Fed Meeting and SEC Decision Pose Risks

Bitcoin (BTC) has shown resilience and decoupled from the S&P 500 Index in recent weeks, with its price climbing 15% and 10.45% in the past two weeks. However, challenges lie ahead as the Federal Open Market Committee's meeting on Nov. 1 and any adverse news regarding the approval of a Bitcoin exchange-traded fund could impact the market. Traders must be cautious as a short-term pullback remains a risk.

Bitcoin and Altcoin Support Levels to Watch

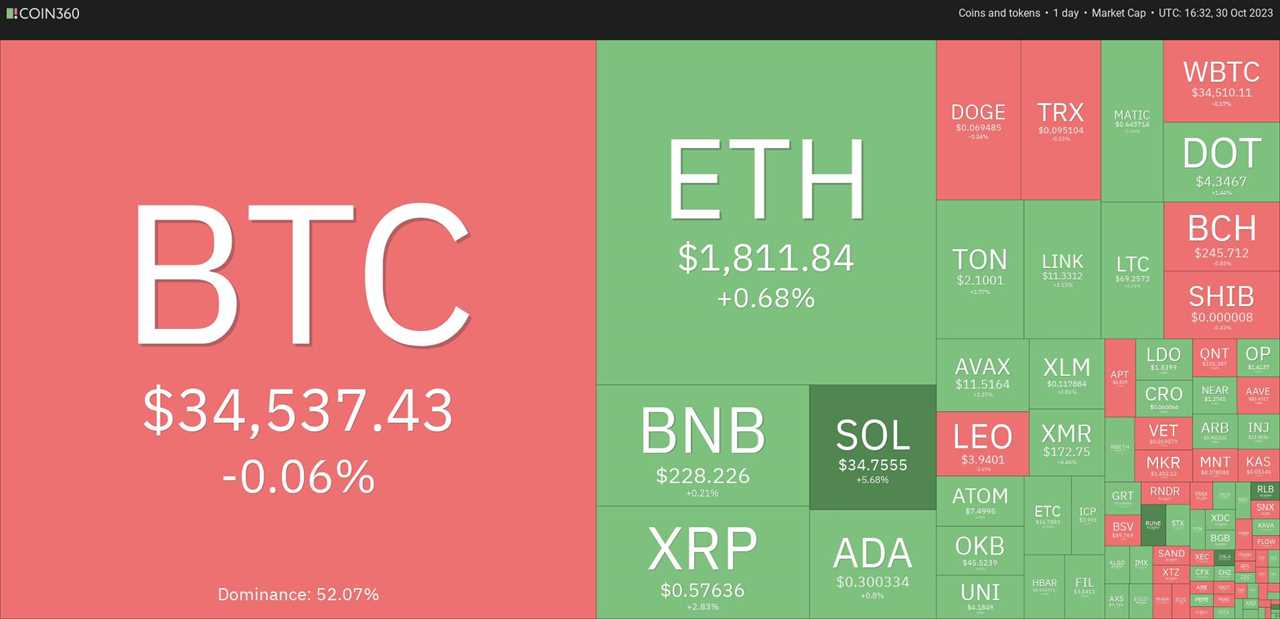

Analyzing the charts, it is important to monitor key support levels for Bitcoin and altcoins to gauge the sentiment. The S&P 500 Index remains in a downtrend, with strong support between 4,050 and 4,100. On the other hand, Bitcoin has entered a consolidation phase between $33,390 and $35,380, with $35,280 posing as a formidable resistance level. Altcoins like Ether (ETH), BNB, XRP, Solana (SOL), Cardano (ADA), and Dogecoin (DOGE) also have their own support and resistance levels to watch.

US Dollar Index and Its Range-Bound Movement

The US dollar index (DXY) has rebounded off the 50-day simple moving average, indicating buyer interest at lower levels. However, the negative divergence on the relative strength index (RSI) suggests that the bullish momentum may be weakening. As a result, the index is expected to remain range-bound between 105.36 and 107.35 for the time being.

Bitcoin Bulls Remain in Control

Despite overbought levels on the RSI, Bitcoin bulls are still in charge as indicated by rising moving averages. If the price breaks above $35,280, a surge towards $40,000 is possible. However, a drop below $33,390 could result in a further decline towards $31,000.

Altcoin Outlook: ETH, BNB, XRP, SOL, ADA, DOGE, TON

Ether (ETH) has been range-bound between $1,746 and $1,865, with the bulls having the upper hand. BNB has been stuck in a range between $235 and $203, but bulls have a slight edge. XRP cleared a hurdle at $0.56 and may climb to $0.66, while SOL is in an uptrend and eyes $38.79 and $48. ADA has sustained above $0.28 and a break above $0.30 could trigger a rally. DOGE is battling near $0.07, with buying on dips indicating a sentiment shift. TON has shown balance between buyers and sellers, with potential resistance at $2.31.

Please note that this article does not contain investment advice or recommendations. Readers should conduct their own research before making any investment decisions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/avax-blockchain-explorer-to-shut-down-as-etherscan-fees-draw-controversy