Bitcoin (BTC) is seeing a new kind of “flippening” above $20,000 as its original whales keep selling their coins to bigger institutional buyers.

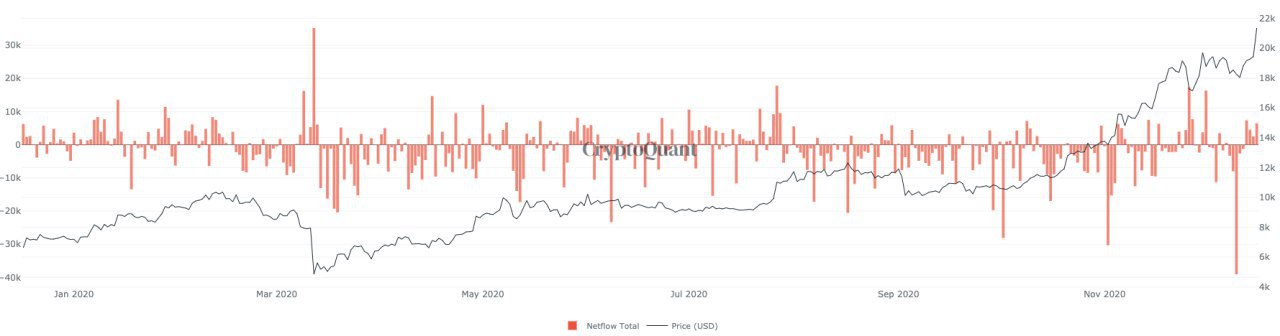

Data from on-chain analytics service CryptoQuant shows that despite long-term investors rushing to offload BTC at a profit, buyer demand is still outpacing them.

Analyst: Bitcoin whales "small" compared to new buyers

With BTC/USD continuing to explore new nighs, the “original” whales are beginning to look like plankton as institutions line up to buy en masse.

According to the CryptoQuant data covering exchanges, outflows hit yearly highs in the hours before $20,000 broke for the first time in history. The combined shortage of BTC on exchanges and institutional buying in over-the-counter (OTC) venues lays the foundation for a fight over the remaining supply — and price rises are the only logical solution.

“I'll repeat... liquidity crisis incoming,” Danny Scott, CEO of United Kingdom exchange Coin Corner, summarized about the status quo.

Even CryptoQuant CEO Ki Young Ju, who said that he shorted Bitcoin at $20,800, admitted that he had been surprised by the whale activity.

“Will focus on the bigger whales next time,” he tweeted as the market kept absorbing large sells.

“OG whales were small whales.”

Ki subsequently highlighted what he described as “massive” outflows from exchange Coinbase as evidence of the institutional OTC activities. Current BTC reserves at exchanges' are at the lowest levels since November 2018.

“It looks like massive Coinbase outflows usually go to their new cold wallet for custody/OTC that held 6000-8000 $BTC. #Greyscale uses #GenesisTrading for buying Bitcoins, and #GenesisTrading uses Coinbase Custody,” he wrote alongside an annotated chart.

Asset manager sees no end in sight to buy-ins

As Cointelegraph reported, the extent of institutional uptake this month is rapidly becoming an order of magnitude more significant.

In addition to Guggenheim giving at $400,000 price evaluation, hedge fund One River Asset Management confirmed on Wednesday that it planned to bring its Bitcoin and Ether (ETH) holdings to more than $1 billion by 2021.

“There is going to be a generational allocation to this new asset class,” Bloomberg quoted CEO Eric Peters as saying.

“The flows have only just begun.”

The $1 billion target immediately pits One River against the largest crypto institutions, among them Grayscale, which itself took its total assets under management over $13 billion this week.

Title: Bitcoin shortage as Wall Street FOMO turns BTC whales into 'plankton'

Sourced From: cointelegraph.com/news/bitcoin-shortage-as-wall-street-fomo-turns-btc-whales-into-plankton

Published Date: Thu, 17 Dec 2020 08:48:48 +0000