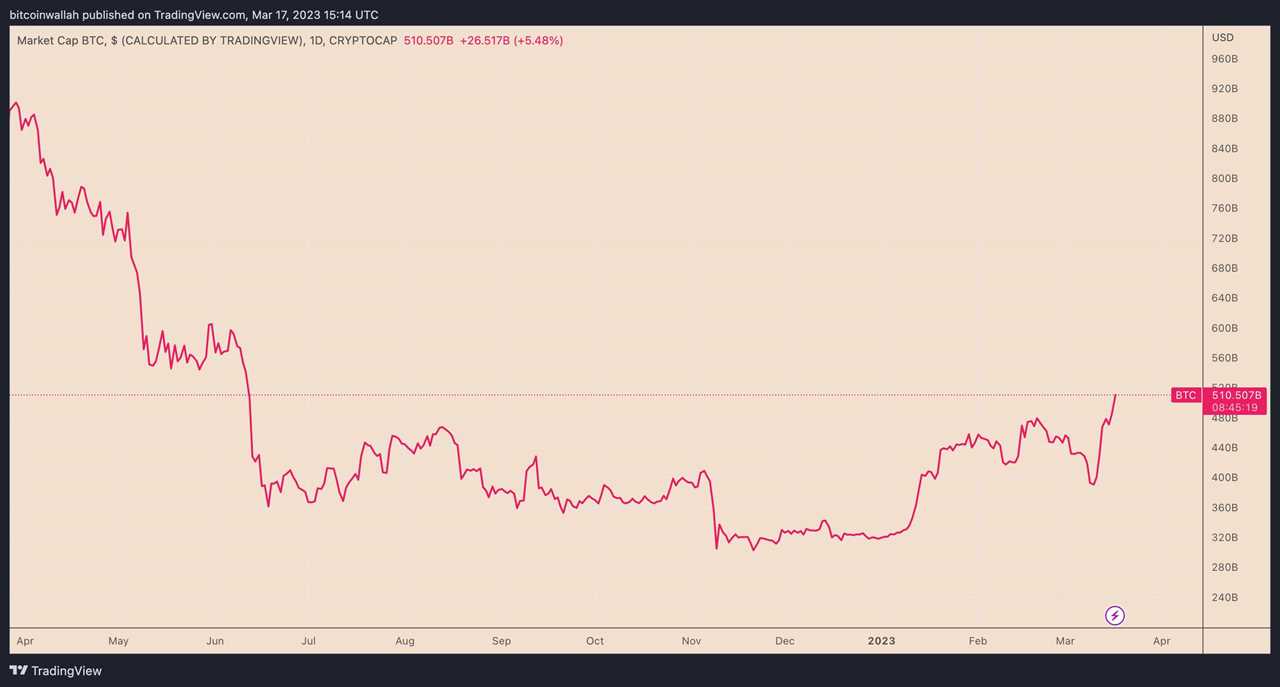

The market capitalization of Bitcoin (BTC) has added $194 billion in 2023. Its 66% year-to-date (YTD) growth is vastly outperforming top Wall Street bank stocks, particularly as fears of a global banking crisis are rising.

Moreover, Bitcoin has decoupled from U.S. stocks for the first time in a year, with its price rising about 65% versus S&P 500's 2.5% gains and Nasdaq's 15% decline in 2023.

Wall Street banks lose $100B in 2023

The six largest U.S. banks — JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), Wells Fargo (WFC), Morgan Stanley (MS), and Goldman Sachs (GS) — have lost nearly $100 billion in market valuation since the year's start, according to data gathered by CompaniesMarketCap.com.

Bank of America's stock is the worst performer among the Wall Street banking players, with a nearly 17% YTD drop in valuation. Goldman Sachs trails with an almost 12% YTD decrease, followed by Wells Fargo (-9.75%), JP Morgan Chase (1%).

The U.S. banks' valuation has slid amid the ongoing U.S. regional banking collapse. That includes the announcement last week that Silvergate, a crypto-focused bank, was closing its doors and the subsequent takeover of Signature Bank and Silicon Valley Bank by regulators.

Related: Breaking: SVB Financial Group files for Chapter 11 bankruptcy

The crisis further expanded with the near-collapse of First Republic Bank, which was saved at the last moment through a $30 billion combined injection by Wells Fargo, JP Morgan Chase, Bank of America, Citigroup, and others.

Cyprus and Greece deja vu?

The rise of Bitcoin in the face of a growing U.S. banking crisis is similar to how it reacted during banking collapses in Cyprus and Greece.

BTC's price grew by up to 5,000% amid the Cyprus financial crisis in 2013, prompted by the exposure of Cypriot banks to overleveraged regional real-estate companies.

The situation was so dire that Cyprus authorities, in March 2013, closed all banks to avoid a bank run.

When Greece faced a similar crisis in 2015 and imposed capital controls on citizens to avoid a bank run, Bitcoin's price gained 150% during the period.

“Fears over the stability of the banking system, along with declining real interest rates, creates a good environment for Bitcoin to rebound," noted Ilan Solot, co-head of digital assets at London broker Marex, adding that the crypto "is seen by some investors as a hedge against systemic risks."

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Title: Bitcoin market cap grows 60% in 2023 as top Wall Street banks lose $100B

Sourced From: cointelegraph.com/news/bitcoin-market-cap-grows-60-in-2023-as-top-wall-street-banks-lose-100b

Published Date: Sat, 18 Mar 2023 08:05:00 +0000