Rich crypto investors are turning their attention back to Bitcoin (BTC) as its price continues to eye a breakout move above $50,000.

Crypto-focused newsletter Ecoinometrics reported positive changes in Bitcoin holdings for addresses controlling 1,000-10,000 BTC. So, based on their rising account balances throughout August, Ecoinometrics spotted a renewed accumulation sentiment among "whales," hinting that wealthy investors consider the current Bitcoin price levels as attractive to place bullish bets.

The sentiment appeared the same among small fishes—Bitcoin investors that hold less than 1 BTC. Ecoinometrics reported that they have been accumulating Bitcoin since June and, during a period, have also absorbed the selling pressure coming from the whales' side. Their buying sentiment coincided with a price rally to $50,000, a key psychological resistance level.

"Recently, there has been some on-chain divergence between small fish who are accumulating coins [and] whales who are offloading coins," tweeted Ecoinometrics on Sunday.

"That's not ideal [for supporting] Bitcoin's price, but it looks like things are changing! Whales are ticking back up."

Supportive data

Blockchain analytics platform Glassnode also reported a spike in buying sentiment among small fishes. In detail, the number of addresses holding at least 0.1 BTC reached a 3-month high of 3,231,069 on Monday, further validating the accumulation data above.

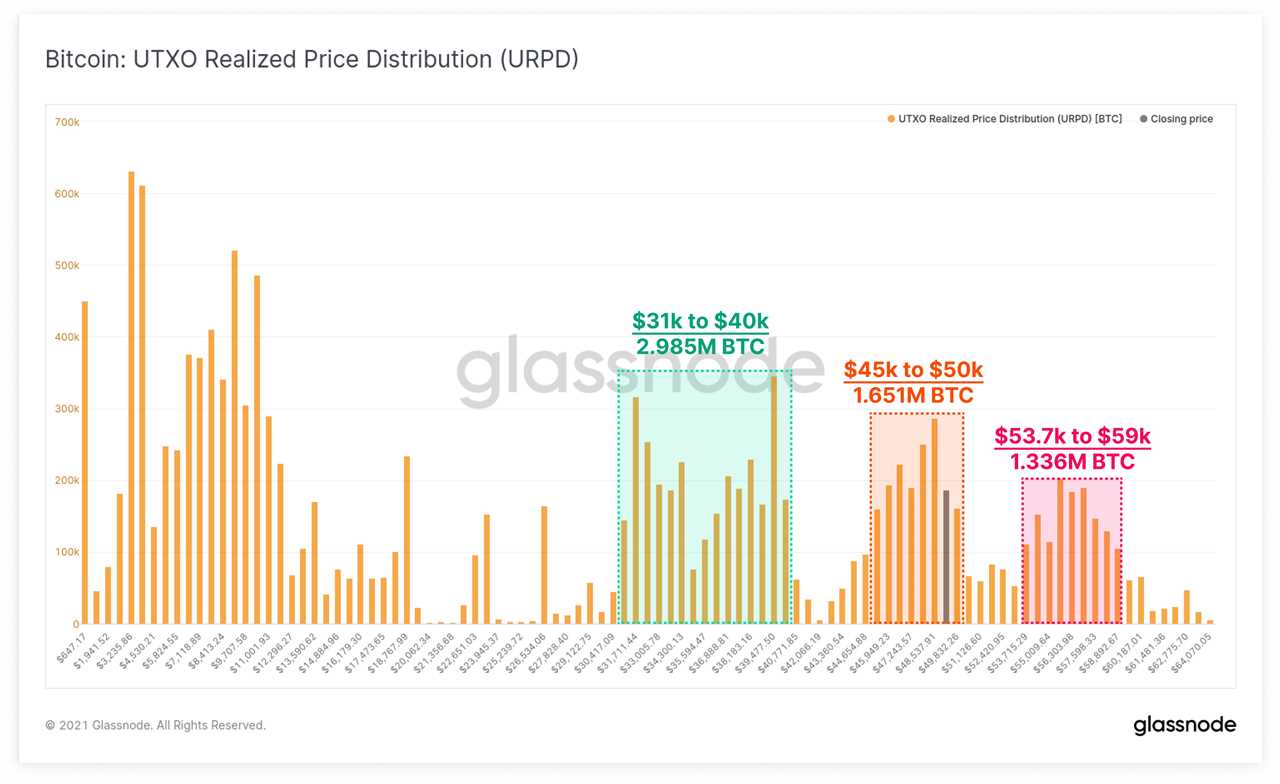

Meanwhile, Glassnode's unspent transaction output (UTXO) data alert presented the $45,000-$50,000 range, wherein whales capitulated the most recently, as a strong support area.

"Over 1.65M BTC now have an on-chain cost basis within the $45k to $50k range," the platform tweeted Monday, adding:

"The $31k to $40k zone is also home to another 2.98M BTC, indicative of large accumulation demand."

Bitcoin holds above the 'green wave'

The whale and fish alert surfaces as the Bitcoin market await a clear breakout move above $50,000.

Related: Bitcoin accumulation accelerates among ‘whales’ and ‘fish,’ while BTC rallies to $40K

As it stands, the BTC/USD exchange rate has been consolidating under the said resistance level since Aug. 27. In doing so, the pair have also found interim support above $47,000, which, more or less, has been coinciding with a 20-day exponential moving average floor (20-day EMA; the green wave in the chart below).

Historically, a break below the 20-day EMA prompts traders to move their downside target to the 50-day EMA (currently near $43,500). Popular market analyst Rekt Capital also presented an outlook that highlighted the levels around $43,500 as Bitcoin's next support range.

The lack of weakness in this red area for #BTC has translated into downside$BTC is in no man's land following its rejection from the red area

— Rekt Capital (@rektcapital) August 30, 2021

Next major support area is the orange region below$BTC #Crypto #Bitcoin https://t.co/wRWfkxc4iw pic.twitter.com/Qe4xvxNqUI

Small fishes have accumulated Bitcoin relentlessly in the $40,000-$50,000 range, with no signs of trend reversals in the previous 30 days. On the other hand, whales underwent a capitulation period when Bitcoin entered the $45,000-$50,000 range.

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: Bitcoin whales join 'small fish' in buying BTC as price holds above $47K

Sourced From: cointelegraph.com/news/bitcoin-whales-join-small-fish-in-buying-btc-as-price-holds-above-47k

Published Date: Mon, 30 Aug 2021 12:00:00 +0100