Bitcoin Surges and Triggers Short Squeeze

Bitcoin (BTC) continued its volatile streak as it reached new September highs on September 8, causing a classic "short squeeze". The price movements of BTC liquidated both shorts and longs, marking a rollercoaster ride for traders.

Both Upside Momentum and Subsequent Comedown for Bitcoin

After showing positive momentum the day before, Bitcoin surged above $26,400 after the daily close. However, the price later dropped, and at the time of writing, it was below $26,000. This market movement turned out to be a challenge for traders chasing quick gains.

Short Liquidations and Recovery from August Losses

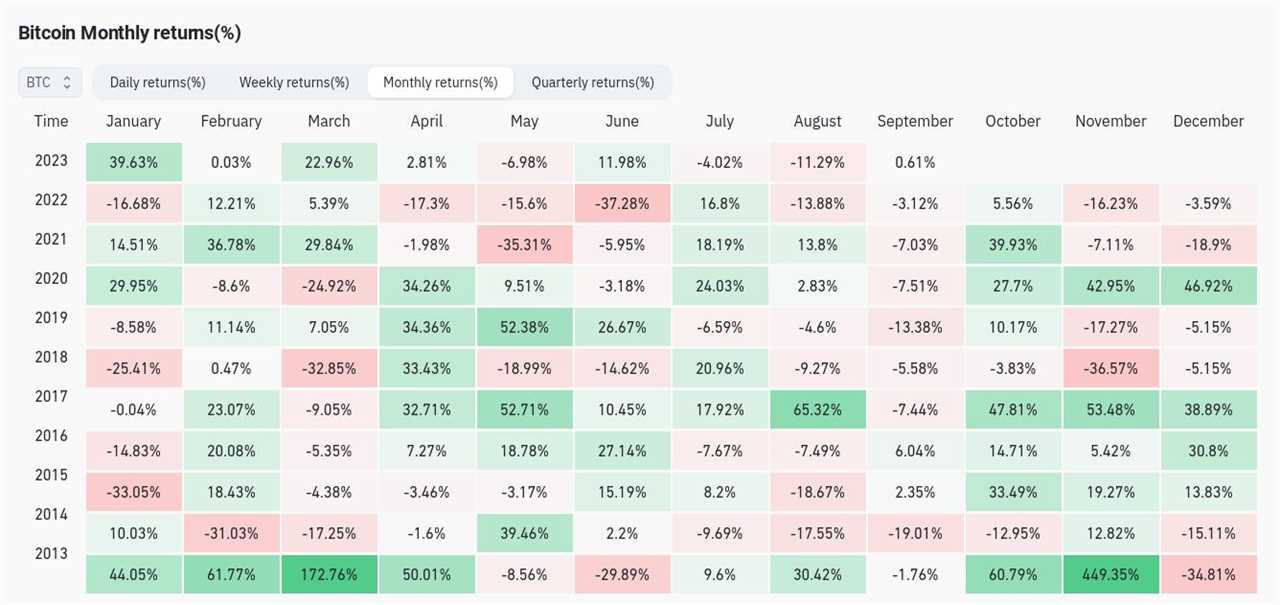

The liquidation of short positions amounted to $23.5 million on September 7, while the total of long positions on September 8 was not yet known. This outcome was in line with expectations, as popular trader Skew noted, "Shorts got hunted as expected." Another trader, Daan Crypto Trades, pointed out the importance of Bitcoin reclaiming lost ground from August, stating, "Up to the bulls to try and maintain a 'green' September."

BTC Price Facing "Final Correction"

Analysts emphasized the significance of Bitcoin's interaction with key levels. Trader Crypto Tony highlighted that crossing the $26,600 mark was crucial for further upward movement. Meanwhile, trader Michaël van de Poppe suggested that Bitcoin was in the midst of the "final" price drop of this cycle. He drew comparisons to the market in 2015 and stated, "In that regard, this is the final correction."

Support Holding at $25,500 as September Brings Uncertainty

Bitcoin managed to hold its support at the 200-day exponential moving average (EMA), which currently stands at $25,674. However, some caution that September tends to bring downside price movements. Despite the uncertainty, Bitcoin is currently holding onto a significant level of support at the $25,500 mark.

This article does not provide investment advice. Readers should conduct their own research before making any investment decisions.