Rare opportunity for investors

A new analysis suggests that Bitcoin (BTC) may be offering investors a unique chance to buy at a support zone with a "100% long hit rate." Crypto asset manager Capriole Investments has advised investors to keep an eye out for a BTC price dip to $24,000.

Firm belief in support zone

Bitcoin has been hovering around the $26,000 mark, but many market participants are predicting further downside for the cryptocurrency. Capriole, however, is highly confident in Bitcoin's long-term trend lines and sees the weekly support zone at $24,000 as a strong level of support.

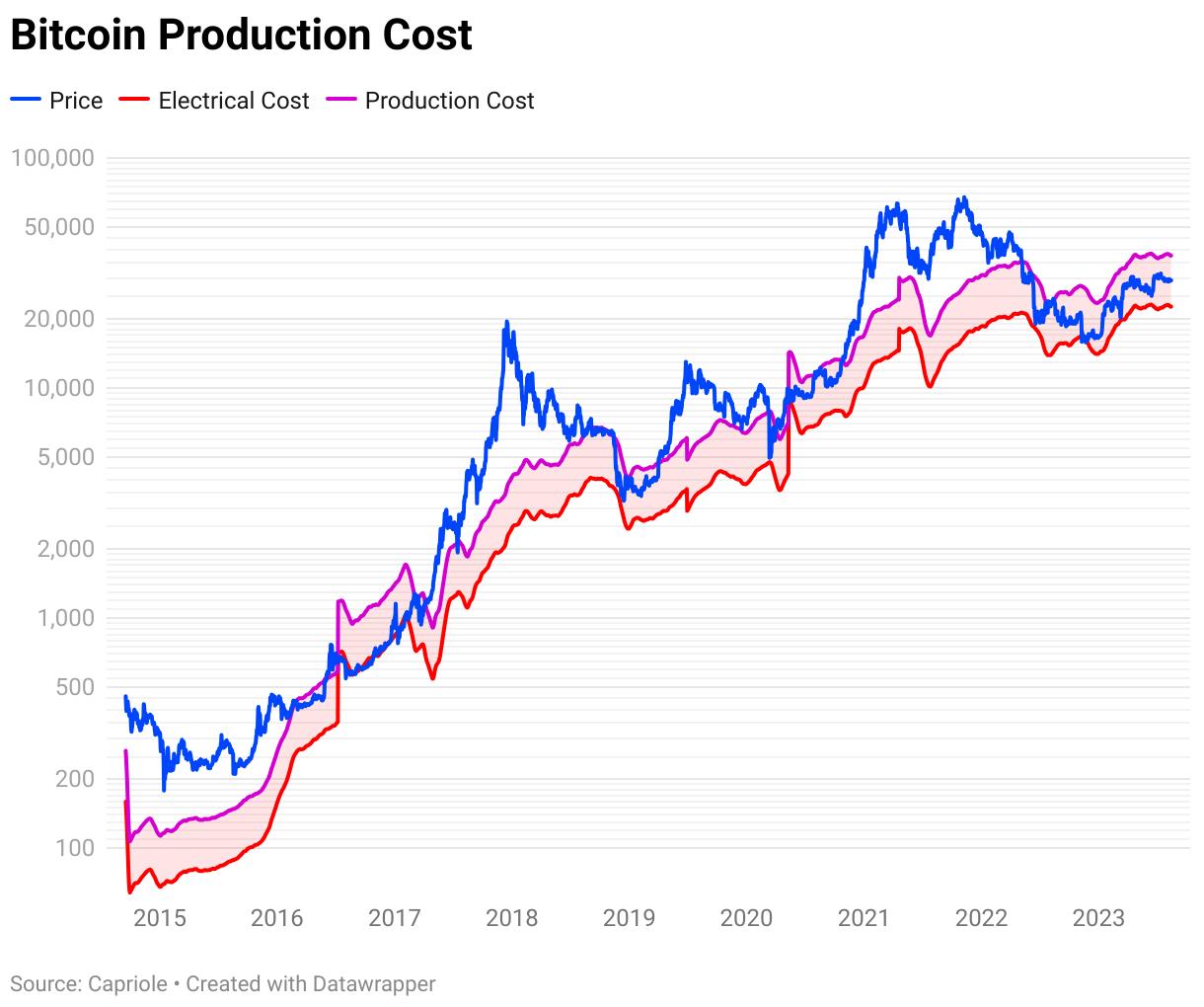

Electrical Price as a historic price floor

Capriole points to Bitcoin's so-called "Electrical Price" (EP) as another significant support level. The EP represents the average miner's electricity bill per BTC worldwide and currently stands at a little above $23,000. In the past, the EP has consistently acted as a strong support on long timeframes. Capriole describes EP as a "historically hard price floor and level with a 100% long hit rate."

Promising trend lines

Capriole founder Charles Edwards sees the trend lines discussed as "promising and rare structures" for Bitcoin that are worth paying attention to. He is confident that $23,000 will act as rock-solid support and presents an incredible long-term opportunity if reached.

Predicting miner pain

Looking at miners' financial buoyancy, James Straten, research and data analyst at crypto insights firm CryptoSlate, predicts a rerun of Bitcoin's price behavior from 2019. He notes that Bitcoin miner revenue is currently sitting just above the 365SMA of $22.5M and believes a break below is likely to happen soon.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.