Bitcoin (BTC) lingered lower on Nov. 3 as the aftermath of the Federal Reserve interest rate hike subsided.

Trading range forms with $20,000 at center

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering just above $20,000 on the day.

The pair had seen flash volatility as the Fed hiked 0.75%, fakeout moves up and down triggering liquidations both long and short.

Cross-crypto liquidations for the 24 hours to the time of writing totaled $165 million, data from Coinglass confirmed.

Bitcoin ultimately finished slightly lower than its pre-Fed level, an area which continued to hold on the day as analysts awaited fresh cues.

For popular Twitter trader Crypto Tony, there was little need to adjust an existing forecast involving downside resuming short term.

“My main bias has not changed as i expect more consolidation and one more drop to produce a spring like motion to kick start the bull run,” he told followers on the day.

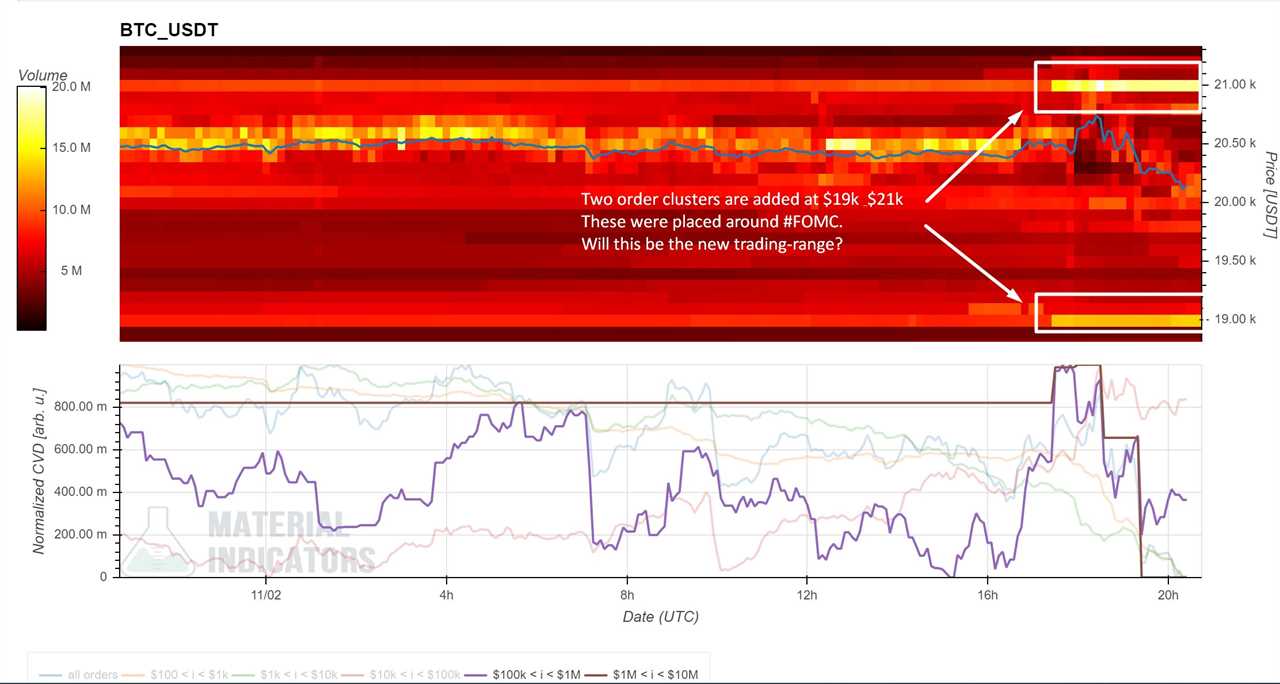

Data from monitoring resource Material Indicators highlighted potential support and resistance zones using trades from the Binance order book.

$19,000 and $21,000 were in focus for analyst Maartunn, a contributor to on-chain analytics platform CryptoQuant.

"Two order clusters are added at $19000 & $21000. These are placed around the FOMC," he noted.

"Will this be the new trading range?"

DXY hints at bad news for risk assets

Fellow trader John Wick meanwhile voiced caution over increasing U.S. dollar strength following the rate hike.

Related: Bitcoin seller exhaustion hits 4-year low in ‘typical’ bear market move

Uploading charts of the U.S. dollar index (DXY), he warned that the impact of USD gaining ground would be felt across risk assets.

“First chart is the wrecking ball weaponized Dollar. Bouncing off recent lows, targeting the top of the uptrend channel, just as I said it would after we see another hike,” he wrote.

“This will pressure all asset prices including BTC. Notice how RSI staying bullish above midline.”

com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Title: Bitcoin holds $20K post-Fed as rising dollar sparks BTC price warning

Sourced From: cointelegraph.com/news/bitcoin-holds-20k-post-fed-as-rising-dollar-sparks-btc-price-warning

Published Date: Thu, 03 Nov 2022 17:47:55 +0000