A recent research report from analytics firm Glassnode has revealed that Bitcoin speculators have been hit hard by last week's "flash crash" that saw the price of BTC drop to $26,000. According to the report, nearly 90% of speculative short-term holders (STHs) are now in the red.

Short-Term Holders Struggle as BTC Price Drops

While short-term holders make up only around 10% of BTC investors, the recent price drop has had a significant impact on their sentiment. With predictions indicating that the price could dip even lower, the trading environment, which had been relatively stable for months, is now experiencing increased volatility.

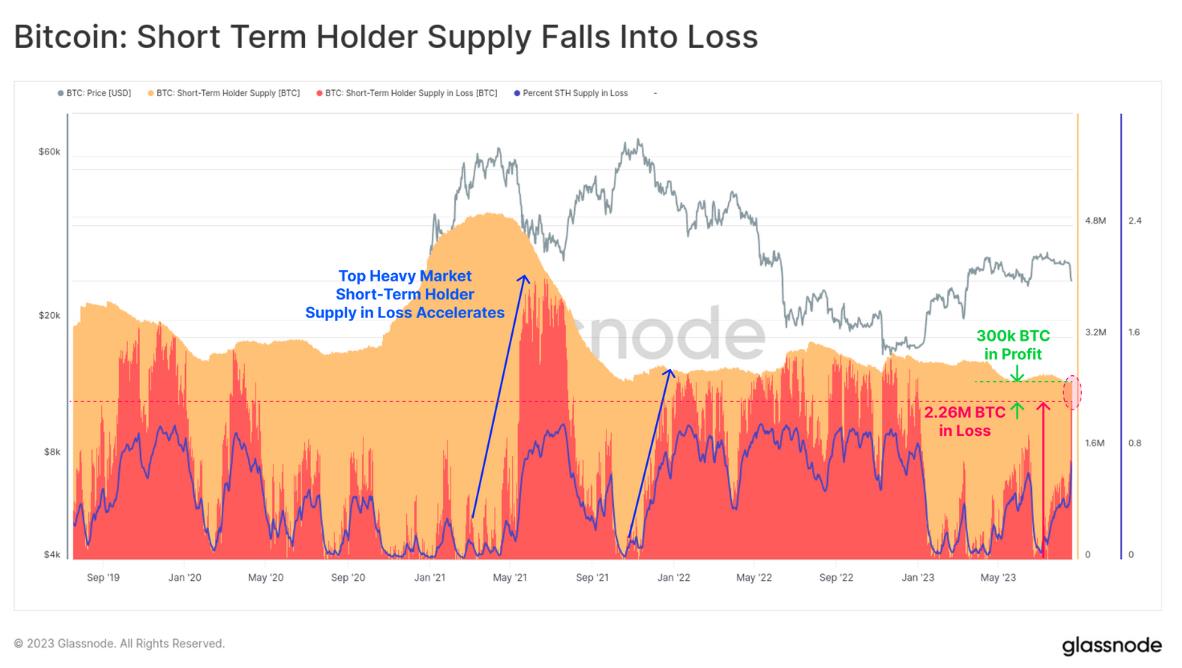

Glassnode defines short-term holders as entities that have held onto BTC for 155 days or less. Out of the 2.56 million BTC held by STHs, only 300,000 BTC (11.7%) are still in profit, the research states.

Long-Term Holders Remain Unfazed

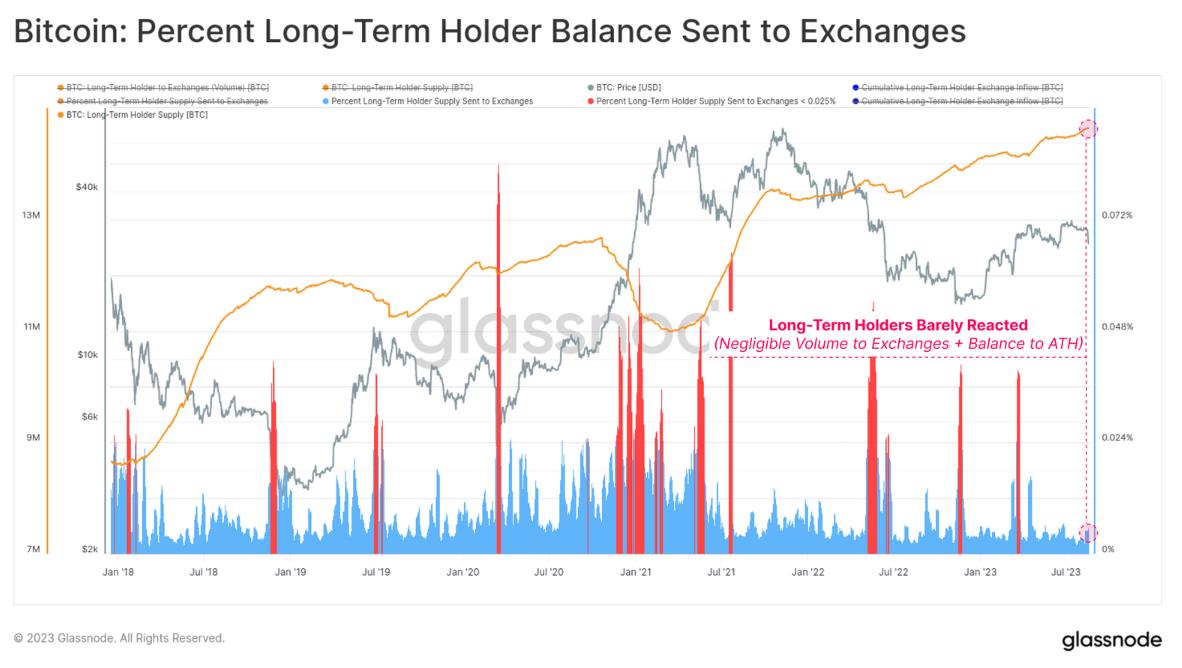

On the other hand, long-term holders (LTHs) have not reacted significantly to the drop in BTC price. Glassnode's research shows that the LTH investor base has remained stable, with negligible volume sent to exchanges. Their aggregate balance even reached a new all-time high.

According to Glassnode, this behavior from LTHs is typical during bear market hangover periods, suggesting that they are unfazed by the recent market movements.

Flash Crash Puts Speculators on the Back-Foot

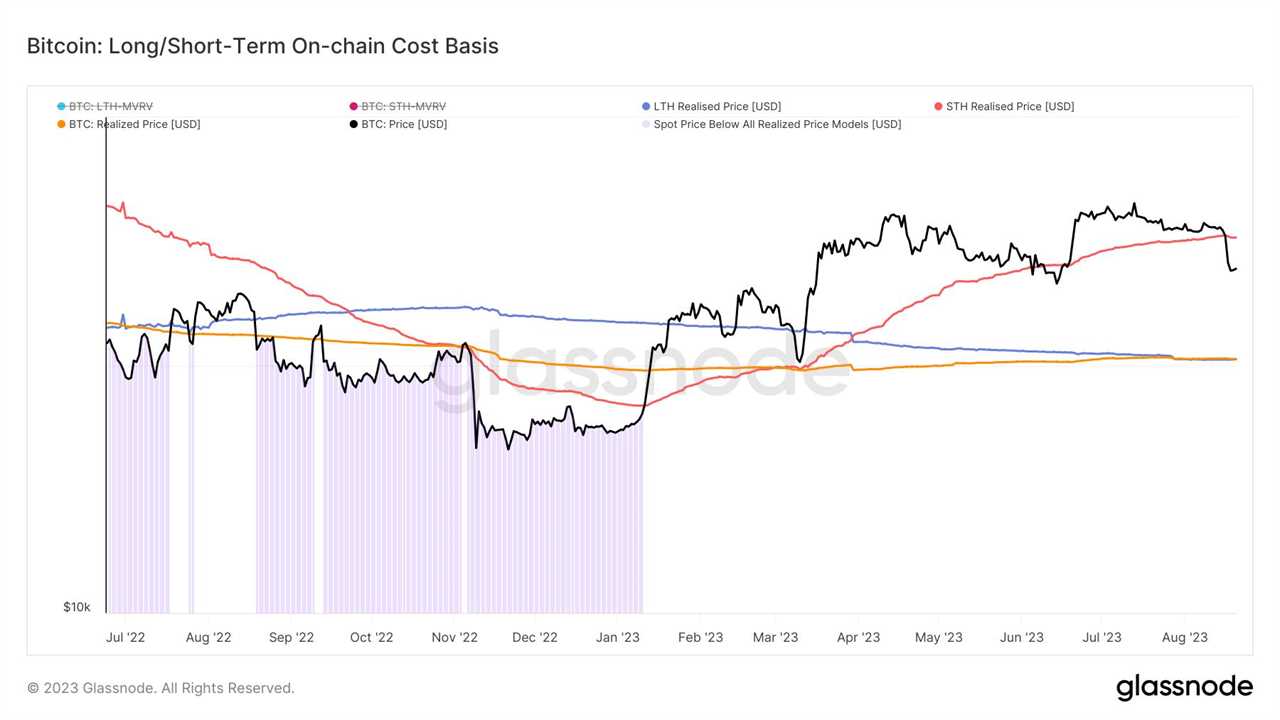

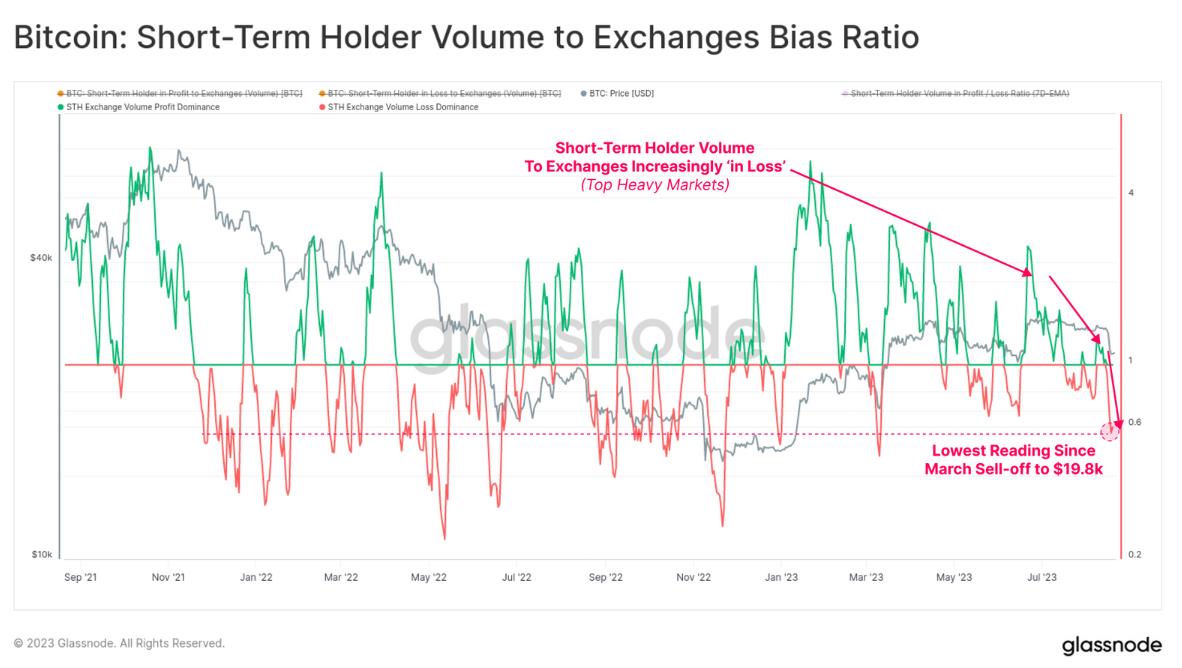

The flash crash has not only left short-term holders with unrealized losses but has also seen an acceleration in realized losses being sent to exchanges. In addition, the loss of key technical moving average support has put the bulls at a disadvantage.

Glassnode's report concludes that short-term holders are of greater interest in the current market conditions. With 88.3% of their held supply now at an unrealized loss, they face a challenging situation.

Disclaimer: This article does not provide investment advice or recommendations. It is important for readers to conduct their own research and make informed decisions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/binance-faces-withdrawal-issues-in-europe-blames-payment-processor