Bitcoin (BTC) chopped and changed on Nov. 18 but held a critical support level to preserve the chance of new all-time highs.

$90,000 remains on the table

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it ranged between $59,000 and $60,000 Thursday, seeing $1,000 swings in minutes.

With the pair’s overall range becoming ever narrower, talk turned to a potential “short squeeze” entering to push its spot price to new, higher levels.

“Based on the Futures Market structure, the funding rate and OI momentum trends are forming a perfect setting for a ‘Short-Squeeze’ scenario," one contributor to on-chain analytics firm CryptoQuant argued Wednesday.

“Then the question is, what price range would act as a support level?”

A similar event occurred at the end of September when Bitcoin suddenly surged into a week of almost unchecked gains, which topped out at $55,000.

For popular trader Crypto Ed, the chances were there that the $58,400 lows of recent days may be a more definitive floor.

“Maybe a bit early to post as the bottom might not be in yet, but I’m getting excited when checking next targets which don’t seem to be that far away!” he ventured Wednesday.

“In case I’m right with bottom in already or around $57k, the target is more or less the same..... $90.000 and a little bit.”

Analyst warns of investor complacency

Such price targets have become increasingly controversial as Bitcoin’s bull run stalls below $70,000, with less than two weeks left to hit PlanB’s “worst-case scenario” November close of $98,000.

Related: Bitcoin holders who bought at $20K refuse to sell BTC at all-time highs — Latest data

This week, PlanB reiterated the difference between that prediction and his stock-to-flow Bitcoin price models, with a failure to hit it leaving the latter intact.

To clarify: 98K Nov prediction is NOT based on S2F model but on my floor model.

— PlanB (@100trillionUSD) November 17, 2021

As I said before (in tweets and latest podcasts), I use 3 models:

1) S2F

2) Floor model

3) On-chain model

If for example 98K Nov floor model prediction fails, that does NOT mean S2F or on-chain fails. https://t.co/tj6SSwSzKR

For the short term, however, some considered the market still unprepared to support a fresh BTC price run-up.

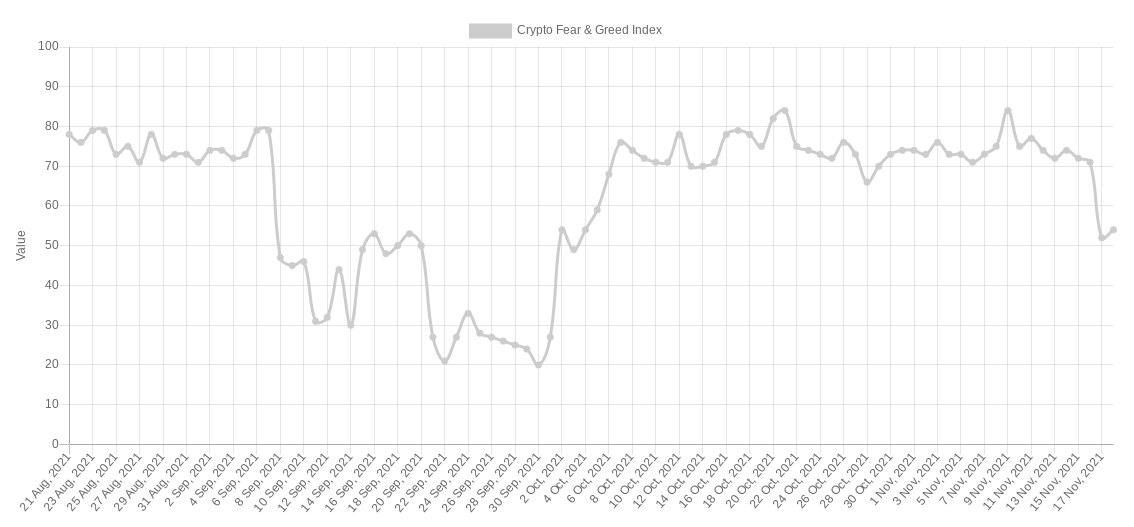

Highlighting a lack of “fear” in sentiment, trader and analyst Rekt Capital was sober on the likelihood of a full-on trend reversal.

“Doesn’t seem that BTC investors are fearful enough towards price for this retrace to be over just yet,” he warned.

“It is Extreme Fear that precedes maximum financial opportunity, not neutrality.”

The Crypto Fear & Greed Index stood at 54/100 Thursday — “neutral” territory — having reached local highs of 84/100 on Nov. 9.

Title: Bitcoin price seesaws beneath $60K as anticipation builds for fresh BTC ‘short squeeze’

Sourced From: cointelegraph.com/news/bitcoin-price-seesaws-beneath-60k-as-anticipation-builds-for-fresh-btc-short-squeeze

Published Date: Thu, 18 Nov 2021 13:01:08 +0000

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/digital-currencies-wont-impact-us-sanctions-treasury-exec-says