GDP Sets the Tone for Crypto Market

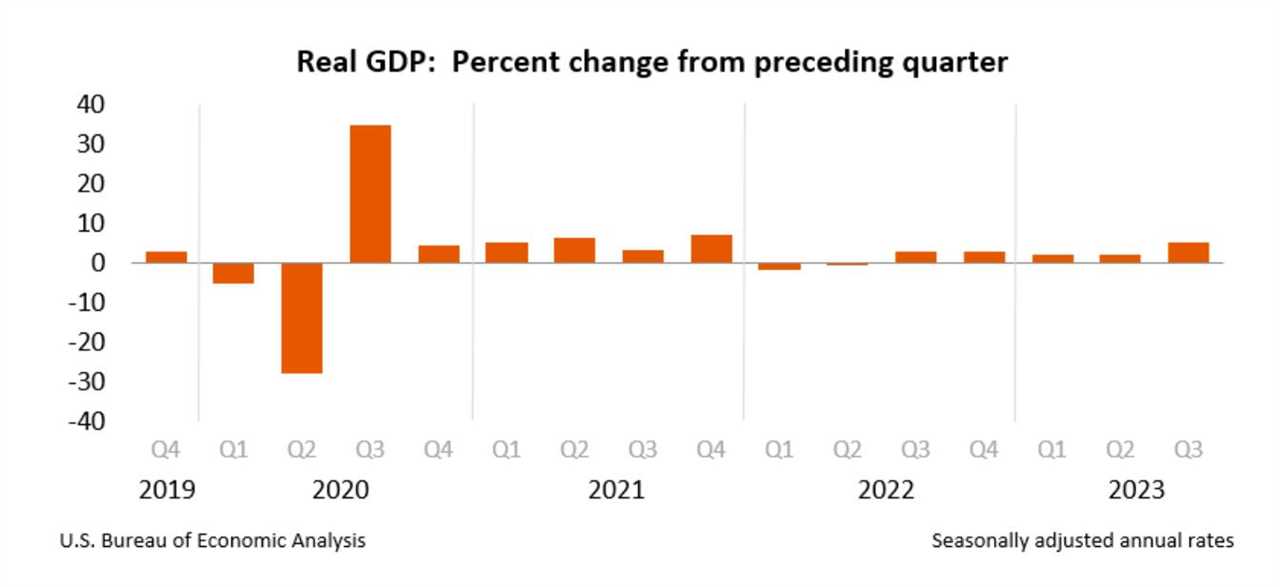

The price of Bitcoin (BTC) retreated from resistance levels after the Wall Street opening on November 29th, following the release of better-than-expected United States GDP figures.

Bitcoin bulls had managed to push the market above $38,000 the day before, only to see it fluctuate around that level and eventually drop as US macro data was released.

Q3 GDP came in at 5.2%, exceeding expectations of 4.9%, causing renewed concerns about how the Federal Reserve will handle policy ahead of the mid-December interest rates decision.

Bill Ackman, CEO and founder of hedge fund Pershing Square Capital Management, predicted a Fed rate pivot as soon as Q1, 2024, further adding to the uncertainty.

Data from CME Group's FedWatch Tool showed a slight increase in bets on a further hike in December following the GDP release.

Bitcoin Continues to Face Resistance

Bitcoin's price has been following a familiar pattern in recent days. Bulls were unable to break through a key resistance zone starting at $38,500, despite some traders being confident in a push towards $40,000.

Analysts suggest that the price of Bitcoin may enter a period of consolidation before experiencing another surge in volatility.

Traders are eyeing a potential downside between $33,000 and $35,000, as this range has already shown significant liquidity.

It's important to note that this article does not provide investment advice or recommendations. Investors should conduct their own research and analysis before making any decisions.