Speculators feeling exhausted and apathetic

A new report from analytics firm Glassnode suggests that Bitcoin (BTC) speculators are experiencing a period of "exhaustion and apathy" in the market. This comes after months of stagnant BTC price action and growing frustration among investors.

Predictions of deeper downside

With bulls unable to break resistance and sellers facing multiple support zones, market participants are predicting further downward movement for BTC. This has caused speculators to become less optimistic about the future of the cryptocurrency.

Short-term holders at risk

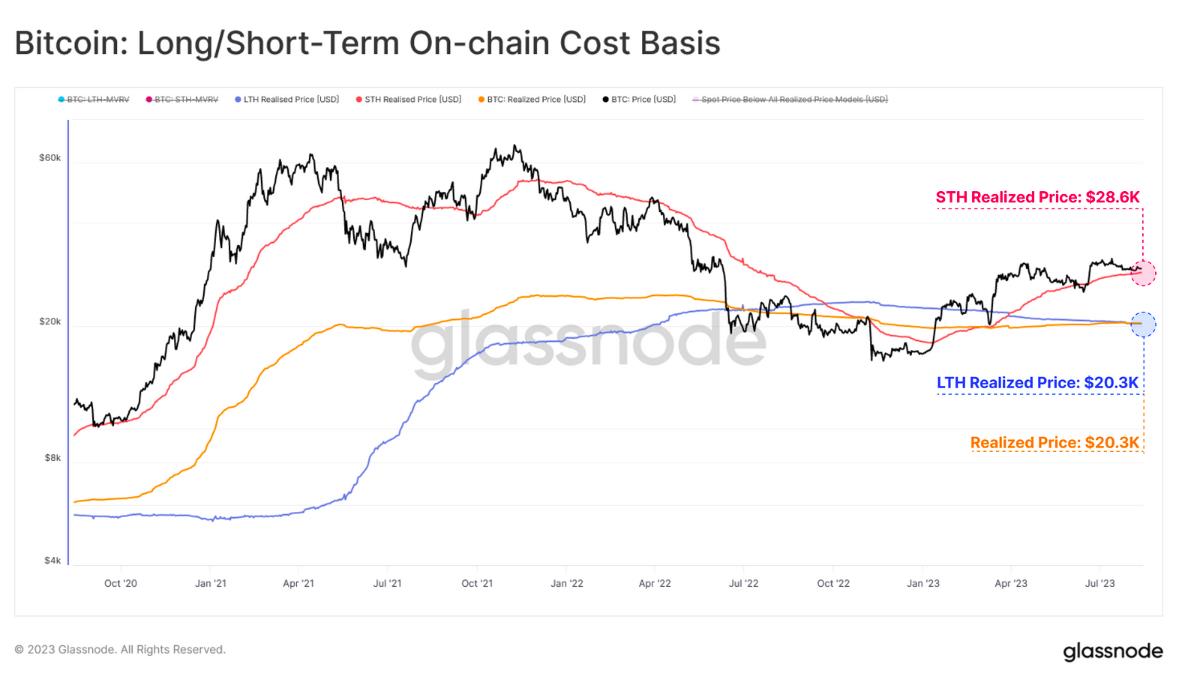

Glassnode identifies short-term holders (STH) as entities that have held Bitcoin for 155 days or less, representing the more speculative side of the investor spectrum. The cost basis for STHs, or the realized price, has been a key support level throughout 2023. However, it is rapidly rising and currently sits at $28,600. In contrast, long-term holders (LTH) have a cost basis of $20,300, indicating that recent buyers have acquired BTC at a higher price.

A potentially top-heavy market

According to researchers, the market could be considered "top heavy" with many price-sensitive investors at risk of falling into unrealized losses. This supply distribution pattern resembles similar periods during bear market recoveries in the past, suggesting a potential downturn for BTC.

Speculators reconsidering their exposure

Despite the increasing skepticism among speculators, Glassnode observes that long-term holders now control a larger portion of the BTC supply than ever before. This suggests that the conviction of Bitcoin investors remains high, and few are willing to sell their holdings.

History repeating itself

The last time that short-term holders had such little market presence was in October 2021, just before BTC reached its current all-time high of $69,000. This similarity in supply distribution raises concerns about the future of BTC price.

Note: This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making decisions.