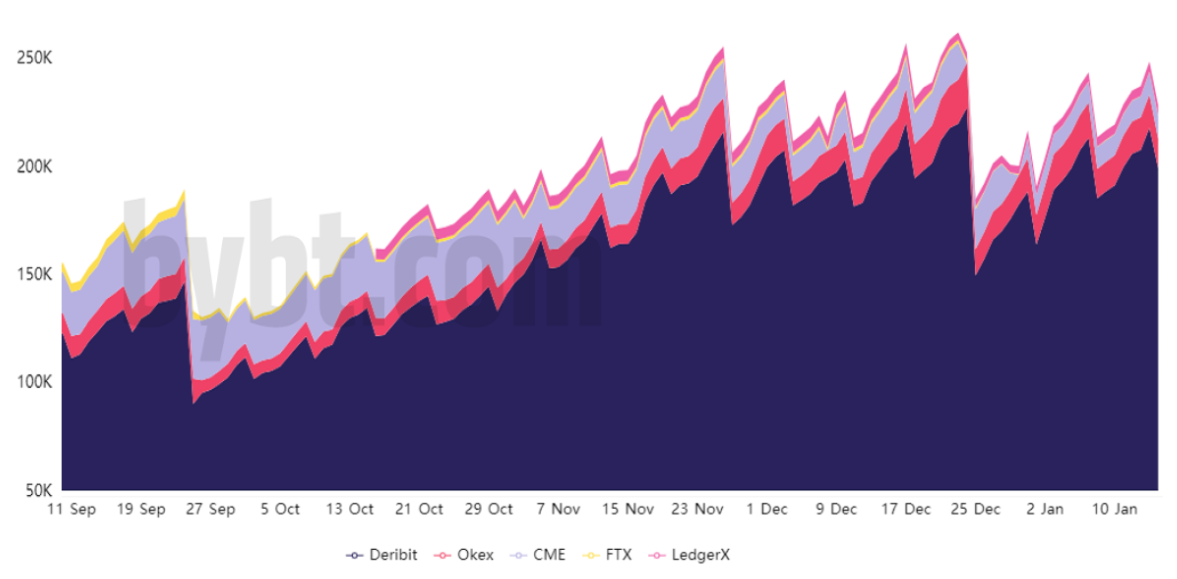

Over the past two months the open interest on Bitcoin options has held reasonably steady even as the figure increased by 118% to reach $8.4 billion as (BTC) price rose to a new all-time high. The result of Bitcoin’s price appreciation and the rising open interest on BTC options has resulted in a historic $3.8 billion expiry set for Jan. 29.

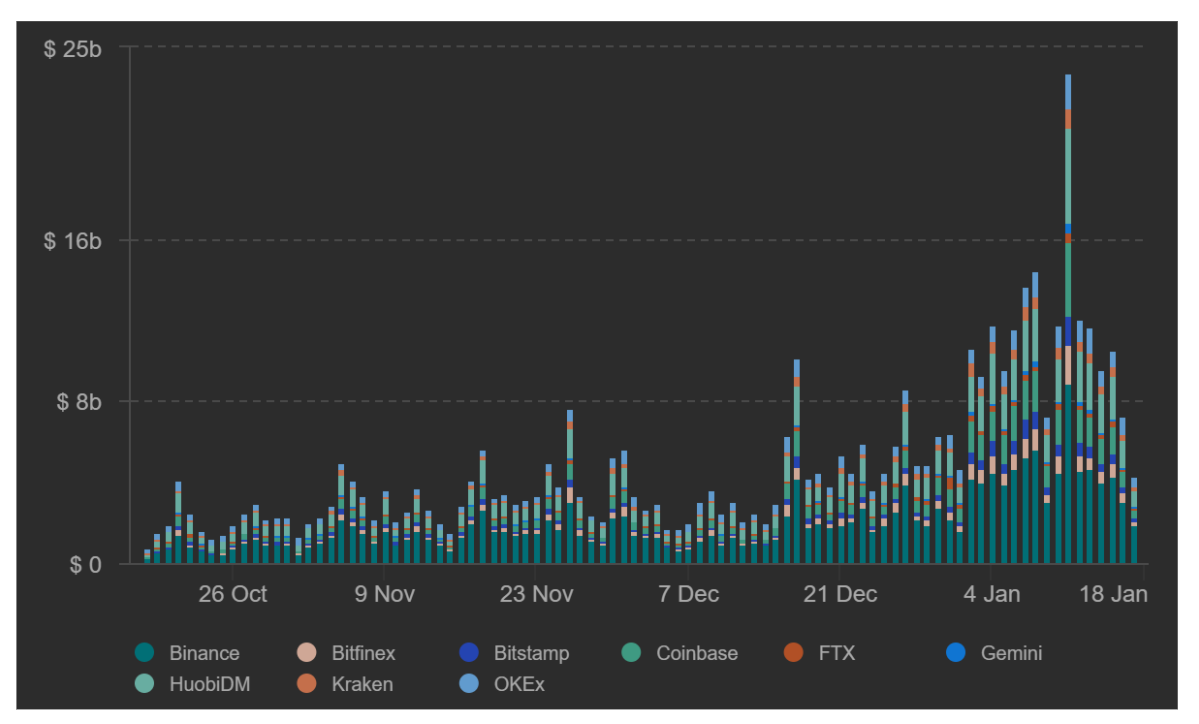

To understand the potential impact of such a large expiry, investors should compare it to the volumes seen at spot exchanges. Although some data aggregators display over $50 billion to $100 billion in daily Bitcoin volume, a 2019 report authored by Bitwise Asset Management found that many exchanges employ a variety of questionable techniques to inflate trading volumes.

This is why when analyzing exchange volume, it’s better to source the figure from trusted data aggregators instead of relying on the data provided by the biggest exchanges.

As the above data indicates, BTC’s spot volume at exchanges averaged $12 billion over the past 30 days, a 215% increase from the previous month. This means the upcoming $3.8 billion expiry translates to 35% of spot BTC daily average volume.

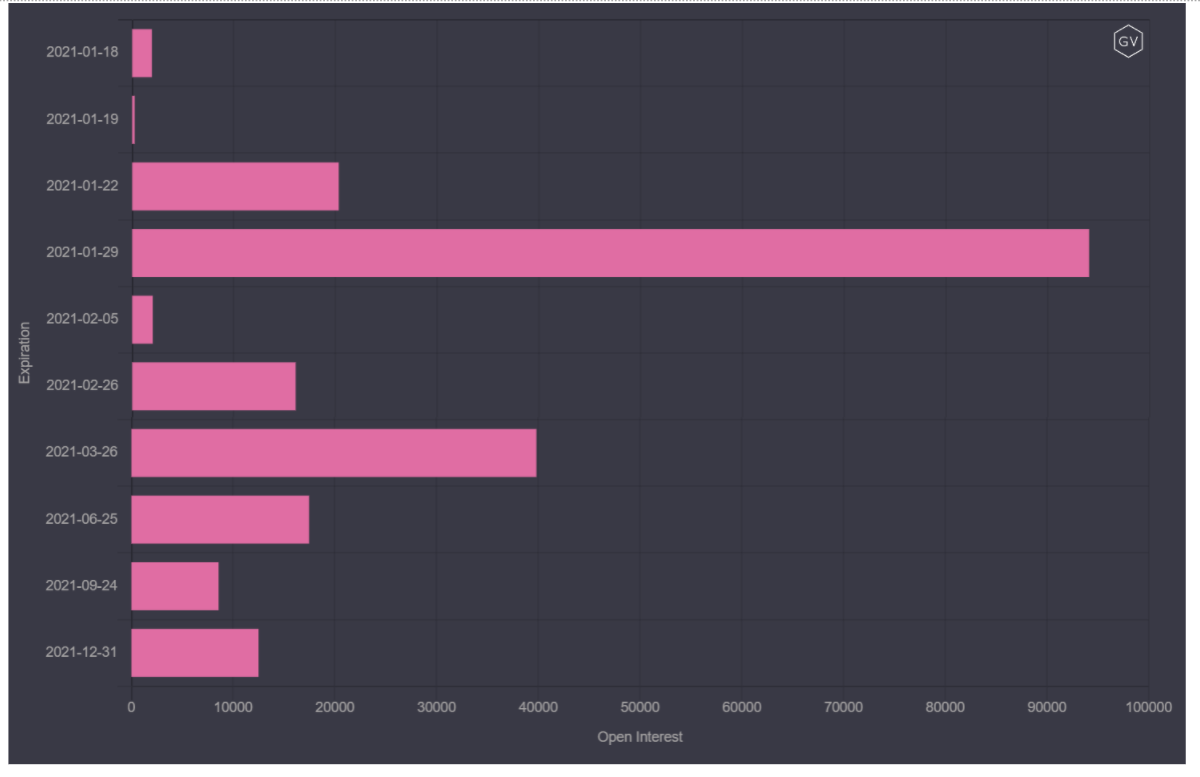

45% of all Bitcoin options expire on January 29

Exchanges offer monthly expiries, although some also hold weekly options for short-term contracts. Dec. 25, 2020 had the largest expiry on record as $2.4 billion worth of option contracts expired. This figure represented 31% of all open interest and shows how options are usually spread out throughout the year.

Data from Genesis Volatility shows that Deribit’s expiry calendar for Jan. 29 holds 94,060 BTC. That unusual concentration translates to 45% of its contracts set to expire in twelve days. A similar effect holds at the remaining exchanges, although Deribit has an 85% market share overall.

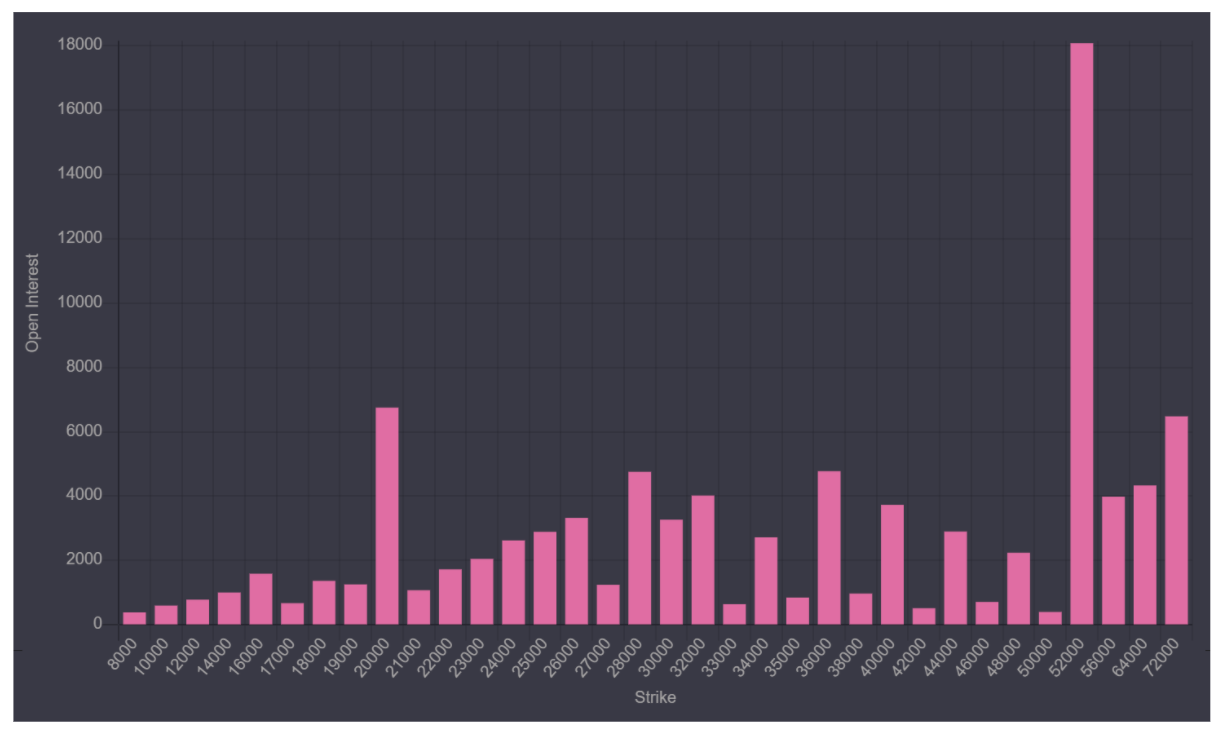

It is worth noting that not every option will trade at expiry as some of those strikes now sound unreasonable, especially considering there are less than two weeks left.

The bullish $46,000 call options and above are now deemed worthless and the same has happened to the bearish put options below $28,000, as 68% of them are now effectively worthless. This means that only 39% of the $3.8 billion set to expire on Jan. 29 are worth exploring.

Analyzing open interest provides data from trades that have alreadyd passed, whereas the skew indicator monitors options in real time. This gauge is even more relevant as BTC was trading below $25,000 just thirty days ago. Therefore, the open interest near that level does not indicate bearishness.

Market makers are unwilling to take upside risk

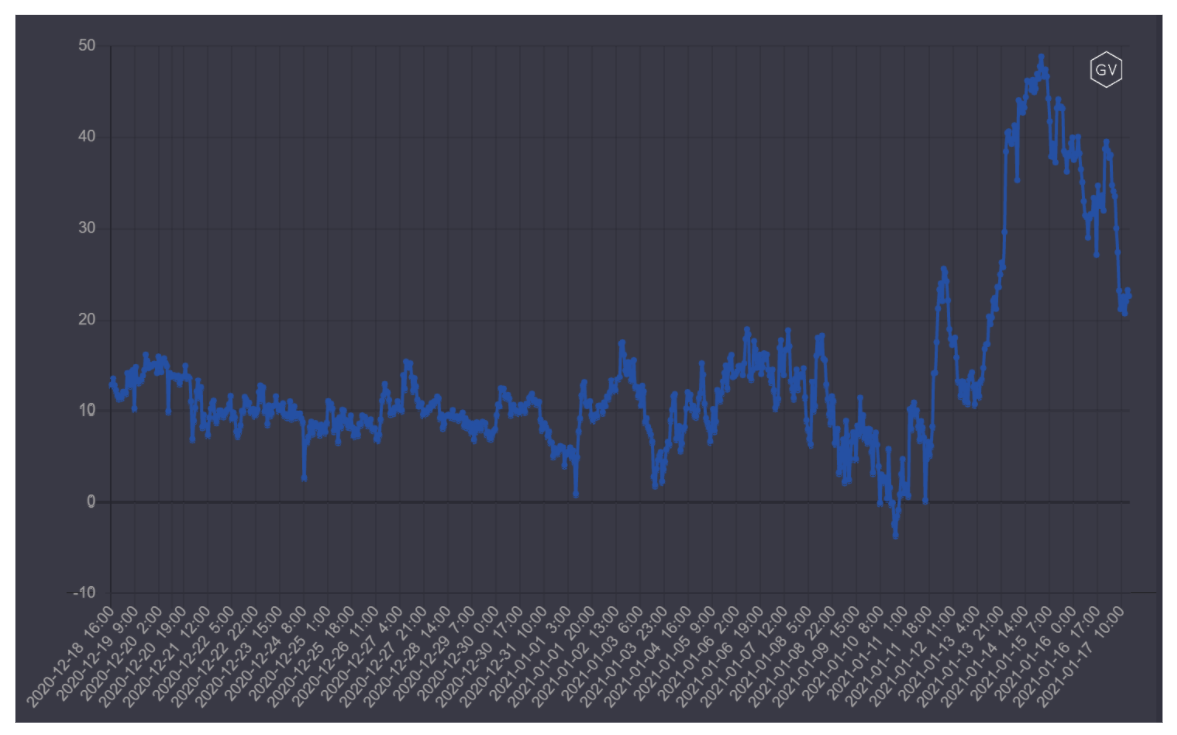

When analyzing options, the 30% to 20% delta skew is the single most relevant gauge. This indicator compares call (buy) and put (sell) options side-by-side.

A 10% delta skew indicates that call options are trading at a premium to the more bearish/neutral put options. On the other hand, a negative skew translates to a higher cost of downside protection and is a signal that traders are bearish.

According to the data shown above, the last time some bearish sentiment emerged was Jan. 10 when Bitcoin price crashed by 15%. This was followed by a period of extreme optimism as the 30%-20% delta skew passed 30.

Whenever this indicator surpasses 20, it reflects fear of potential price upside from market makers and professionals, and as a result, is considered bullish.

While a $3.8 billion options expiry is spine tingling, nearly 60% of the options are already deemed worthless. As for the remaining open interest, bulls are mainly in control because the recent price hike to a new all-time high obliterated most of the bearish options. With the expiry moving closer, a growing number of put options will lose their value if BTC remains above the $30,000 to $32,000 range.

author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Title: Bitcoin open interest hits $8.8B as 45% of BTC options expire in 2 weeks

Sourced From: cointelegraph.com/news/bitcoin-open-interest-hits-3-8b-as-45-of-btc-options-expire-in-2-weeks

Published Date: Mon, 18 Jan 2021 01:41:23 +0000