Bitcoin in a Precarious Position

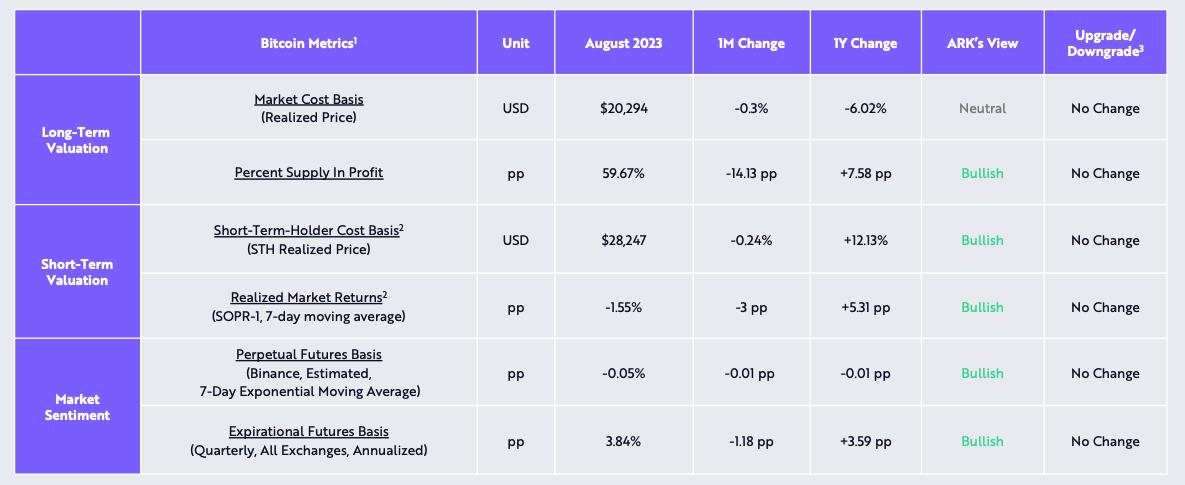

Bitcoin's price action has raised concerns about the asset's stability, as recent data shows that short-term Bitcoin investors were forced to sell in August. The percentage of Bitcoin supply in profit fell by 14 percentage points, indicating a rocky road ahead for the cryptocurrency.

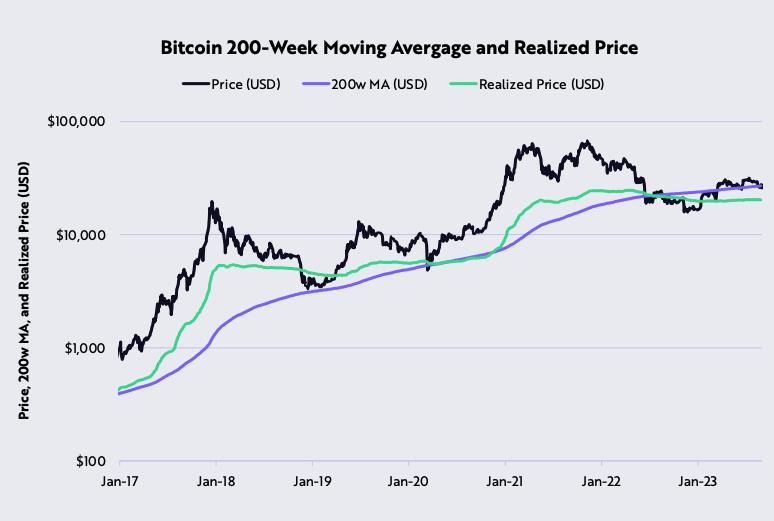

Break Below 200-Week Moving Average

In a significant bearish move, Bitcoin's price fell below its 200-week moving average for the first time since June 2023. This is a key support level during major downtrends, and analysts suggest that if bearish catalysts continue, Bitcoin could fall as low as $20,300.

Optimism Amidst the Dismal Outlook

Despite the short-term challenges, some experts see a silver lining. Previous market trends have shown that dips below realized price and long-term moving averages can present buying opportunities. Investors who took advantage of such opportunities in 2019, 2020, and early 2022 found themselves in significant profit within six months.

Bitcoin Dominance Expected to Rise

Analyst Ben Lilly predicts that Bitcoin will regain its dominance in the crypto market. He draws parallels between the current price action and the period before a major reversal in 2019. According to Lilly, the sentiment among market participants is reminiscent of a time when few people were interested in Bitcoin or crypto.

Declining Investor Sentiment and Market Liquidity

The decline in bullish investor sentiment is further reflected in the stablecoin marketcap data. Aggregate stablecoins have dropped by over 20% since March 2022, indicating a decrease in market liquidity and investor confidence in Bitcoin and altcoins.

Waiting for ETF Approval

The approval of Bitcoin exchange-traded funds (ETFs) is eagerly awaited by retail and institutional investors. Until then, the market dynamics described above are likely to persist, with the upcoming Bitcoin halving potentially taking precedence over the ETF approval as a trigger for a bull market.

Note: This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.