Legal Battle Takes a Surprising Turn

The ongoing legal battle between the Binance cryptocurrency exchange and the U.S. Securities and Exchange Commission (SEC) took a surprising turn on Sept. 18. The SEC's request for access to Binance.US's systems was rejected by Magistrate Judge Zia M. Faruqui. Instead, the judge suggested that the SEC should formulate specific discovery requests.

While this decision only temporarily postponed the need for Binance to demonstrate the separation between Binance.US's custody solution and Binance International, the market responded positively. Bitcoin (BTC) surged to its highest level in three weeks, breaking above the $27,000 resistance. Traders are now wondering whether the rally has been supported by leverage or genuine spot buying demand.

Investors Must Wait Three Weeks for Further Rulings

Judge Faruqui scheduled a follow-up hearing for Oct. 12 and called upon the involved parties to submit a status report before the event, as reported by Yahoo Finance. What might have seemed like a setback for the SEC, at least for the time being, could potentially increase the risks for Binance.

Binance's founder and CEO, Changpeng "CZ" Zhao, remains steadfast in asserting that Binance.US has never utilized Binance International's custody solutions. Nevertheless, the SEC has yet to produce clear evidence of Binance attempting to mislead the court.

Regardless of the current evidence, the outlook for Bitcoin bulls has significantly improved for the next three weeks, with no anticipated changes until the upcoming court hearing.

Bitcoin Margin, Options Show Clear Path Toward $28,000

To gauge the increasing optimism among professional traders, let's examine Bitcoin's margin and derivatives metrics.

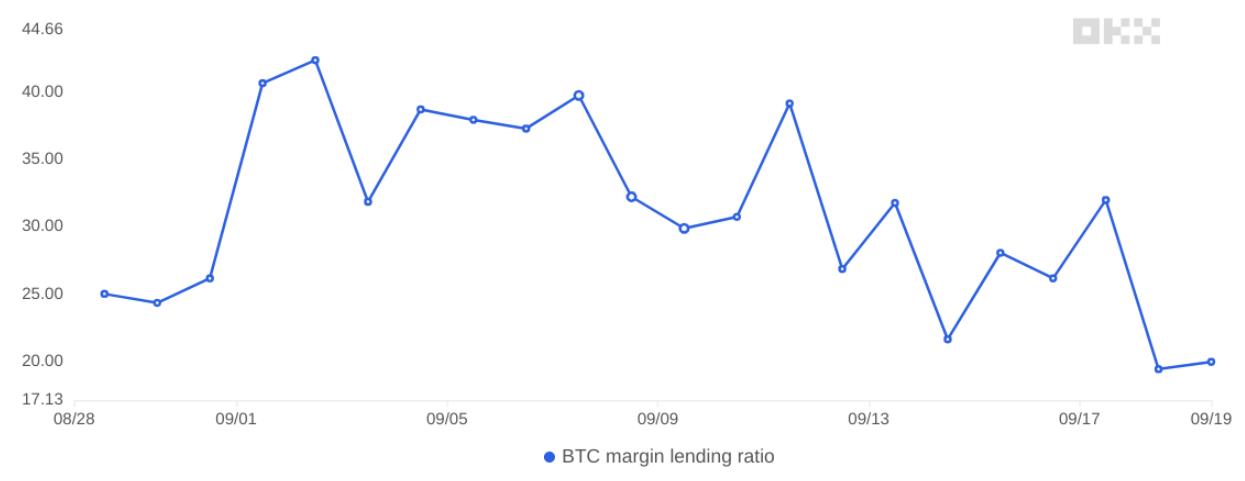

Margin markets offer valuable insights into the positioning of professional traders as they enable investors to increase their exposure through stablecoin borrowing. Recent data reveals that the margin-lending ratio for OKX traders has dropped to its lowest point in three months, standing at 19x, down from 27x just a week ago. These findings suggest that the overwhelming dominance of leverage long positions has diminished, although the current ratio still favors the bulls.

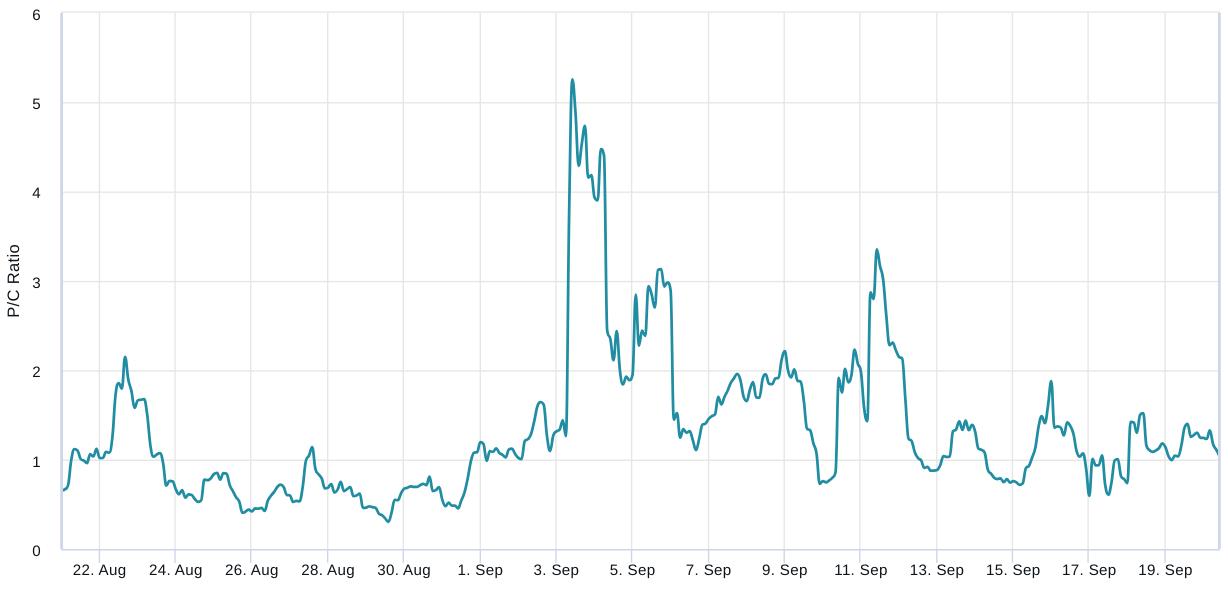

Market sentiment can also be assessed by analyzing whether more activity is occurring through call (buy) options or put (sell) options. The put-to-call ratio for Bitcoin options volume has recently shifted from favoring put options at 1.50 to a balanced 1.04 level on Sept. 20, indicating a reduced interest in protective puts.

Both Bitcoin margin and options markets indicate a balanced demand between long and short positions. From a bullish perspective, this suggests that excessive leverage hasn't been utilized as Bitcoin's price climbed from $26,500 to $27,500 on Sept. 19.

Nonetheless, the data does hint at buying support from spot orders, possibly indicating that big entities, or so-called whales, are accumulating regardless of price.

Three More Weeks of Optimism

Now, BTC and other crypto bulls have a window of three more weeks, until Oct. 12, when the Federal Judge will convene another hearing and potentially issue orders that could pose challenges for Binance.US. In the meantime, a Bitcoin price rally above $28,000 is certainly on the table.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/wormhole-makes-native-usdc-transfers-seamless-across-multiple-blockchain-networks