After weeks of Bitcoin (BTC) sell-offs, high-net worth individuals, or whales, are finally back to buying.

Their buying activity did not only pick up when the BTC price broke out of the two-months ascending triangle to new all-time highs, but also stayed intact since the price crash on April 18.

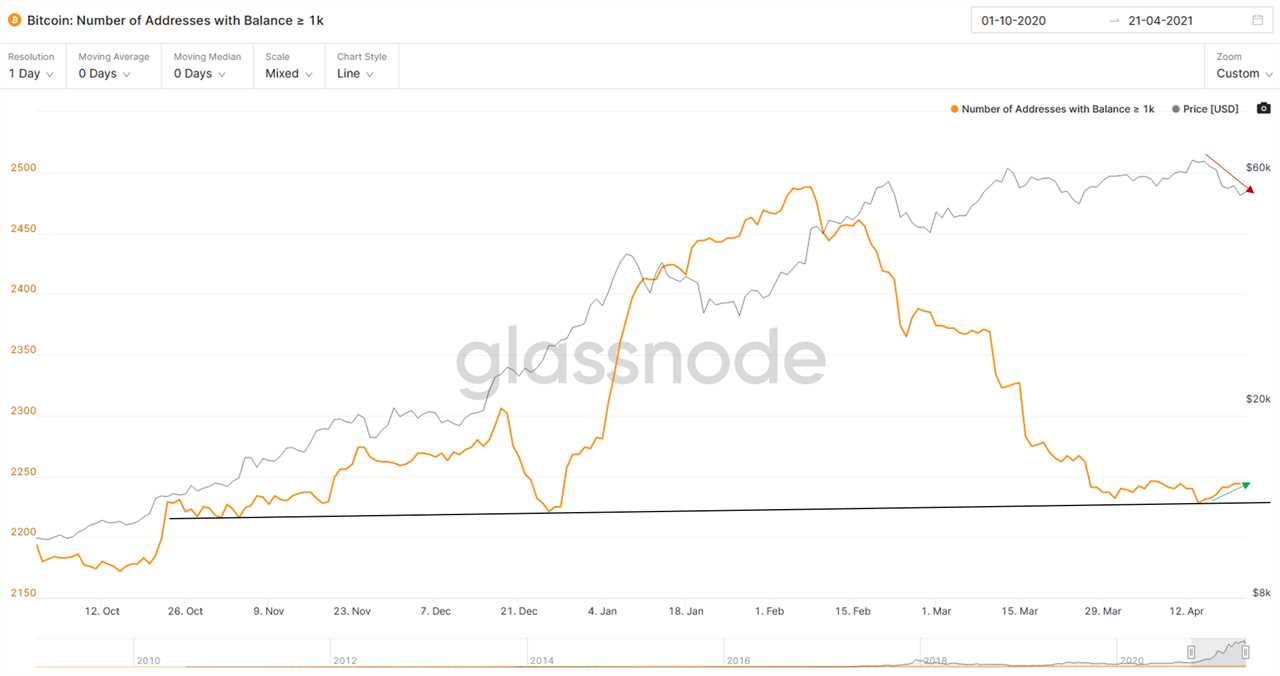

Whales have come back to accumulate Bitcoin

Their continuous buying activity comes at a time when addresses holding more than 1,000 Bitcoin reached their 4-month support line.

This is probably not a coincidence as the turnaround takes place at a time when profit-taking in the market is close to its support line too.

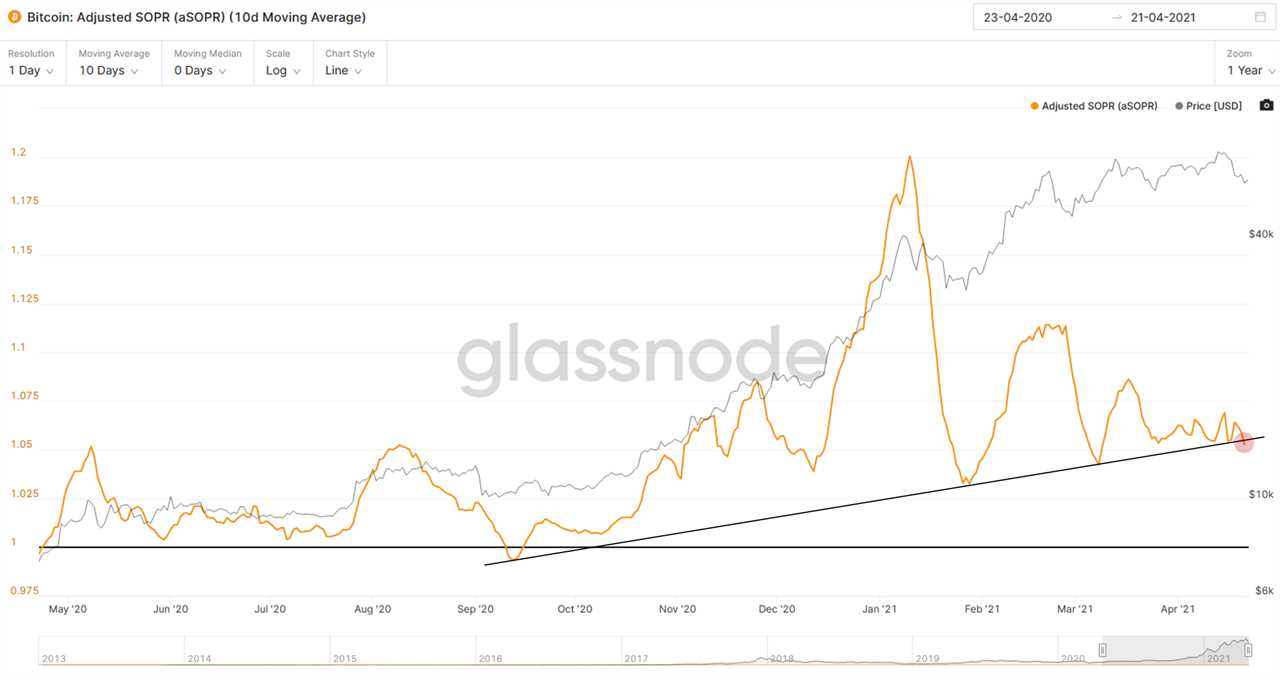

Current profit-taking behavior has followed a 7-month trend

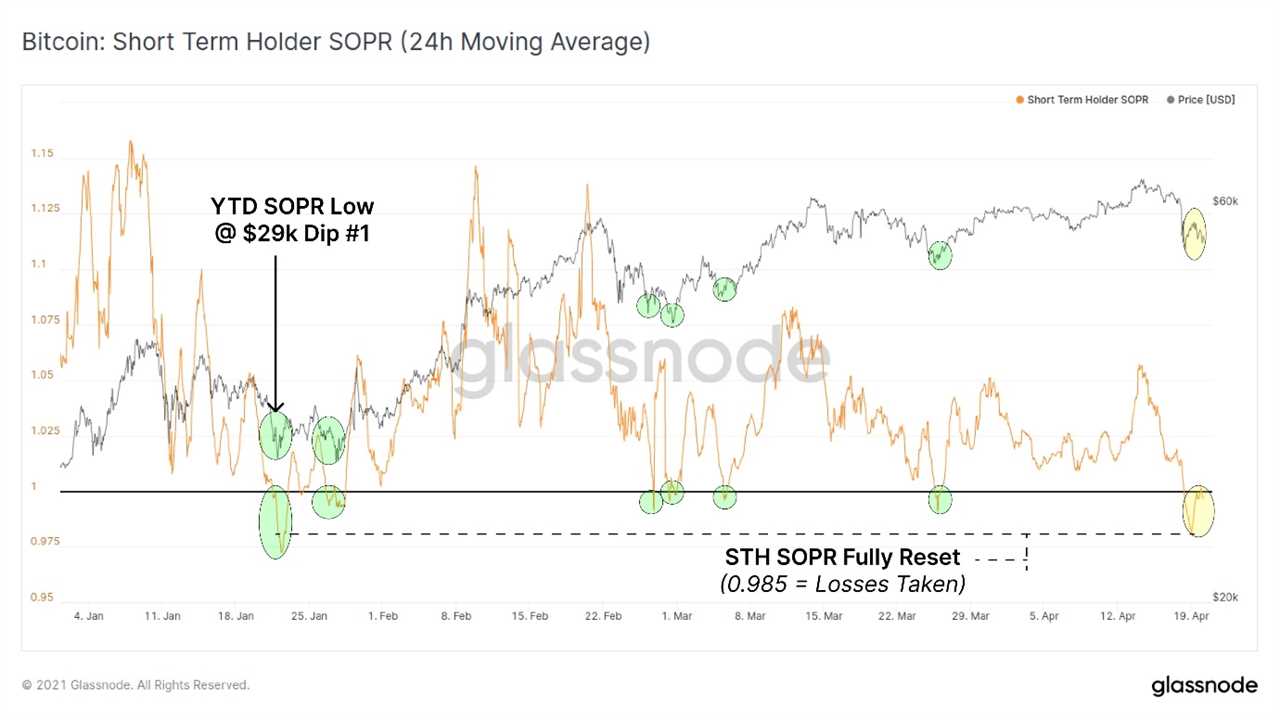

The level at which profit-taking takes place can be derived from the adjusted Spent Output Profit Ratio (aSOPR), which measures the ratio between the price sold and the price paid for a coin while disregarding temporary coin movements (movements within less than 1 hour).

In other words, aSOPR measures by how much holders were sitting in profit (in USD) by the time they sold their coins.

Since September 2020, profit-taking has kept finding positive support at higher levels. This suggests that whenever sell-offs happened in the past seven months, sellers were comfortable not selling at a higher profit level each time, compared to the previous sell-offs. However, this trend might eventually come to an end.

Profit-taking activity suggests the market is at a pivotal moment

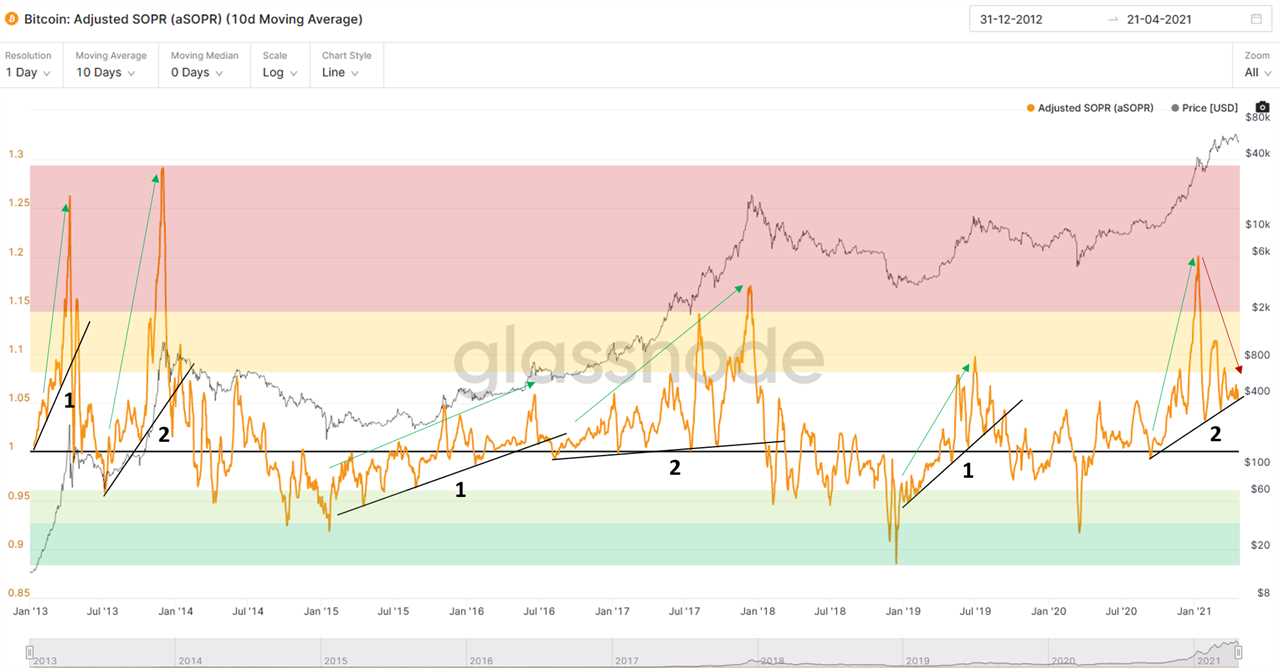

When zooming out and looking at profit-taking behavior in all prior bull markets, it becomes apparent that this is not only a one-time or a short-term trend but rather a longer-term pattern in Bitcoin bull markets.

These support lines tend to hold for 3-18 months. The chart below shows that a break of the second support line in each bull market historically confirmed that the bull market top was in.

Not only is the aSOPR close to breaking the 7-month support, but there is also one major difference in the latest pattern of this metric that could be a cause of concern.

Usually, the short-term tops of the aSOPR come in at higher levels each time as price increases further and rising confidence leads people to hold on to higher profits after each sell-off.

However, in the latest pattern, profits have been realized earlier in every sell-off wave for the last three months (see red arrow), a pattern usually common after a bull market top was already in.

Short-term sellers are in the driver’s seat

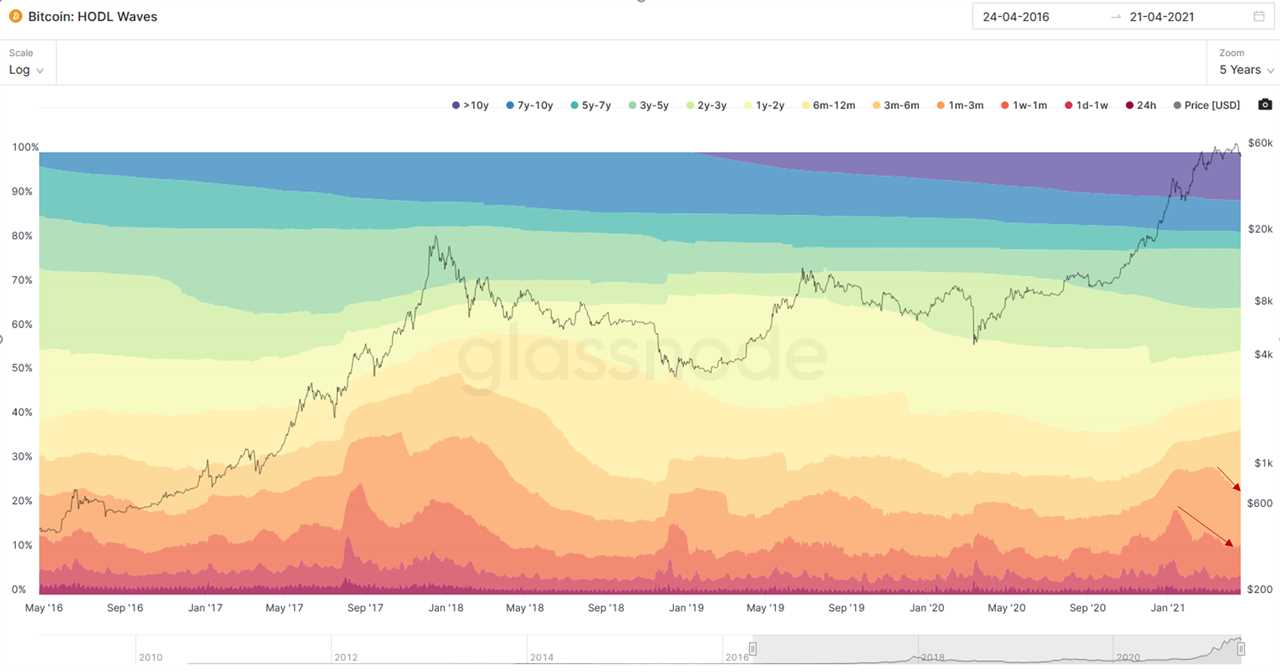

The latest pattern could be explained by a slower price increase in recent months and a higher number of short-term holders realizing profits. This assumption is confirmed by looking at HODL Waves, which visualize the time Bitcoins are held on to.

The redder the color, the shorter the holding period. It becomes visible that it is short-term holders who have held Bitcoin for between one week and three months have been primarily selling into the market as of late.

When looking at the profit-taking behavior of short-term holders (STH-SOPR) only, one could infer that this cohort of traders might almost be done selling. The latest dip below the value of 1 shows that short-term holders even started realizing losses.

In a bull market run-up, this is usually where a bottom in price could be expected as selling activity tends to decrease significantly.

However, as bull market tops are not formed by a lack of sellers but rather by a lack of buyers, it is highly important to also look at the trend of the current demand side.

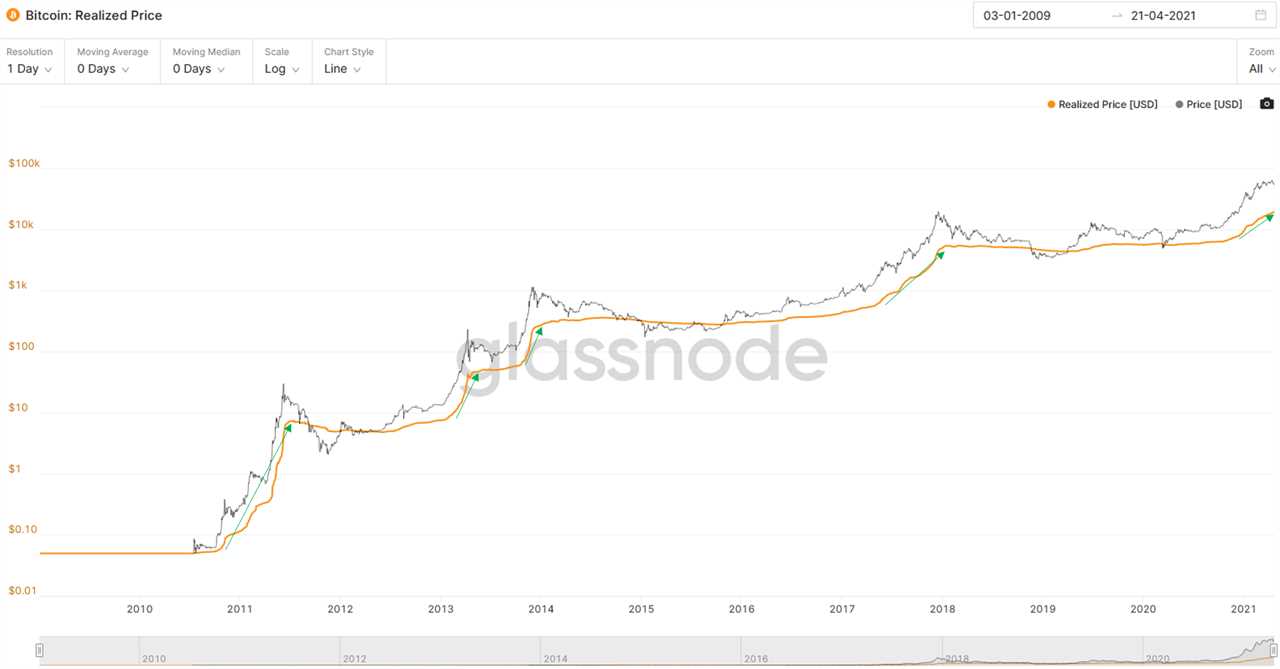

Current on-chain volume activity suggests that the capital inflow trend is still intact. A high number of coins are still changing hands, suggesting that buying activity is still ongoing. The realized price, which expresses this buying activity by valuing all Bitcoins based on when they last moved on a daily basis, gives a good idea of how much capital moved in and out of Bitcoin.

A steep curve suggests high on-chain transaction volumes. If it is followed by a flat trend, it usually indicates the beginning of the bear market as not enough buyers are coming into the market willing to pay higher prices anymore. As long as this steep curve does not flatten, there should be no concern about a dwindling number of buyers.

Although this evidence suggests that the bull market top is likely not in yet, there is also no clear confirmation that sellers are done selling just yet.

A break of the aSOPR 10-day moving average support line could be confirmed in the next few days. This may signal a trend shift in sellers’ behavior from bullish to bearish. Therefore, a negative short- to mid-term scenario should be considered if this occurs.

Support levels in a bearish case

There are two major price support levels to look out for. The first one is around $51,325, which could be a strong defense zonea support level where whales most recently acquired a high volume of Bitcoin.

The second price support level is the NVT (Network Value to Transactions Ratio) price, which is currently at $47,679 and is a major price support level in Bitcoin bull markets.

If the market price was to fall significantly below the NVT price without a quick recovery within a few days, a detailed analysis of the demand side would be needed to judge if the market’s bullish structure has broken.

Market at a critical level, strong support between $47K–$51K

The supply-side suggests that sellers are currently in the driver's seat, even selling Bitcoin at a loss in the past few days. However, their selling activity is expected to significantly reduce over the next few days if current behavior stays in line with prior bull market sell-offs.

If that is not the case, the breakdown of the aSOPR 7-month support line is likely and could signal a trend shift from bullish to bearish selling. Further downside should be expected with next major support in the range of $47,000-$51,000.

On the demand side, the capital flow still looks healthy. Enough volume is still willing to pay current prices, while whales ramped up their buying again. Current price action is still above NVT price, which suggests that current price fluctuations are still within the expected bullish territory.

Nevertheless, the demand side should be watched closely for a potential dry-up in on-chain volume over the next few days if price comes close to the NTV price.

Title: Bitcoin whale watching: This metric that called the 2018 top is now flashing red

Sourced From: cointelegraph.com/news/bitcoin-whale-watching-this-metric-that-called-the-2018-top-is-now-flashing-red

Published Date: Thu, 22 Apr 2021 15:22:54 +0100