Bitcoin started the week off with an abrupt bullish breakout to $37,500, a level some analysts have identified as a crucial 'line in the sand', but the rally was short-lived as BTC met selling near the lower arm of the bearish pennant that can be seen on multiple timeframes.

While many traders are concerned that the 2021 bull market is now over and considering whether gains should be locked in, on-chain data shows that long-term Bitcoin (BTC) holders have been accumulating in preparation for a potential 2013-style double-pump that has the potential to elevate BTC to a fresh all-time high.

Ether (ETH), on the other hand, rallied 8% to $2,677 as chatter about a possible ‘flippening’ between Bitcoin and Ethereum continues to be a topic of discussion. Most recently, Bloomberg speculated that Ether could one-day surpass Bitcoin as the world’s cryptocurrency of choice.

Short-term holders are feeding the sell-off

Further insights into what is feeding the uncertainty in the markets can be found in the most recent “Week on-chain” report from Glassnode which looked at the activity of short-term holders (STH), who are newer market entrants that hold coins younger than 155 days, and long-term holders (LTH) who hold coins older than 155 days.

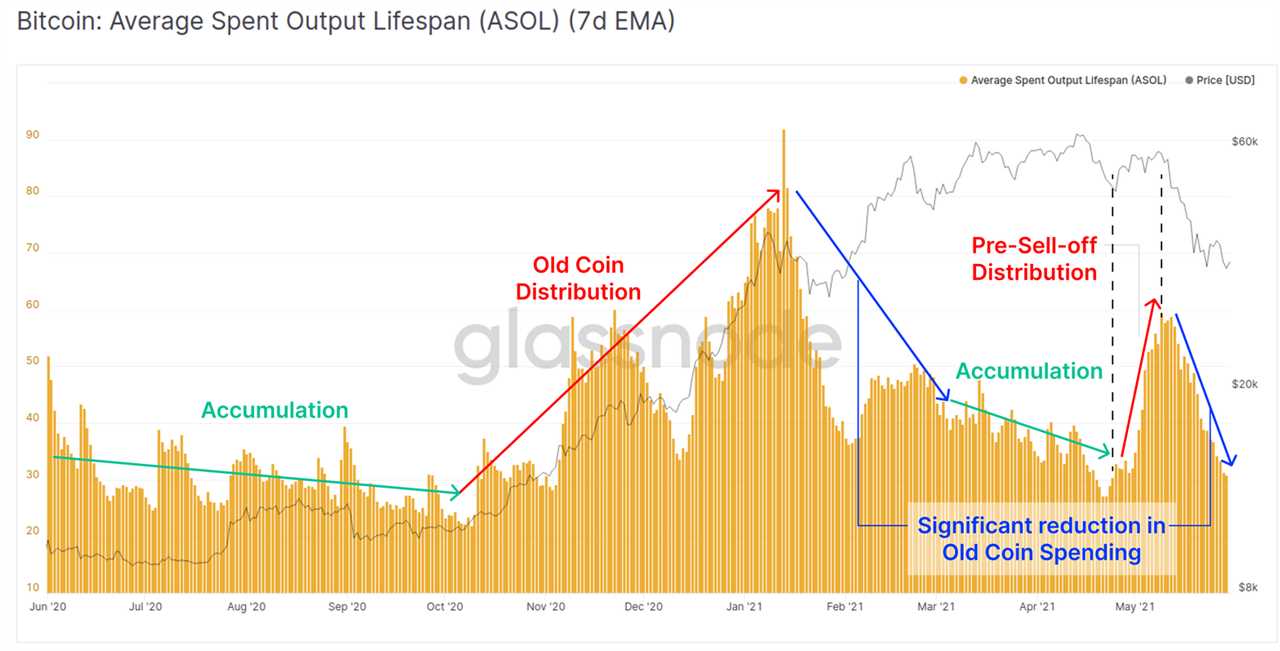

According to the Average Spent Output Lifespan (ASOL) metric, which provides insight into the average age of all UTXOs spent that day, LTHs primarily held through the recent dip as evidenced by the ASOL falling dramatically “back to levels below the accumulation range seen between $50,000 and $60,000."

Further proof that it has been STHs that are behind the sell-off can be found by comparing the amount of on-chain Bitcoin transfer volume that is in profit (LTHs) to the at a loss (STHs).

According to data from Glassnode, LTHs were seen taking profits early in the 2021 rally from $10,000 to $42,000 before their spending “reached a fairly stable baseline,” with last week’s sell-off “having little effect on their spending patterns” indicating “that LTHs are generally unwilling to liquidate coins at reduced prices.”

This compares to the behavior of STHs who “increased their spending by over 5x during this sell-off with the maximum spending occurring near the current local low of the market.”

Evidence of this can also be found in a review of the Spent Output Profit Ratio (SOPR) for STHs, who continue to realize losses by spending coins that were accumulated at higher prices at the current lower prices, indicating capitulation.

According to Glassnode: s

“Without doubt, the current market structure is best described as a battleground between the bulls and the bears with a clear trend forming between long-term and short-term investors. This is a battle of HODLer conviction and immediate buying power.”

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: Bitcoin rejects near $37.5K, on-chain data shows capitulation from short-term holders

Sourced From: cointelegraph.com/news/bitcoin-rejects-near-37-5k-on-chain-data-shows-capitulation-from-short-term-holders

Published Date: Mon, 31 May 2021 23:15:00 +0100

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/miami-crypto-conference-predicts-attendance-exceeding-50000