Bitcoin's Bull Market Began in March

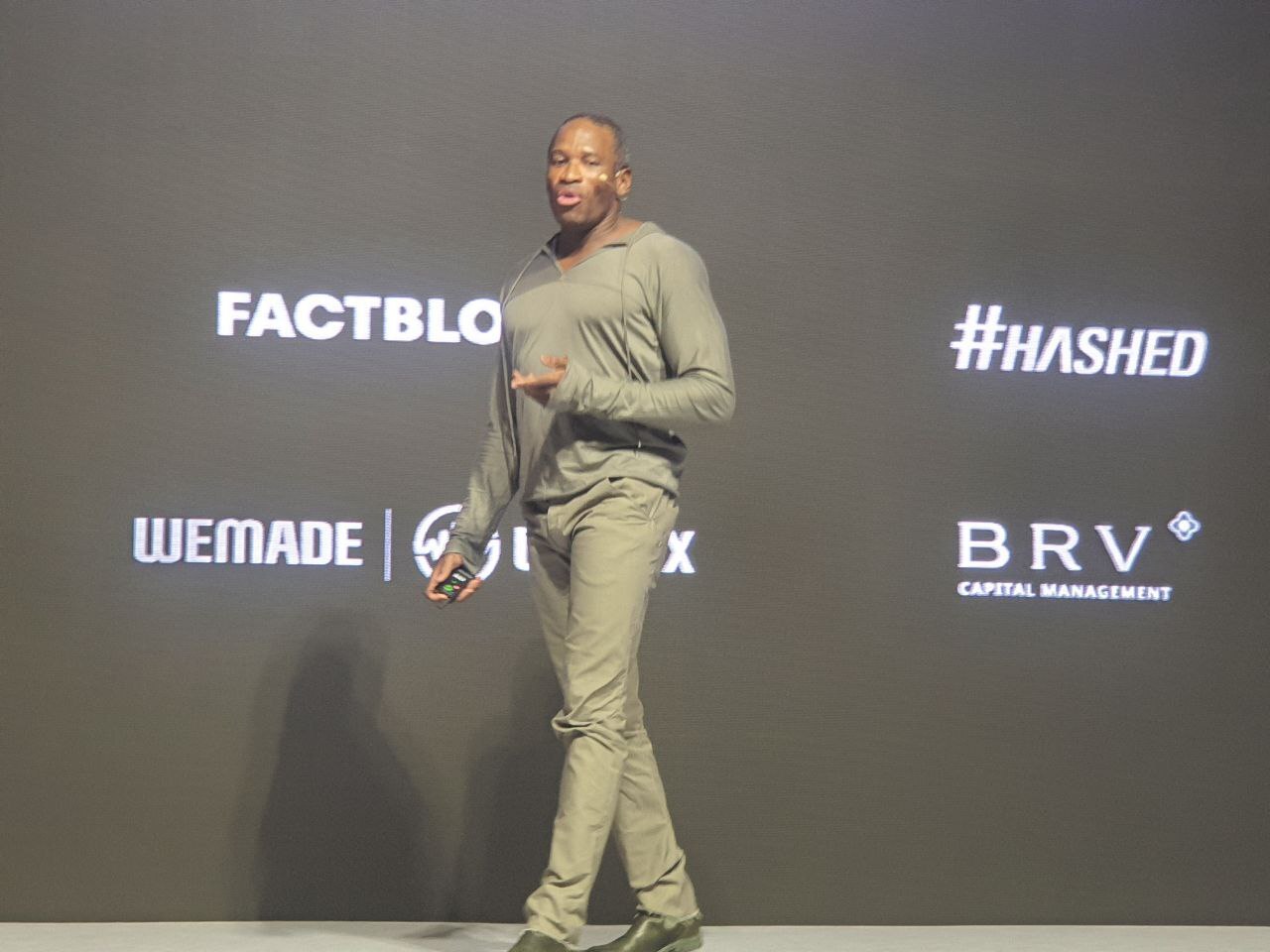

According to Arthur Hayes, co-founder of BitMEX and former CEO, Bitcoin has been on a bull run for the past six months. Hayes argues that the bull market began on March 10, the day Silicon Valley Bank (SVB) was taken over by the Federal Deposit Insurance Corporation. This takeover came after Silvergate Bank's liquidation and the forced closure of Signature Bank by New York regulators.

The Federal Reserve's Intervention

In response to these bank collapses, the Federal Reserve created the Bank Term Funding Program (BTFP), which offered banking loans of up to a year in exchange for "qualifying assets" as collateral. Hayes explains that this move effectively backstopped the entire banking system, which led traders to re-evaluate their trust in fiat currency and consider fixed-supply assets like Bitcoin.

The Market's Delayed Response

While Bitcoin's price has risen by approximately 26% since the Fed's intervention, the rest of the market has yet to fully respond. However, Hayes predicts that it will take between six to 12 months for the market to catch up.

Bitcoin's Performance in Different Economic Scenarios

Hayes asserts that even if the Federal Reserve and other central banks continue to raise interest rates or "print more money," Bitcoin will still perform well. He believes that the cryptocurrency industry is positioned to thrive regardless of these scenarios.

Overall, Hayes remains optimistic about Bitcoin's future and its impact on the market. With the bull run underway and a delayed market response expected, it will be interesting to see how Bitcoin continues to evolve in the coming months.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/ethereum-cofounder-calls-for-cheaper-and-easier-node-running-to-combat-centralization