Bitcoin (BTC) may experience a significant price correction before the launch of a highly-anticipated exchange-traded fund (ETF), according to gold enthusiast Peter Schiff.

Schiff, a long-time critic of Bitcoin, recently expressed concerns over the recent price surge of BTC.

Schiff anticipates a crash in BTC price before ETF launch

Peter Schiff, the chief economist and global strategist at asset management firm Europac, has been a vocal critic of Bitcoin for years.

He has consistently argued that Bitcoin's value will eventually drop to zero and that nobody wants to hold it unless they plan to sell it at a higher price.

With BTC/USD reaching 18-month highs, Schiff has now shifted his focus to what many believe will be a pivotal moment for cryptocurrencies — the launch of the first Bitcoin spot price ETF in the United States.

The approval is expected to come in early 2024, although rumors of a possible approval in November contributed to last week's surge above $37,000.

While some analysts believe the ETF announcement will trigger a "sell the news" event, where investors reduce their exposure to Bitcoin once the certainty of the ETF is confirmed, Schiff believes a price correction could occur even before that.

In a recent survey, Schiff presented two scenarios for a Bitcoin crash — one before the ETF launch and one after. However, the most popular choice among respondents was "Buy and HODL till the moon," with 68% of the nearly 25,000 votes.

Despite this, Schiff remains firm in his prediction.

"Based on the results, my guess is that Bitcoin crashes before the ETF launch," he responded.

"That's why the people who bought the rumor won't actually profit if they wait for the fact to sell."

AllianceBernstein: Bitcoin ETF impact already factored into the price

The institutional sentiment towards ETF approval has been increasingly positive, as the likelihood of a Bitcoin ETF approval grows stronger.

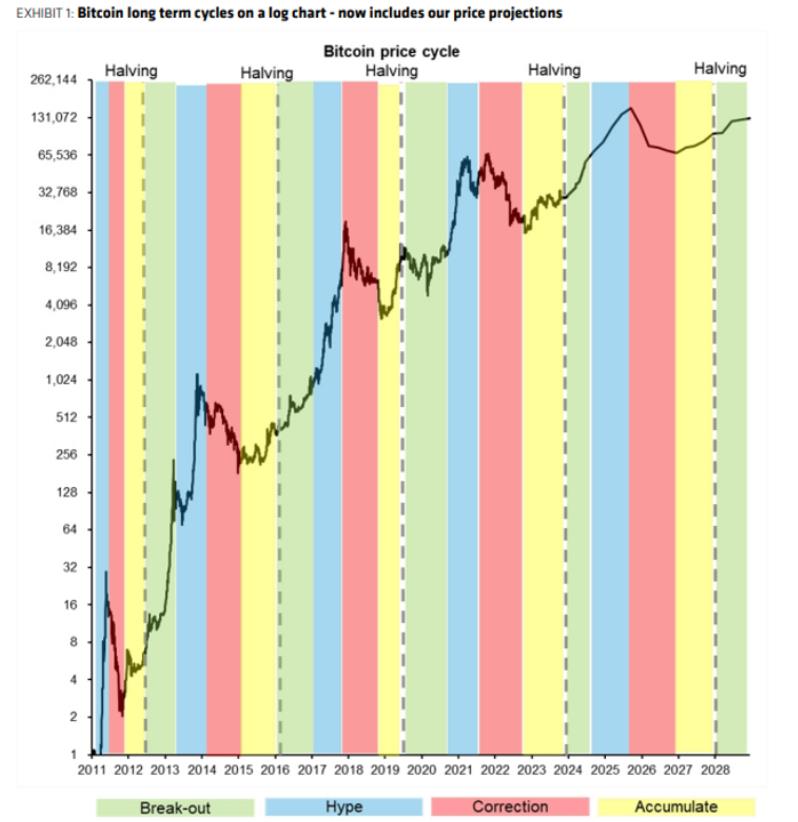

AllianceBernstein, among the latest to offer an optimistic BTC price forecast, predicts a peak of $150,000 in the next market cycle.

In a note quoted by MarketWatch and others, analysts at AllianceBernstein stated, "We believe early flows could be slower, and the build-up could be more gradual. The ETF flows momentum could build after the halving, leading to a cycle peak in 2025 instead of 2024."

"The current BTC breakout is simply the ETF approval news being slowly factored into the price. The market will then monitor the initial outflows and may experience short-term disappointment."

An accompanying chart illustrated BTC price behavior in previous and future halving cycles.

Please note that this article does not provide investment advice or recommendations. All investment and trading activities involve risk, and readers should conduct their own research before making any decisions.