Bitcoin (BTC) has been stuck below the $18,600 resistance for the past 19 days and while bears successfully breached the $16,000 support on Nov. 21, the 8% range is pretty narrow for an asset class with 60% annualized volatility.

This gives investors good reason to doubt that BTC price will hold its current gains leading into the $430 million BTC options expiry on Dec. 2.

Investors are still unsure about whether $15,500 was the Bitcoin bottom and the consequences of the FTX and Alameda Research demise continue to emerge. The latest contagion victim was Auros Global, an algorithmic trading and market-making firm, which missed a repayment on a decentralized finance loan.

Regulatory uncertainty also continues to limit Bitcoin's price ascension, especially after United States Senator Elizabeth Warren reinforced the importance of blocking direct exposure of the insured financial institutions and the "highly speculative activity, highly leveraged, and vulnerable" crypto space.

Considering these risks, it seems essential that bulls defend $17,000 ahead of the Dec. 2 options expiry.

Bears placed most of their bets below $16,500

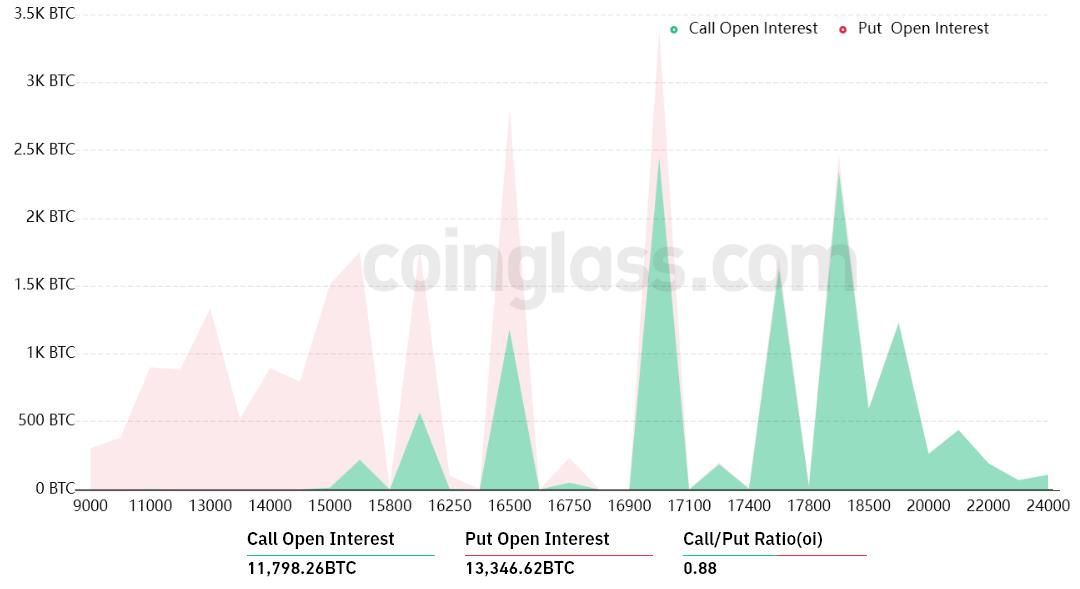

The open interest for the Dec.2 options expiry is $430 million, but the actual figure will be lower since bears were overly-optimistic. These traders completely missed the mark by placing bearish bets between $12,000 and $15,000 after Bitcoin lost the $16,000 support on Nov. 21.

The 0.88 call-to-put ratio shows the dominance of the $230 million put (sell) open interest against the $200 million call (buy) options. Nevertheless, as Bitcoin stands near $17,000, most bearish bets will likely become worthless.

If Bitcoin's price remains above $17,000 at 8:00 am UTC on Dec. 2, only $4 million of these put (sell) options will be available. This difference happens because a right to sell Bitcoin at $16,000 or $17,000 is worthless if BTC trades above that level on expiry.

Bulls still have a slight chance

Below are the four most likely scenarios based on the current price action. The number of Bitcoin options contracts available on Dec. 2 for call (bull) and put (bear) instruments varies, depending on the expiry price. The imbalance favoring each side constitutes the theoretical profit:

- Between $15,500 and $16,500: 600 calls vs. 3,100 puts. The net result favors the put (bear) instruments by $40 million.

- Between $16,500 and $17,000: 1,700 calls vs. 1,400 puts. The net result is balanced between calls and puts.

- Between $17,000 and $18,000: 6,200 calls vs. 100 puts. The net result favors the call (bull) instruments by $110 million.

- Between $18,000 and $19,000: 8,600 calls vs. 0 puts. The net result favors the call (bull) instruments by $160 million.

This crude estimate considers the put options used in bearish bets and the call options exclusively in neutral-to-bullish trades. Even so, this oversimplification disregards more complex investment strategies.

For example, a trader could have sold a put option, effectively gaining positive exposure to Bitcoin above a specific price, but unfortunately, there's no easy way to estimate this effect.

Related: CFTC chief says Bitcoin is the only commodity in the wake of FTX collapse

Pending regulation and contagion risk help to raise investors' fear

During bear markets, it’s easier to negatively impact Bitcoin price due to the outsized effect negative newsflow has on the crypto market.

For example, Binance exchange moved $2 billion worth of Bitcoin on Nov. 28, triggering concerns in the community.

The transaction raised investors' eyebrows because Binance CEO Changpeng Zhao had previously declared that it's bad news when exchanges move large amounts of crypto to prove their wallet address. Consequently, odds are bears will likely be able to push the Bitcoin price below $17,000 and avoid a potential $110 million loss.

More importantly, the bulls' best-case scenario requires a pump above $18,000 to extend their gains to $160 million — rather improbable considering the lingering regulatory and contagion risks. So, for now, bears seem to have control over Friday's expiry, despite being overconfident.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Title: Bitcoin price volatility expected ahead of Friday’s $430M BTC options expiry

Sourced From: cointelegraph.com/news/bitcoin-price-volatility-expected-ahead-of-friday-s-430m-btc-options-expiry

Published Date: Thu, 01 Dec 2022 18:13:13 +0000