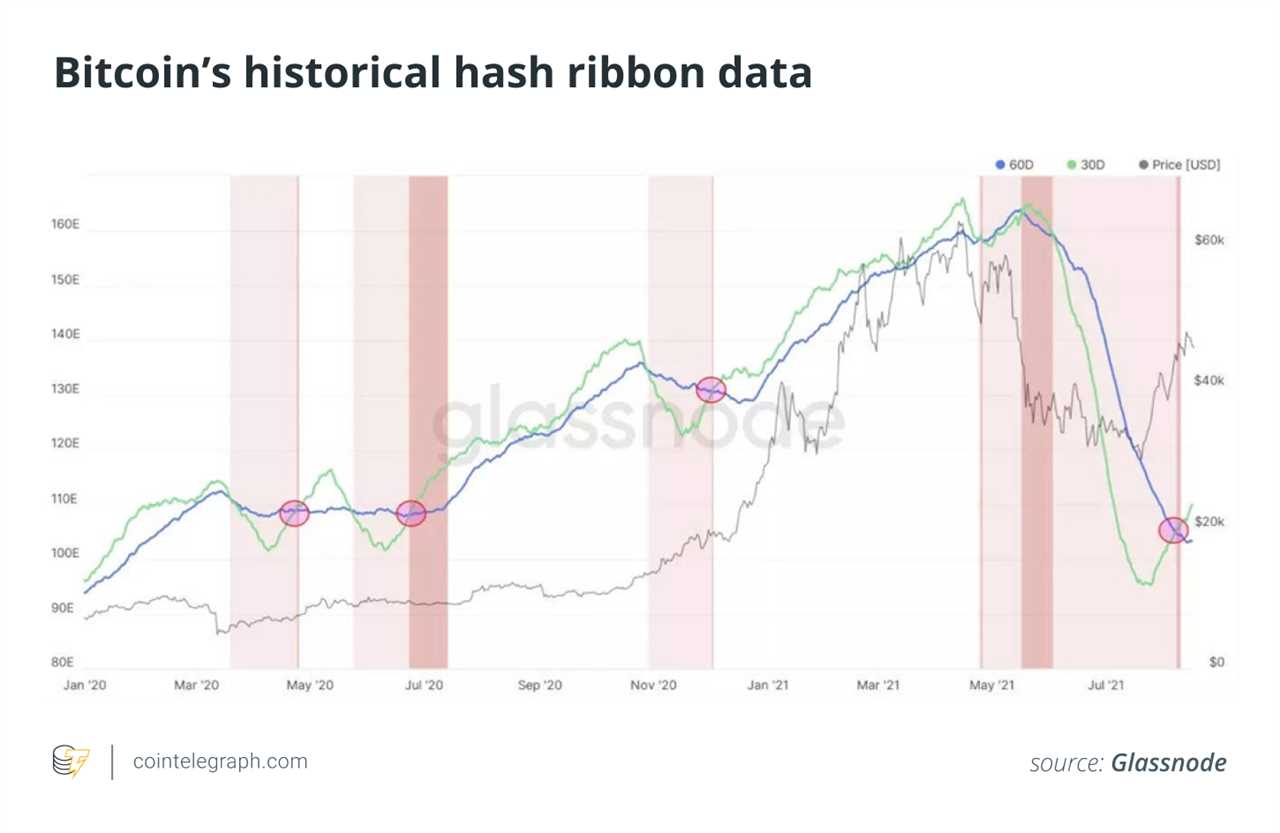

Despite there being some uncertainty over the last few months in terms of where the crypto sector may be headed, there is enough evidence to suggest that the market may be primed for another bull run in the near term. In this regard, blockchain analytics platform Glassnode recently reported that a “golden cross” formation — between the 30-day and 60-day moving averages of Bitcoin’s hash ribbon — has been recently observed.

A golden cross is observed when the short-term average value of an asset rises above that of its average value in the long term. As can be seen from the chart above, the comparison between BTC’s 30- and 60-day hash ribbons indicates that trading volumes are on the rise once again. It is also important to highlight that the same formation was spotted before Bitcoin rallied back in January 2019 and 2020, and in March 2020 and December 2020.

Lastly, Glassnode’s reported hash rate suggests that miners who may have been forced to move their operations from China — following the country’s recent regulatory tightening — may have finally established their bases elsewhere. In this vein, it should be noted that just over a fortnight or so ago, five North American mining operators — including Marathon Digital, Riot Blockchain, Bitfarm, Argo Blockchain and Hut8 — reported witnessing a 58% increase in their operational output.

Other factors affecting BTC’s price action

Recently, Elon Musk made a U-turn in his outlook regarding Bitcoin, after having slighted the premier crypto earlier this year regarding its adverse environmental impact, thus giving investors — who follow the Dogefather’s every word — more fuel to become bullish on Bitcoin. Not only that, Twitter CEO Jack Dorsey and Ark Invest’s Cathie Wood recently confirmed their long-term investment in the premier crypto.

On BTC’s increasing adoption, a spokesperson for cryptocurrency exchange Bitstamp told Cointelegraph that the number of active retail female investors has grown more than 24% in the last six months:

“The share of the trading volume generated by female investors at Bitstamp has increased by an astonishing 58% in that same time, pointing to a surge of new investors interested in cryptocurrencies.”

Lastly, with a growing list of countries — most prominently El Salvador — starting to adopt varied measures to recognize and regulate the crypto market, it will be interesting to see how the coming few days play out for Bitcoin, especially with the prevailing market sentiment that seems to be overwhelmingly positive at the moment.

Title: Bitcoin's race to $50K heats up as solid institutional backing continues

Sourced From: cointelegraph.com/news/bitcoin-s-race-to-50k-heats-up-as-solid-institutional-backing-continues

Published Date: Fri, 20 Aug 2021 16:07:00 +0100