Bitcoin (BTC) is facing the possibility of a significant price decline, as data suggests that the cryptocurrency may retest long-term support levels after a fall in August.

BTC Price: Roads Point to $23,000

Recent data from Cointelegraph Markets Pro and TradingView shows that BTC/USD has dropped below $26,000 as of September 1, reversing the gains it had made the previous week.

Bitcoin’s price had been seen as bullish due to its ability to hold a key long-term trendline and maintain a value of $27,000. However, a delay in Bitcoin spot price exchange-traded fund applications by the United States Securities and Exchange Commission caused a reevaluation, leading to a $1,000 drop over just two hours.

Now, analysts are concerned that current support levels may not be enough to sustain the market in the long term.

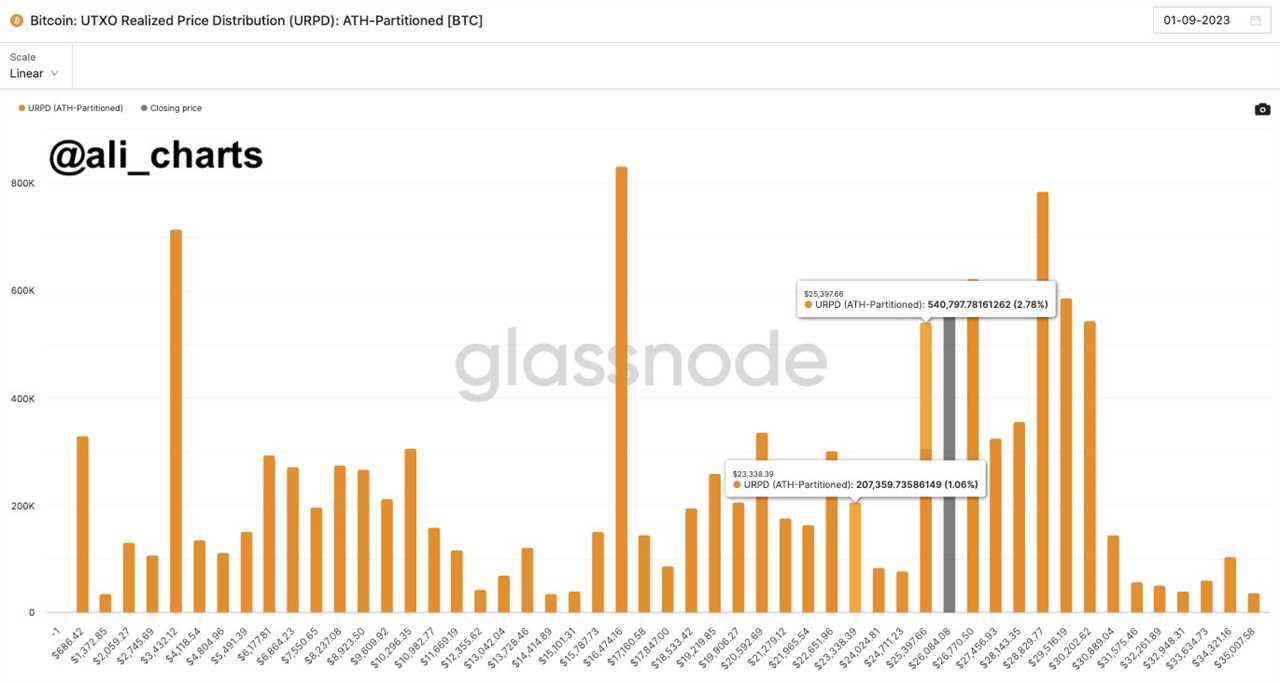

Popular trader Ali explained to X subscribers that on-chain data suggests BTC lacks strong support below the $25,400 mark. If the cryptocurrency breaks below this threshold, it could rapidly correct down to $23,340.

Ali shared a chart of the UTXO Realized Price Distribution (URPD) metric from on-chain analytics firm Glassnode, which tracks the price at which the current set of transaction outputs were created and helps determine likely price levels of support and resistance. A breakdown to $23,000 would not be unexpected, as this target has already been identified by various traders and analysts.

Bitcoin Inches Toward Key Support Battleground

Material Indicators, an on-chain monitoring resource, provided a similar analysis for BTC/USD on daily (D), weekly (W), and monthly (M) timeframes. Utilizing signals from its proprietary trading tool, Trend Precognition, Material Indicators warned that $24,750 needs to hold for Bitcoin to have a chance at rebounding.

Material Indicators stated, “We will look to the Monthly candle open for a signal from the Trend Precognition algos to gain insight into whether we can expect an extension of the downtrend or a monthly momentum shift to the upside."

Data from CoinGlass also indicated that August 31 saw the largest volume of BTC long liquidations since Bitcoin's 10% drop earlier in the month. These liquidations amounted to $41 million, with the overall value across cryptocurrencies reaching $108 million. However, this figure is still significantly lower than the daily tally from two weeks prior.

It should be noted that this article does not provide investment advice or recommendations. The decision to invest or trade in cryptocurrencies carries risks, and readers are advised to conduct their own research before making any decisions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/china-court-recognizes-virtual-assets-as-legal-property-protected-by-law