BTC Price Weekly Close Puts $25,900 in Focus

Bitcoin (BTC) closed the week below $26,000 on September 3, with analysts dismissing bearish sentiment and highlighting a key support level to watch.

Data from Cointelegraph Markets Pro and TradingView showed that BTC price stayed within a tight $200 range over the weekend, indicating a lack of direction and a sense of déjà vu from previous market behavior.

Traders are now assessing the impact of different weekly close levels. Popular trader Skew noted that as long as the weekly close stays above the June higher low (HL) of $25,000, the focus remains on reclaiming $25,900 this week to avoid a move towards the previous weekly resistance at $24,300.

Threat of Bitcoin "Bearadise" Remains

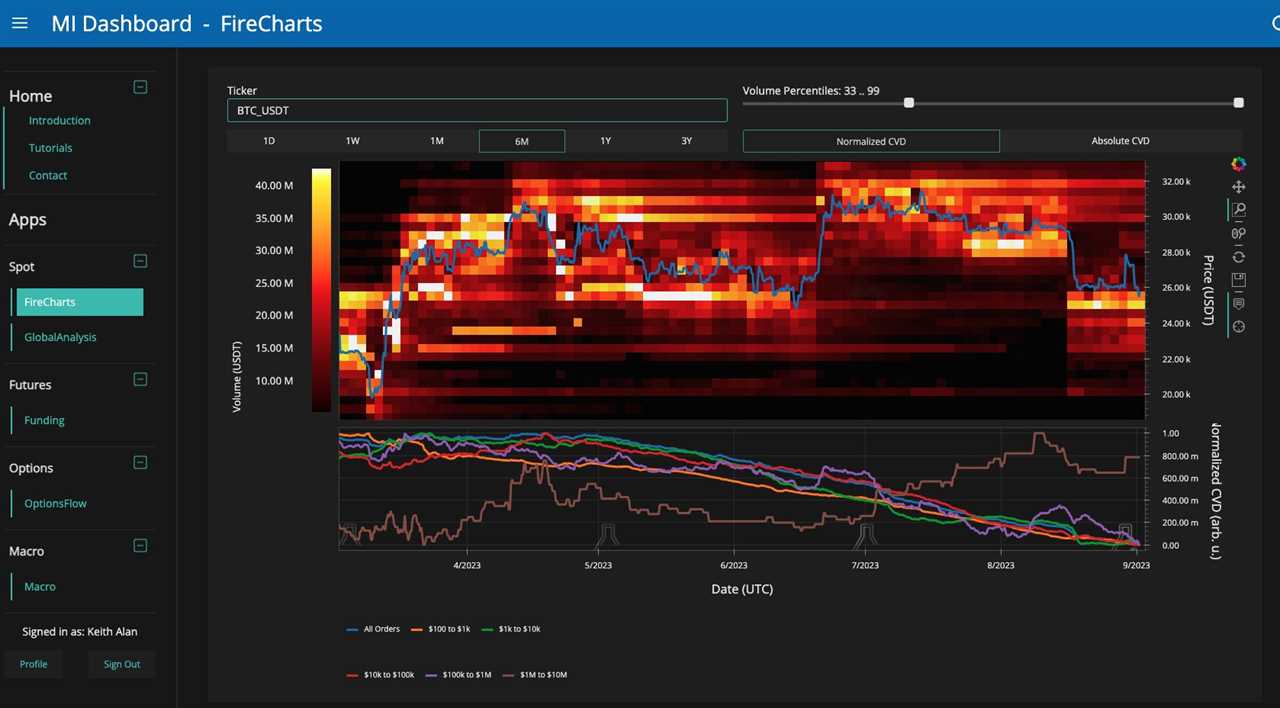

Despite recent volatility caused by Grayscale's legal victory and the SEC's decision on Bitcoin spot price ETFs, Bitcoin's market structure remains unchanged, according to Keith Alan, co-founder of monitoring resource Material Indicators.

Alan cautioned against making definitive bullish or bearish statements about Bitcoin, stating that neither a breakout nor a breakdown has been technically confirmed or invalidated. He emphasized that $24,750 is the support zone to watch, as a failure to hold this level could put Bitcoin at risk of entering a "bearadise" scenario.

Please note: This article does not provide investment advice. Readers are encouraged to conduct their own research and assessments before making any investment or trading decisions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/introducing-changex-the-allinone-mobile-wallet-bridging-the-gap-between-traditional-finance-and-defi