Bitcoin Supply Tightens as Long-Term Holders Accumulate

The Long-Term Holder metric for Bitcoin, which tracks addresses holding the cryptocurrency for at least 155 days, is nearing an all-time high, indicating a tightening supply. On the other hand, Short-Term Holders, addresses holding Bitcoin for less than 155 days, are at an all-time low. This suggests that while the long-term outlook for Bitcoin remains positive, there could be short-term fireworks in store.

Bitcoin Derivatives Market Sees Huge Build-Up

The Bitcoin derivatives market is experiencing a significant build-up of open interest, surpassing $16 billion. Historically, increases in open interest above $12.2 billion have resulted in a minimum dip of 20%. Traders should be cautious of a potential decline in the near term.

Altcoins Rally as Traders Accumulate

Traders have started accumulating select altcoins, leading to solid rallies in several of them. These altcoins have broken out of long basing patterns and are showing signs of starting a new uptrend. While bouts of profit-booking may occur, altcoins are likely to remain in focus as long as Bitcoin stays above $30,000.

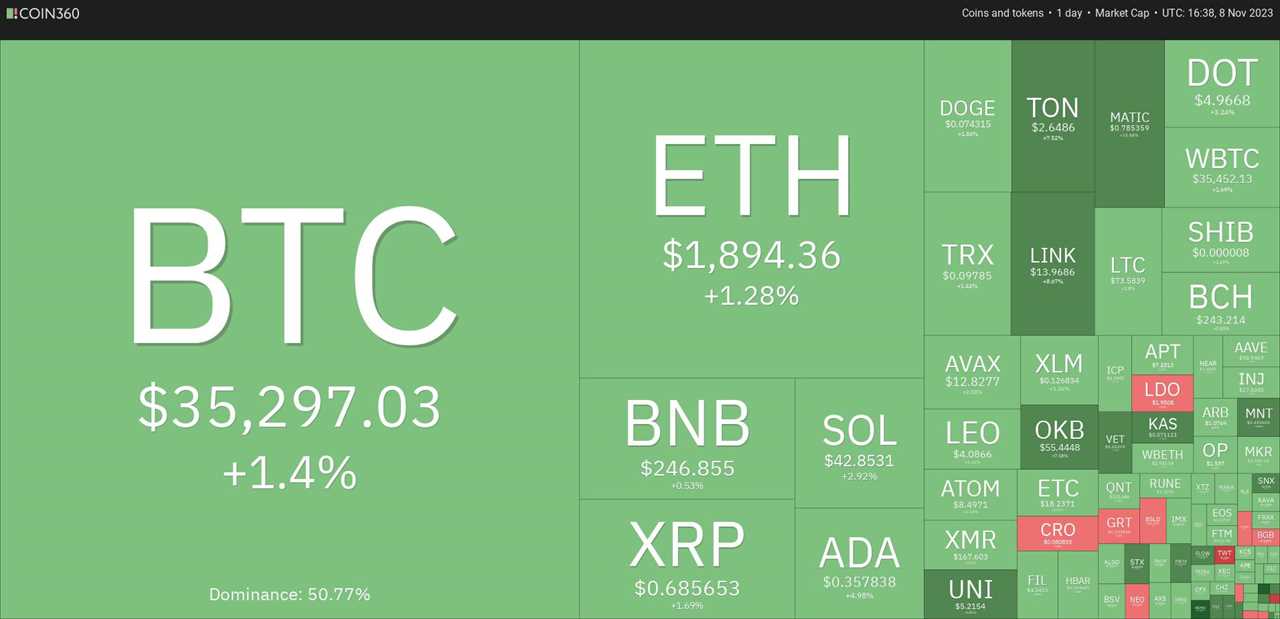

Analyzing the Charts: Bitcoin and Top 10 Cryptocurrencies

Bitcoin continues to trade inside a narrow ascending channel pattern, with the 20-day exponential moving average and the relative strength index indicating an upside bias. A potential rally to $40,000 is possible if buyers push the price above the channel. However, a drop below the 20-day EMA could signal profit-booking.

Ether has been slowly moving higher toward the significant resistance at $2,000. If the price remains above the 20-day EMA, another leg higher is anticipated. On the other hand, a break below the 20-day EMA could lead to a drop to $1,746.

BNB has been in a recovery phase, but the bears may step in to stall the up-move at $256. A rebound off the 20-day EMA could indicate positive sentiment, while a break below it would suggest the bears are back in control.

XRP climbed above the $0.67 resistance, but struggles to break past $0.74. A retest of $0.74 is possible if the price remains above $0.63. However, a break below $0.63 could weaken the bullish momentum.

Solana has been consolidating in an uptrend, with the price stuck between $48 and $38. The bulls have the upper hand, and a climb to $48 is possible. However, a drop below the 20-day EMA could lead to a deeper correction.

Cardano has been in a strong uptrend, with resistance at $0.38. A sustained move above $0.38 could start the next leg of the uptrend, while a break below $0.33 would invalidate this view.

Dogecoin is attempting to break above $0.08, with the 20-day EMA and RSI indicating an advantage for the bulls. A break above $0.08 could pave the way for a surge toward $0.10.

Toncoin surged above the overhead resistance of $2.59, completing a cup and handle formation. A target objective of $4.03 is possible, but a break below $2.59 could lead to a sharp correction.

Chainlink has been in an uptrend, reaching resistance at $13.50. If buyers break through, the price may jump to $15 and $18. However, a break below the 20-day EMA could signal a reduction in bullish momentum.

Polygon pierced the resistance at $0.70 and held its ground, indicating a strong position for the bulls. The next target is $0.80, but caution is advised as the RSI is in the overbought territory.

Note: This article does not contain investment advice or recommendations. Readers should conduct their own research.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/the-rise-of-nfts-sales-soar-to-129-million-in-november