Bitcoin (BTC) stemmed losses as Wall St. opened on Nov. 26 after concern over a new Coronavirus variant spark a global market sell-off.

Pfizer gains as Coronavirus panic sets in

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD ending its downturn at just above $53,500 on Bitstamp.

The pair then added almost $1,500 as some sense of equilibrium returned to crypto markets, trading around around $54,400 at the time of writing.

Both crypto and traditional assets were rattled on the day thanks to the proliferation of a new Coronavirus variant, designated "Nu," which some parties claim could pose a problem for vaccine programs.

Pfizer (PFE), one of the major producers of Coronavirus vaccines, conspicuously bucked the nervous market downtrend, opening up 7% at the Wall St. open. By contrast, the S&P 500 was down 1.5%.

In what will be familiar to those who witnessed the events of March 2020, Bitcoin thus abandoned its asymmetrical investment traits to fall in line with both equities and the U.S. dollar.

The drop below $54,000 was accompanied by a familiar cocktail of misgivings from sources including mainstream media outlets, with CNBC joining Bloomberg in claiming that Bitcoin had "entered bear market territory."

"Let's see how the Daily candle closes," trader and analyst Rekt Capital said in cautious words about the impact of Friday's moves on Bitcoin's longer-term outlook.

#BTC revisits the black diagonal resistance and rejects there

— Rekt Capital (@rektcapital) November 26, 2021

On the rejection, $BTC has returned to the bottom of the wedging structure

Daily Close below the bottom trendline would confirm the breakdown

Let's see how the Daily candle closes#Crypto #Bitcoin pic.twitter.com/xnEroEYfEj

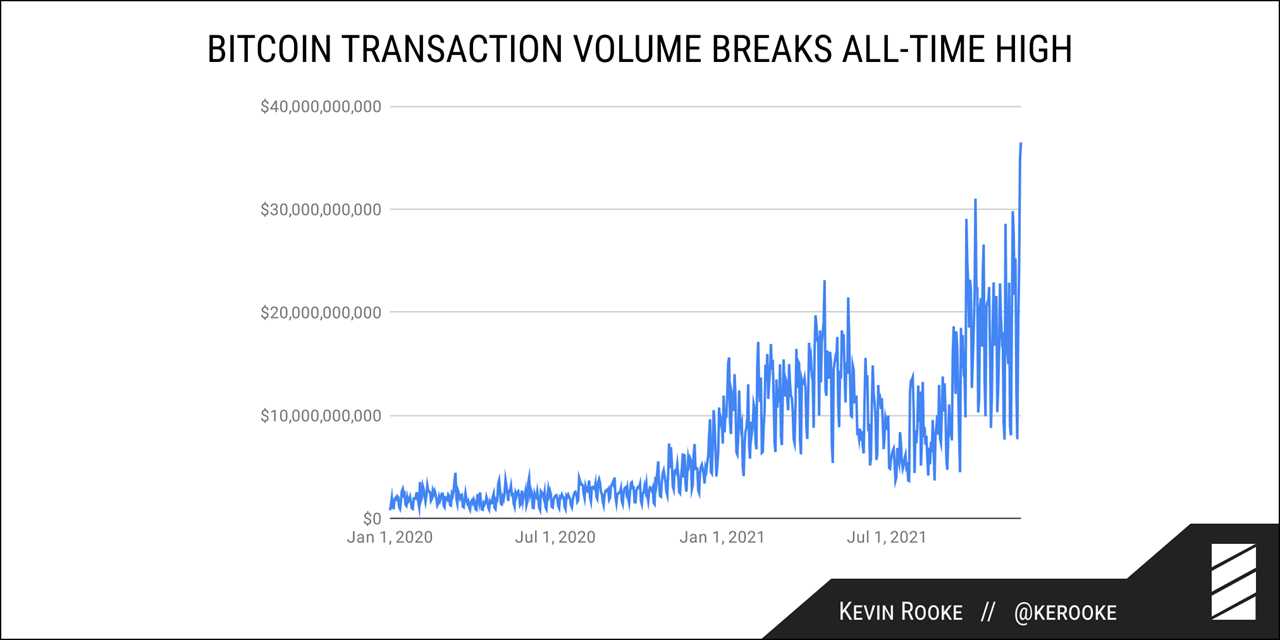

BTC transaction volume hits all-time high

Among crypto analysts and other longtime participants, however, there were still few signs of genuine bearishness.

Related: Bitcoin offers ‘Black Friday deal’ with sub-$55K BTC price — Just like 2020

"Massive corrections = massive buy opportunities," Cointelegraph contributor Michaël van de Poppe summarized.

We still at +$50K. Really tho. Why are you so hurt?

— Looposhi (@22loops) November 26, 2021

While Friday's lows have not been seen since mid-October, overall, Bitcoin's performance in Q4 remains not only profitable but fully in line with previous bull market years.

Amid the panic over spot price, meanwhile, data showed that Nov. 25 marked the largest single on-chain transaction volume day in Bitcoin's history.

"Bitcoin set another all-time high for transaction volume yesterday with $36.5 billion of value settled on-chain," researcher Kevin Rooke commented.

Title: Bitcoin reverses 'bear market' at $53.5K as Pfizer gains on fresh panic over Coronavirus 'Nu' variant

Sourced From: cointelegraph.com/news/bitcoin-reverses-bear-market-at-53-5k-as-pfizer-gains-on-fresh-panic-over-coronavirus-nu-variant

Published Date: Fri, 26 Nov 2021 15:22:27 +0000