Bitcoin on the Verge of a Bearish Breakdown

Bitcoin (BTC) is teetering on the edge of a bearish breakdown, with traders closely watching the $25,000 support level. The cryptocurrency recently broke out of its parallel range between $25,500 and $26,500, dropping to an intraday low of $24,950. A daily close below $24,750 could result in a further drop to below $20,000. However, there is a slight chance that bullish momentum could revive.

A Buying Opportunity at $25,000?

Some traders see the current price of $25,000 as a potential short-term buying opportunity. They believe that this level presents the best area to trap sellers and offers a favorable risk-to-reward ratio for long positions. While there is still a risk involved, these traders are optimistic that the market will not break through this level easily.

Market Indicators Offer Hope for Bulls

There are several market indicators that could give hope to buyers. Bitcoin has a negative correlation with the U.S. dollar and a positive correlation with stocks. On September 11, when the S&P 500 and Nasdaq indexes were trading higher, the U.S. Dollar Index (DXY) was falling. If the DXY continues to weaken, it could provide a boost to Bitcoin's price. Additionally, the upcoming Consumer Price Index (CPI) print in the United States on September 13 could provide a decisive direction to global markets.

On-Chain Data Shows Accumulation by Long-Term Holders

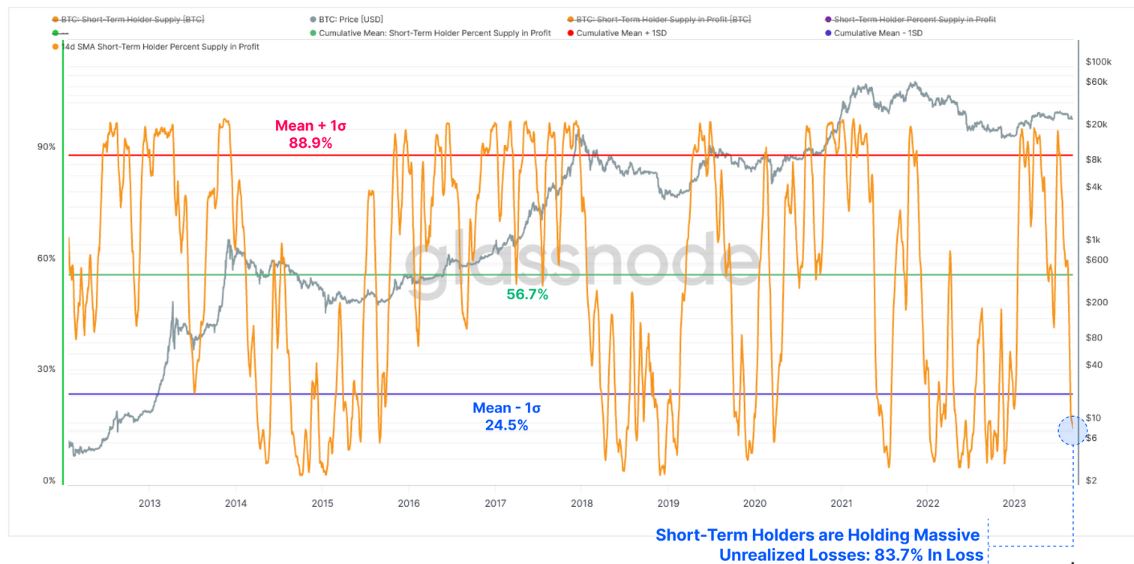

A report by on-chain analytics outlet Glassnode reveals that Bitcoin's recent price drop has caused several metrics to reach historical lows. This period of low liquidity and low trading volumes has made it challenging for bulls to push the BTC price through resistance levels. However, long-term holders are starting to accumulate Bitcoin as the bullish hype cools down. Glassnode also notes that a majority of short-term supply is currently in an unrealized loss, which could act as a potential short-term reversal level. However, the market's volatility, liquidity, trade volumes, and on-chain settlement volumes are also at historical lows, indicating a sense of apathy and boredom among market participants.

Potential for Sellers to Enter the Market

If there is a bullish reversal, there is a possibility that a significant number of sellers may enter the market, especially near the break-even level of short-term buyers around $26,000. This could create selling pressure and potentially limit the upside potential.

Conclusion

Combining the price action of the U.S. Dollar Index (DXY) with on-chain data, there is a possibility that buyers could return sooner than expected. This makes the current price action a potentially lucrative opportunity for opening Bitcoin long positions. However, it is important to note that cryptocurrency investments involve risks, and readers should conduct their own research before making any decisions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/how-web3-improves-data-storage-ghostdrive-joins-cointelegraph-accelerator