BTC Forms Third Consecutive Doji Candlestick Pattern

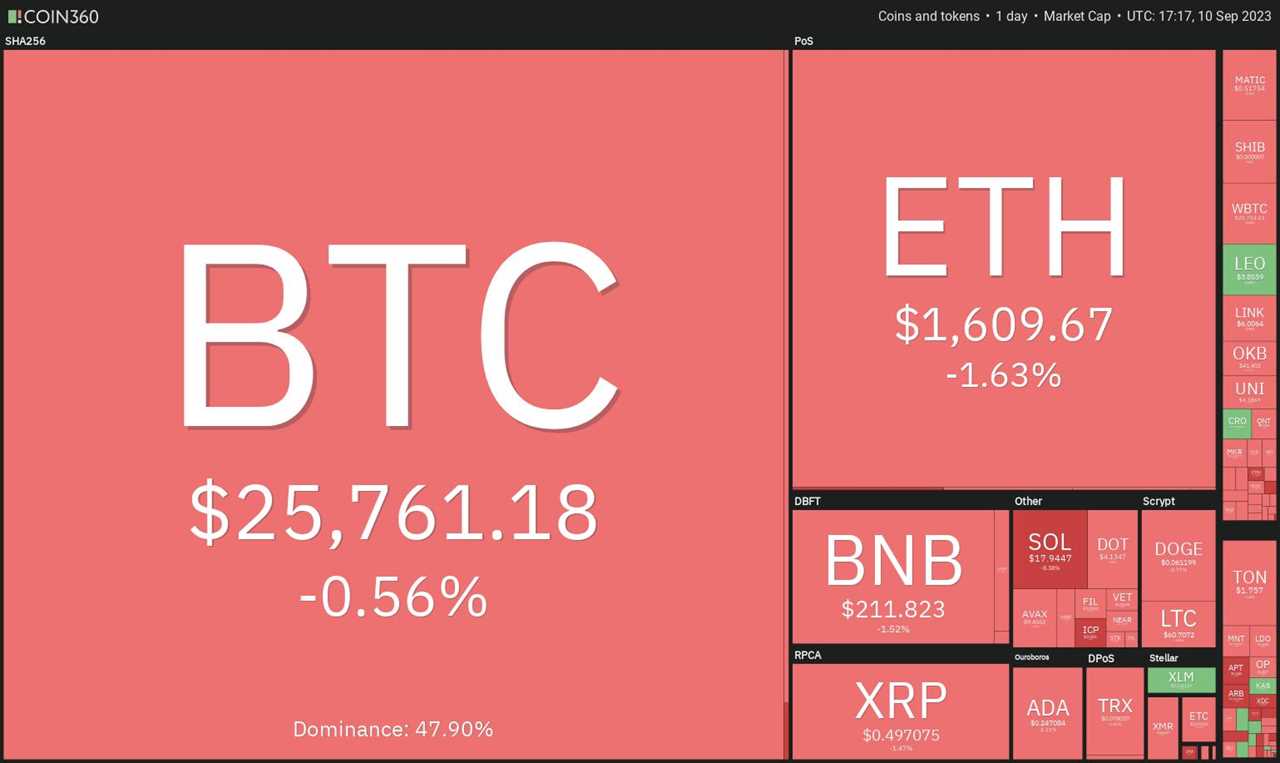

Bitcoin (BTC) has been trading in a narrow range this week, forming what could be the third consecutive Doji candlestick pattern on the weekly chart. The cryptocurrency markets have not received any support from the United States equities markets, which ended the week on a negative note. The S&P 500 Index dropped 1.3% while the Nasdaq closed down 1.9%. As a result, Bitcoin's weakness has dragged several altcoins lower, signaling that the broader crypto market is firmly in a bearish grip.

Long-Term Investors May Find Opportunity Amidst Negative Markets

While negative markets make it difficult for buyers to identify short-term bullish trades, it could be an opportune time for long-term investors to build their portfolio. A recent report by Amberdata revealed that 24% of asset management firms are appointing senior executives dedicated to implementing digital strategies, demonstrating seriousness about adoption. Additionally, 13% of firms plan to adopt digital assets strategies in the future, indicating a growing trend among institutional investors.

Bitcoin Price Analysis: Bulls and Bears Locked in Tussle

Bitcoin has been trading near the $26,000 level, showcasing a battle between the bulls and the bears. Despite downsloping moving averages favoring the bears, positive divergence on the relative strength index suggests decreasing selling pressure. However, with indicators not providing a clear advantage to either side, it is best to wait for the price to sustain above $26,500 or drop below $24,800 before making significant moves. A breakout above $26,500 could propel the BTC/USDT pair towards the overhead resistance at $28,143, while a fall below $24,800 may lead to a collapse towards $20,000.

Toncoin Price Analysis: Correction Offers Entry Opportunity

Toncoin (TON) has pulled back to the 20-day exponential moving average ($1.69), presenting a potential low-risk entry opportunity during an uptrend. The 20-day EMA is expected to act as a strong support, and if the price rebounds from this level, it will indicate positive sentiment and buying on dips. The TON/USDT pair could rise to $1.89 and potentially attempt a rally to $2.07. However, if the price continues lower and falls below the 20-day EMA, it may signify bearish abandonment and open doors for a possible drop to $1.53 and the 50-day simple moving average ($1.45).

Ultimately, while Bitcoin remains trapped in a narrow range and altcoins suffer in a bearish market, the future of the crypto market may depend on whether Bitcoin can break out to the upside and spark renewed buying interest in other cryptocurrencies.