Bitcoin (BTC) sentiment is seeing its first significant test of the rally to year-to-date highs as bullish gains dry up.

The start of Wall Street trading on March 30 failed to induce a fresh advance on BTC/USD, which threatened to lose support at $47,000.

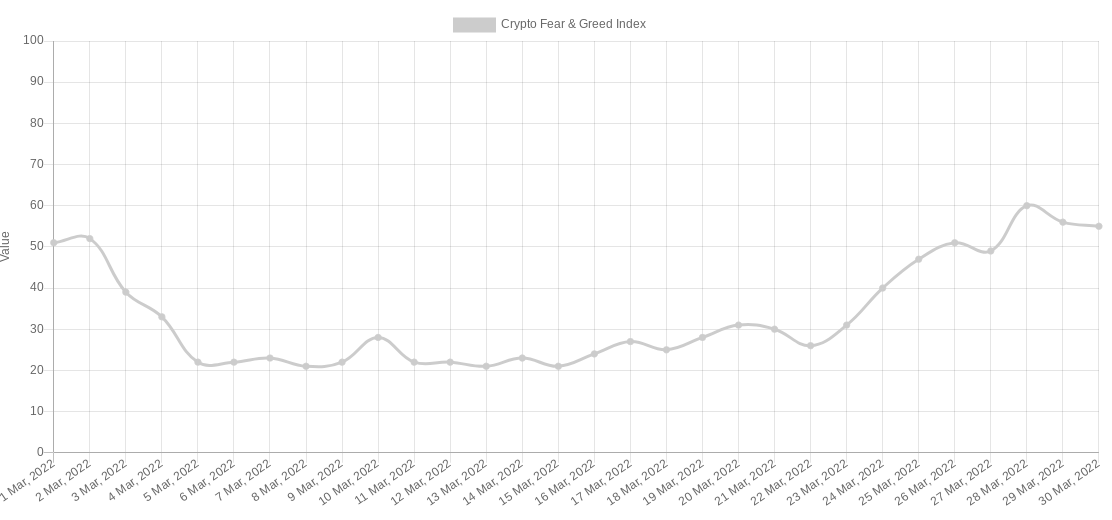

From "extreme fear" to "greed" in one week

After gaining nearly 30% since March 14, Bitcoin has managed to cling to its yearly opening price as support, this previously marking the resistance ceiling of its trading range for throughout 2022.

Now, however, hopes of a retracement appear to be coming true, as momentum shows signs of — at least temporary — fatigue.

Data from Cointelegraph Markets Pro and TradingView captured the turnaround overnight on March 30, with $48,000 currently the level proving stubborn for bulls to overcome.

Traders are keenly eyeing the possibility of a support backtest, but remain mixed over how low would be "too low" and end up threatening the uptrend altogether.

Popular trader Crypto Ed highlighted $45,000 as a core bounce zone in the event of a broader pullback, this nonetheless being below the all-important yearly open at $46,200.

A breakdown there and move towards $40,000, he added in his latest YouTube update, was something he "doubted."

Looking at sentiment gauge the Crypto Fear & Greed Index, however, the need for a time out becomes all the more apparent. In under a week, its normalized score went from 22/100 — "extreme fear" — to 60/100 — "greed" and its highest level since mid-November.

Since the local top, the score has already begun falling toward "neutral" territory, and measured 56/100 as of March 30.

Inflation nightmare scenario playing out

Analyzing the sentiment issue, social media users referenced macro forces at work, which traditionally spell trouble for risk assets in order to argue that enthusiasm around Bitcoin was overheated.

Related: Bitcoin hits 3-day low as Terra BTC buy-ins dry up below $48K

The highest inflation in 40 years and interest rates near zero hardly provide a fertile risk-on environment, they argued.

A look at gold markets, however, could show that the trend is going nowhere despite central bank measures to tame inflation.

Material Scientist, creator of on-chain analytics resource Material Indicators, noted that gold futures deliveries were following the "dysfunctional" path previously forecast by ex-BitMEX CEO, Arthur Hayes.

Hayes had warned that gold would skyrocket once it became apparent that saving in major fiat currencies was a lame bet.

This is what Hayes talked about in his last article https://t.co/khsadQuEGK

— Material Scientist (@Mtrl_Scientist) March 30, 2022

In the same piece, Hayes said that Bitcoin would ultimately benefit from the chaos via a decoupling from traditional equities.

"A gold price of >$10,000 will psychologically shock the global asset markets. As global asset allocators now think chiefly about inflation and real yields, any and all hard monetary assets believed to protect portfolios from this pestilence will get bid to astronomical levels," he wrote.

"And that is the mental shift that breaks the correlation of Bitcoin with traditional risk-on / off assets, such as US equities and nominal interest rates."

Title: Bitcoin sentiment hits 'greed' in 2022 first amid calls for $45K BTC price pullback

Sourced From: cointelegraph.com/news/bitcoin-sentiment-hits-greed-in-2022-first-amid-calls-for-45k-btc-price-pullback

Published Date: Wed, 30 Mar 2022 16:37:05 +0100

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/is-chinas-apprehension-to-ban-nfts-a-hopeful-sign-for-investors-