Bitcoin (BTC) was on repeat Dec. 2 as markets watched another attack on $60,000 end in defeat.

"Nothing has changed"

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD back at $57,000 Thursday, having come full circle in 24 hours.

The pair had briefly hit $59,000 into the Wall St. open the day prior, this failing to hold as another round of macro triggers skewed sentiment to the downside once more.

Bitcoin thus fell in line with stocks reacting, it seemed, to continued concern over the new Coronavirus omicron variant. The S&P 500 ended the day down 1.2%.

With a sense of frustration pervading crypto markets, analysts took the opportunity to reassert a longer-range perspective.

“It's very simple. Below $60K I've remained cautious/bearish as I'd like to see that area flip,” Cointelegraph contributor Michaël van de Poppe summarized.

“Levels to watch for buys; $53K-54K zone and $47-50K zones for Bitcoin. When to buy altcoins? December. Nothing has changed past weeks.”

Those buy target lows were accompanied by renewed predictions for this cycle’s bullish peak which, as in April this year, place BTC/USD at up to $400,000.

Reminder, peak high bull cycle prediction; #Bitcoin to $350,000-450,000#Ethereum to $10,000-17,500#Polkadot to $250-350#Chainlink to $250-350#Cardano to $10-20#Zilliqa to $5-7#Elrond to $1.500-1.750 (already hit -> revised now)#DIA to $50-75

— Michaël van de Poppe (@CryptoMichNL) December 1, 2021

Some might be conservative. https://t.co/rgZOEyljC0

Fellow analyst TechDev, eyeing Fibonacci levels on the two-week chart, also described Thursday as “another day to zoom out.”

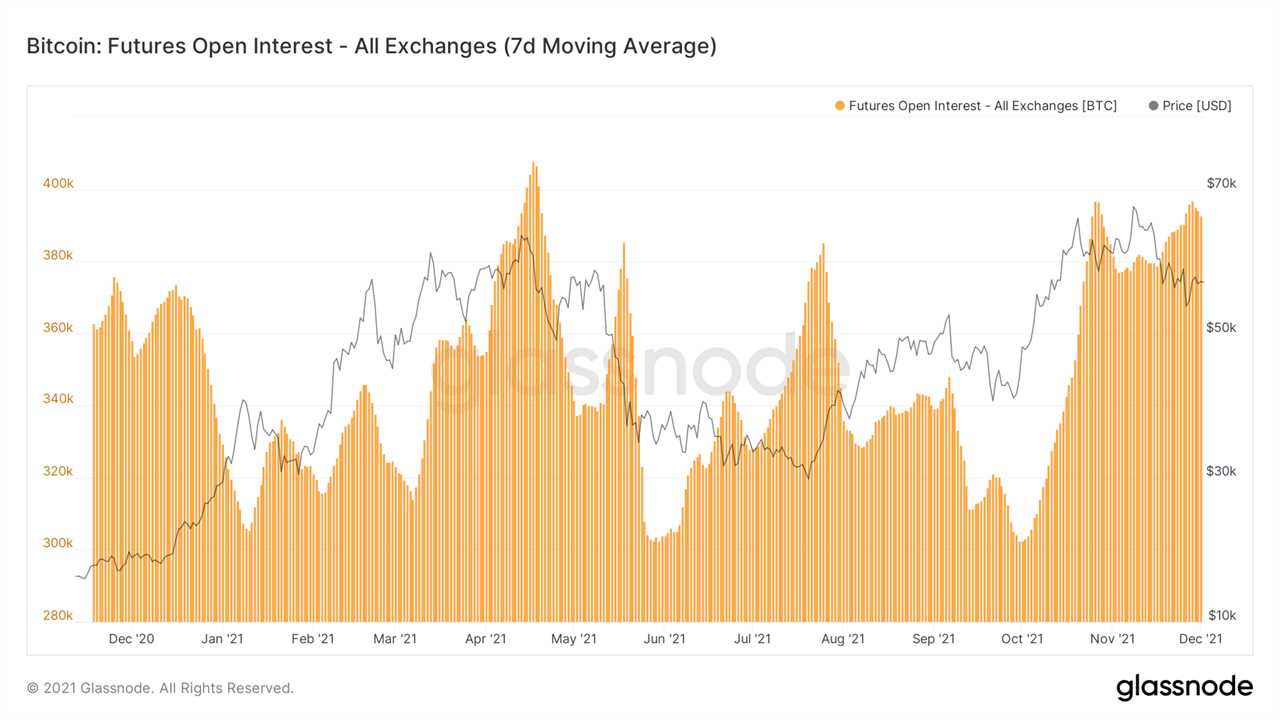

Open interest stays near all-time highs

On exchanges, open interest meanwhile remained a source of concern due to its sheer volume relative to price action.

Related: Bitcoin fails ‘worst-case scenario’ monthly close for the first time, starts December sub-$57K

Data from on-chain analytics firm Glassnode showed open interest on Bitcoin futures recently matching its second-highest levels in history, nearing its April record.

“At some point, this open interest is going to get flushed out one direction or the other,” analyst William Clemente commented.

With cyclical price action characterizing the week, the mood thus stayed favoring an ultimate exit up or down, with derivatives structures being “reset” as a result.

Funding rates were mostly neutral across exchanges Friday.

Title: Bitcoin tests traders' nerves as analyst reissues $400K BTC price forecast

Sourced From: cointelegraph.com/news/bitcoin-tests-traders-nerves-as-analyst-reissues-400k-btc-price-forecast

Published Date: Thu, 02 Dec 2021 09:47:54 +0000

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/badgerdao-reportedly-suffers-security-breach-and-loses-10m-