Bitcoin (BTC) erased some of its gains on June 24 in a test of lower levels, which spooked already wary traders.

All eyes on $37,000

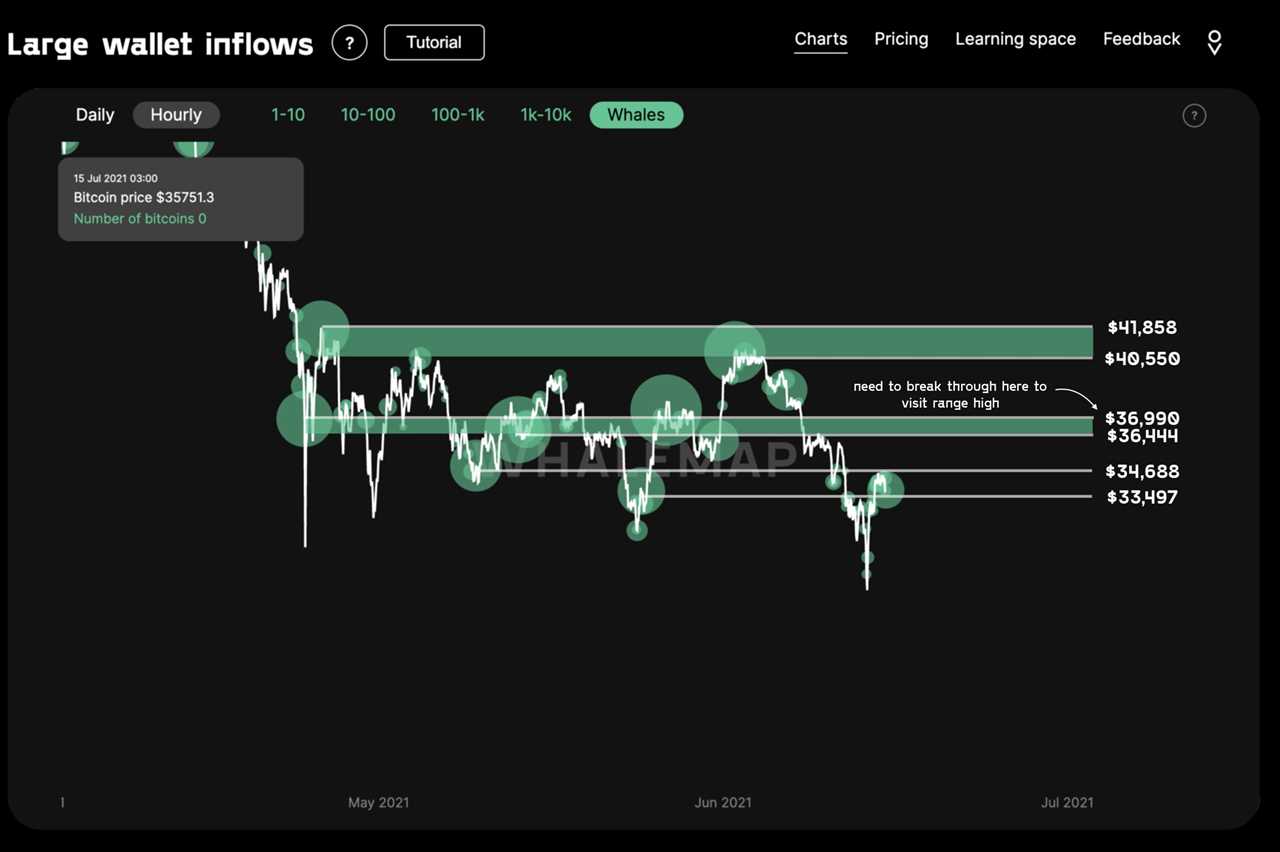

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting local lows of $32,400 on Thursday.

The pair had risen as high as $34,711 on Bitstamp the day before, making a remarkable comeback after falling to six-month lows of $28,600.

With resistance still pressuring a fuller recovery, however, caution was noticeable among market participants.

“CT is turning bearish again but I think this looks like a correction of the bounce from 28k,” popular trader Crypto Ed summarized in an update.

He added that he expected “at least” another push to a local top of $37,000-$38,000, but for this to be likely, Bitcoin needed to bounce at a target zone around $32,000.

At the time of writing, BTC/USD was already higher, eyeing $33,500.

“BTC is still in the process of retesting the ~$32000 level (black) as support,” analyst Rekt Capital added.

“Hold here and $BTC should be able to challenge higher soon.”

Analytics service Whalemap also highlighted $37,000 as a significant resistance hurdle for Bitcoin to overcome thanks to the distribution of whale positions.

Historical buy signs creep in

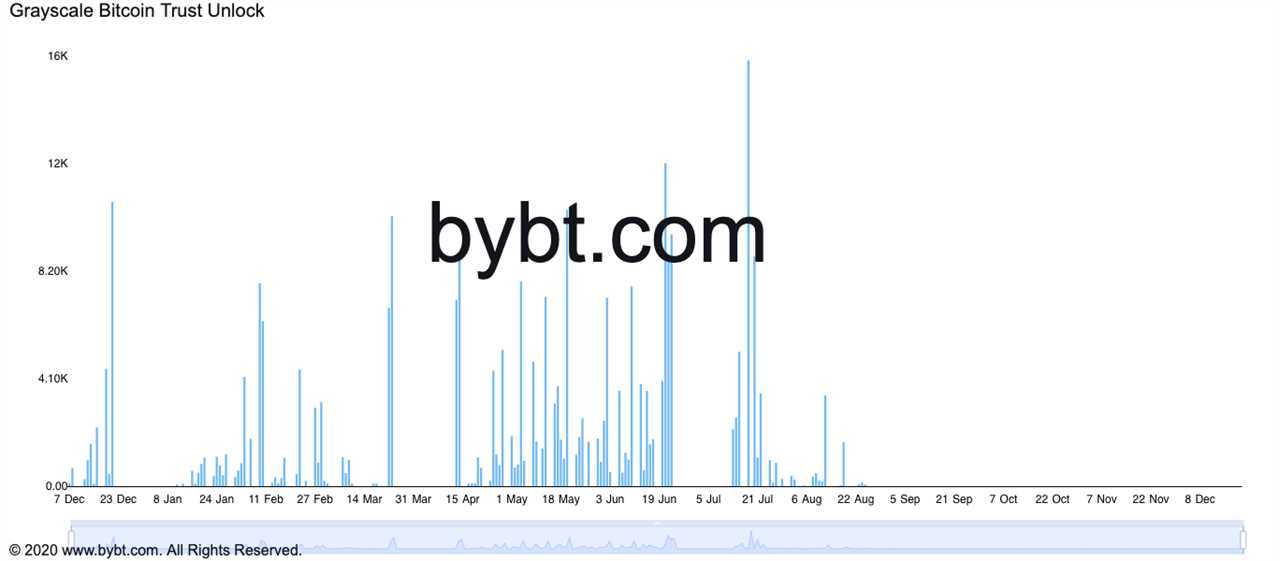

As Cointelegraph reported, the end of this month is being met with trepidation in the face of a quarterly futures expiry worth some $2.3 billion.

This, combined with unlocking events scheduled for July at the Grayscale Bitcoin Trust ($GBTC), means that selling pressure can remain for the next several weeks before substantially subsiding.

Changes in selling pressure from miners, meanwhile, are already visible amid the ongoing shake-up in China, data suggests.

On Thursday, on-chain analytics service CryptoQuant eyed Bitcoin’s Puell Multiple hitting lows at which it has historically bounced.

A classic indicator, Puell can be used to eye “buy” signals, and captured the start of the past year’s bull market with precision.

“Low Puell Multiple values indicate miner profitability is low compared to yearly averages. This means some miners will reduce hash power, difficulty will reduce allowing further decentralization, and less sell pressure/impact on liquid supply from miners,” CryptoQuant explained.

“This may indicate we have reached a bottom for this consolidation and are on the path to recovery.”

Title: Bitcoin rejects at $34.5K as analysts reveal key resistance level to beat next

Sourced From: cointelegraph.com/news/bitcoin-rejects-at-34-5k-as-analysts-reveal-key-resistance-level-to-beat-next

Published Date: Thu, 24 Jun 2021 11:11:52 +0100