Bitcoin On-Chain Activity Resembles Pre-2021 All-Time Highs

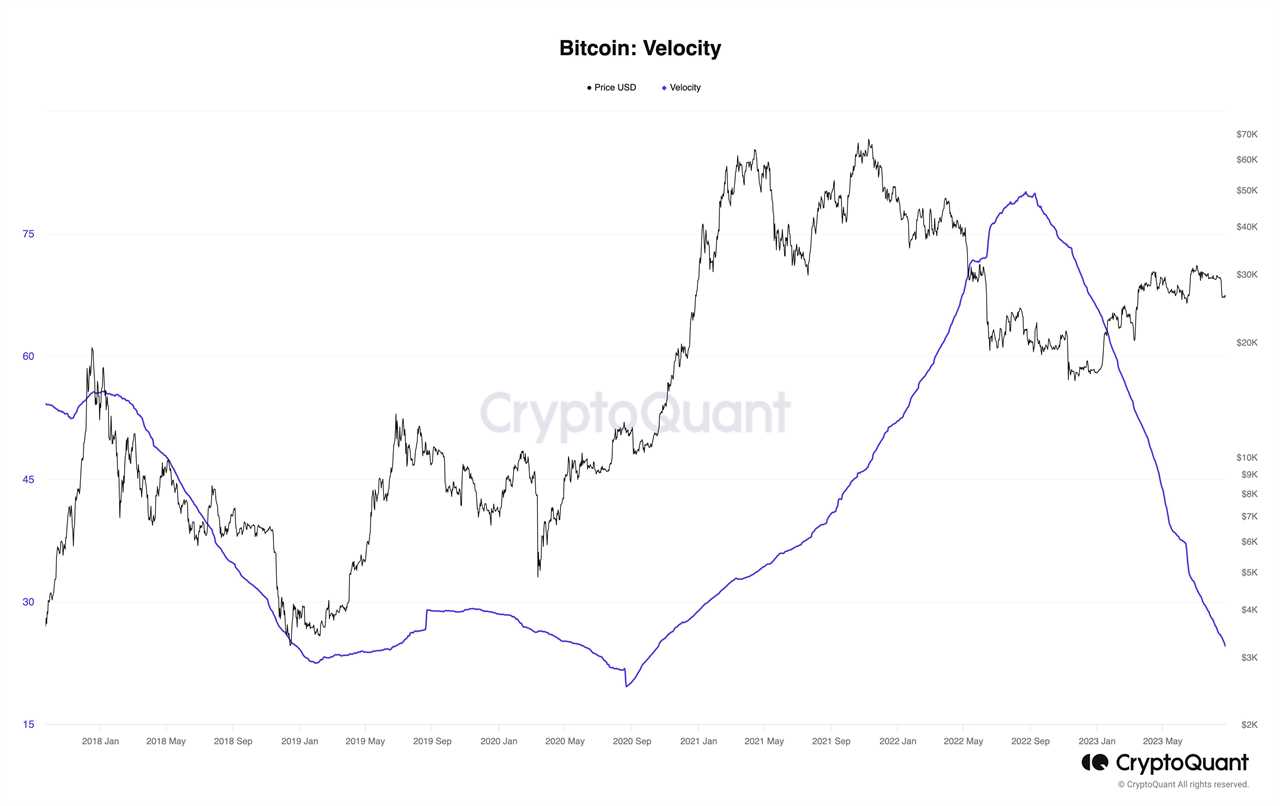

New data reveals that Bitcoin (BTC) on-chain activity has reached levels not seen since its impressive run to all-time highs in 2021. Bitcoin's velocity, a measurement of BTC units moving around the network, has hit multiyear lows, indicating a stagnant market.

Bitcoin Stagnates at $26,000, Diminishing Buying and Selling Interest

Bitcoin is currently experiencing a period of stagnation, with the cryptocurrency remaining at around the $26,000 price level. This lack of movement in the BTC price for several months has reduced the incentive for investors to buy or sell. Additionally, the velocity metric, provided by analytics platform CryptoQuant, is now at its lowest point since October 2020.

The implications of this stagnation can be seen as both positive and negative. On the positive side, it suggests that large investors, known as whales, are holding onto their Bitcoin. However, on the negative side, this lack of movement indicates a lack of interest from new investors.

Low Trading Activity Reflects a "Wait and See" Approach

The absence of significant trading activity among high-volume investors is contributing to the current state of the Bitcoin market. This trend supports the idea that the market is in a "wait and see" mode regarding BTC. At the beginning of the year, new money flowing into the cryptocurrency space was evident as BTC/USD began its winning streak in the first quarter, ultimately reaching a 70% increase in value.

Long-Term Bottom Rebound May Not Repeat

Previously, a rebound in the volume metric coincided with Bitcoin's surge past $20,000 and its subsequent climb to new all-time highs in late 2020. However, the current market situation is different. Bitcoin is currently oversold, with its daily relative strength index (RSI) indicating a potential buying opportunity. Yet, investor interest in Bitcoin has not yet fully materialized, as shown by the RSI hitting its lowest point in five years earlier this month.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/proxrp-attorney-argues-sec-erred-in-aiding-and-abetting-allegations-against-ripple-ceo