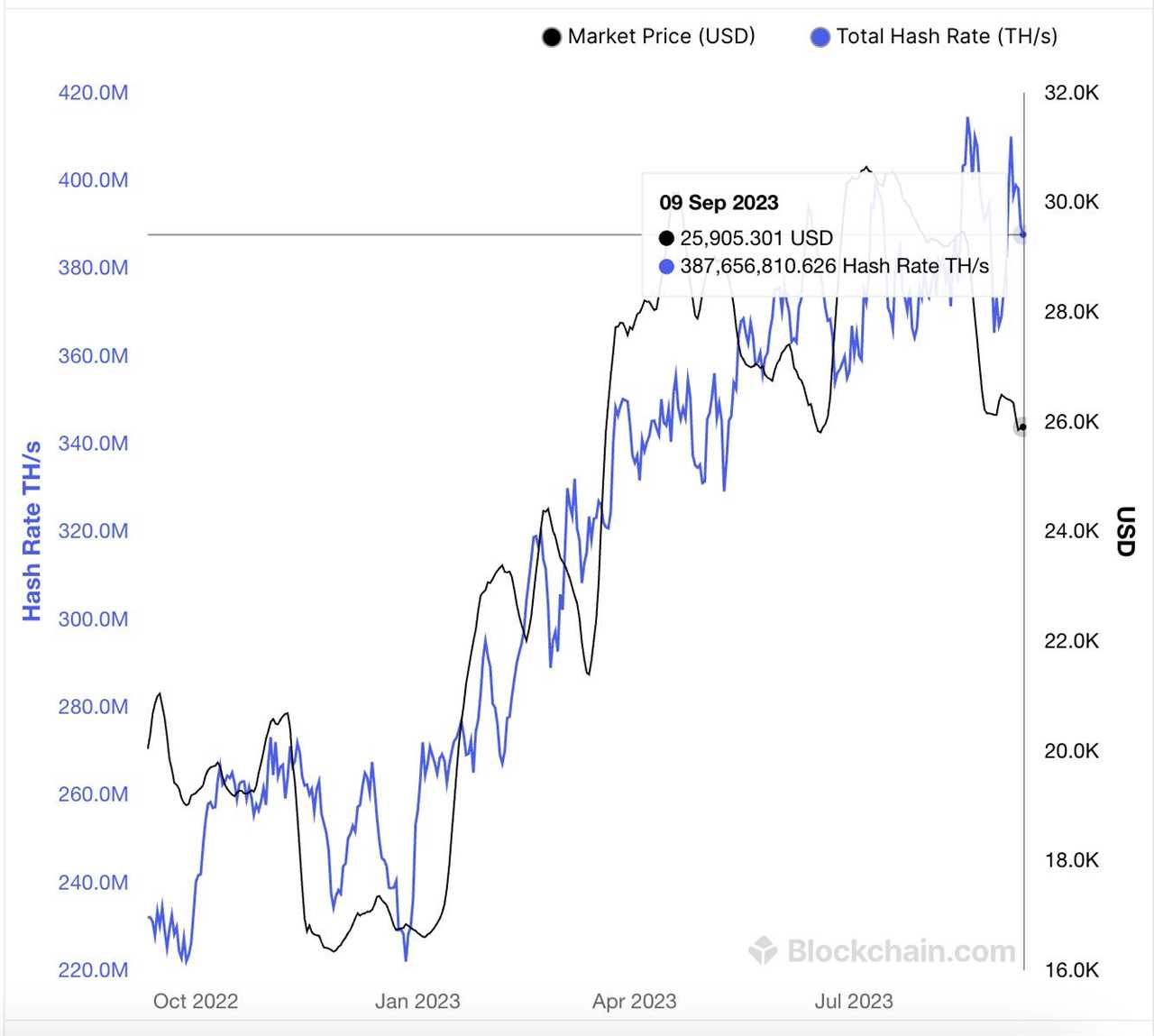

Bitcoin's Hashrate Reaches Record High

Despite recent price struggles, Bitcoin's hashrate, a metric indicating the network's computing power, has hit a record high. This demonstrates the strength of the network and miners' continued interest. Higher hashrate usually translates to higher prices, as miners increase their mining efforts. It's a sign that miners believe in the future of Bitcoin.

Bitcoin Addresses Holding 0.1 BTC Reach All-Time High

Bitcoin hodlers remain strong, with the number of wallets holding 0.1 BTC or more hitting 12 million for the first time. This shows trust in the asset class, even amidst disappointing price action. The fact that more entities are accumulating significant amounts of Bitcoin showcases the growing adoption of this investment.

Bitcoin Balances Held on Exchanges Trend Down

More individuals are taking custody of their Bitcoin, as the amount of Bitcoin held on exchanges continues to decrease. This trend has intensified since the collapse of FTX in November 2022. It suggests that people are disinterested in selling their coins in the near future. Historically, outflows from exchanges have boosted the Bitcoin price.

All of these metrics indicate that the bullish case for Bitcoin has strengthened. Miners keep mining, hodlers remain strong, and individuals secure custody of their coins. Despite the investment risks involved, these metrics paint a positive picture for Bitcoin's future.